In The Spotlight

The Etihad Rail has unveiled fresh details of its forthcoming passenger services. (Image source: Etihad Rail)

The Etihad Rail has unveiled fresh details of its forthcoming passenger services, offering insight into what travellers can expect when the UAE’s national rail network begins operations later this year.

The announcement follows confirmation of the country’s long-anticipated intercity passenger rail system, positioned as a modern alternative to driving between the Emirates.

The service has been designed to reflect changing lifestyles across the UAE, with a focus on reliability, comfort and sustainability.

Azza AlSuwaidi, deputy chief executive of Etihad Rail Mobility, said the next phase marks a shift from delivering infrastructure to shaping the overall travel experience.

She noted that the ambition is to create a service people actively choose because it integrates seamlessly into their daily routines.

For commuters, predictability is central to the offering. A consistent timetable and guaranteed seating are intended to provide peace of mind, enabling passengers to plan their schedules with greater certainty.

Quiet, calm onboard environments are also expected to allow travellers to use their journey time productively or as an opportunity to rest.

Key features

AlSuwaidi said reliability remains the defining factor for daily passengers, adding that the rail network is designed to give people “useful and usable time back” rather than adding to the pressures of the working day.

Business travellers are another key demographic. Trains will feature onboard Wi-Fi, power outlets at every seat and spacious interiors, creating what the operator describes as a professional and connected setting.

The aim is to allow passengers to work, prepare for meetings or unwind while travelling between the UAE’s major commercial hubs.

Families and leisure travellers are also being targeted as core users of the service. Dedicated family seating areas and generous luggage storage are intended to make weekend breaks, holidays and visits to relatives easier and less stressful.

By removing the demands of driving, such as navigating traffic and long hours at the wheel, the operator believes rail travel can help families spend more meaningful time together.

AlSuwaidi highlighted that 2026 has been designated the UAE Year of the Family, noting that rail journeys can offer uninterrupted shared time that is increasingly rare in modern life.

The passenger experience has also been developed to reflect a distinct Emirati identity. From station architecture to onboard design, the network aims to embody national values centred on safety, quality and hospitality.

Officials say international best practice and rigorous operational standards will underpin the system, reinforcing confidence among citizens and residents alike.

A key focus at the show will be dust and spillage control at conveyor transfer points. (Image source: Martin Engineering)

Global bulk material handling specialist Martin Engineering has announced it will unveil a series of new conveyor accessories and flow technologies at CONEXPO-CON/AGG 2026, taking place from 3–7 March at the Las Vegas Convention Center.

Exhibiting at booth C30148 in the Central Hall, the company will present heavy-duty systems developed at its Center for Innovation, targeting safer and more efficient bulk handling operations across the aggregates and mining sectors.

Chris Schmelzer, Director of National Sales for the US and Canada, said the new portfolio has been tested in demanding real-world environments. He added that visitors will be able to explore solutions designed to support cleaner, safer and more productive material handling processes, from extraction through to final product.

Products on show

A key focus at the show will be dust and spillage control at conveyor transfer points, where emissions remain a persistent industry challenge.

Among the products on display is the Martin Skirtboard Liner, engineered to protect sealing systems by absorbing impact and abrasion inside transfer point skirtboards. The liner features a steel-reinforced urethane construction and a T-slot mounting interface that allows adjustment from outside the chute wall, reducing the need for confined space entry.

The company will also preview the Martin ApronSeal Urethane Skirting system, a dual-seal assembly combining a primary urethane seal with a self-adjusting secondary flap to contain fine material. Designed for belt speeds of up to 4.5 m/s, the system requires minimal maintenance and limited free belt space.

In addition, Martin’s modular A.I.R. Control Dust Curtains are designed to create controlled air recirculation zones within transfer enclosures, helping to reduce dust emissions compared with conventional rubber curtain systems. The curtains can be adjusted or replaced externally, cutting service times.

Flow improvement technologies will also feature prominently. The N2 Air Cannon Intelligence System monitors connected air cannons multiple times daily, detecting misfires, measuring blast efficiency and tracking pressure and temperature. A cloud-based dashboard enables predictive maintenance and reduces manual inspections.

An expanded line of electric vibrators will be introduced, aimed at improving material separation and preventing build-up in hoppers, silos and chutes. The new models offer increased power and efficiency while maintaining durability, backed by a three-year warranty.

The company will also present upgraded belt cleaning systems, including the Martin H1 Primary Belt Cleaner and P2 and R2 secondary cleaners, built with stainless steel components and tungsten carbide tips for use on abrasive materials and high-speed or reversing belts.

The exhibition will cover six core product groups spanning the full lifecycle of process industries. (Image source: ACHEMA)

Saudi Arabia’s expanding industrial and energy transition ambitions are set to gain a new international platform with the launch of ACHEMA Middle East, scheduled to take place from 26-28 October 2026 at the Riyadh International Convention & Exhibition Center.

The inaugural regional edition of the long-established ACHEMA exhibition comes as the Kingdom accelerates large-scale projects aimed at decarbonisation and advanced manufacturing. These include a major carbon capture hub in Jubail, designed to capture up to nine million tonnes of CO2 annually by 2028, and the US$8.4bn NEOM Green Hydrogen Project, which targets the production of 600 tonnes per day of clean hydrogen by 2027.

Held under the patronage of the Saudi Ministry of Industry and Mineral Resources and supported by ASAS, the event is organised by Messe Frankfurt and powered by DECHEMA. The exhibition extends ACHEMA’s century-long legacy in chemical engineering and process industries into the Middle East, Africa and South Asia (MEASA) region.

For more than 100 years, ACHEMA has served as a global meeting point for the chemical, pharmaceutical, biotechnology and laboratory sectors. Its debut in Riyadh is intended to connect international technology providers with regional manufacturers, policymakers and researchers at a time when Saudi Arabia is pursuing industrial diversification under Vision 2030.

Exhibition main themes

The exhibition will cover six core product groups spanning the full lifecycle of process industries, including industrial engineering, laboratory and analytical solutions, automation and digital systems, packaging and supply chain technologies, and research and development. Organisers say the integrated scope reflects the increasingly interconnected nature of modern industrial operations.

Conference programming will centre on six innovation themes: process, pharma, lab, digital, green and energy innovation. CPD-accredited sessions and expert-led discussions will address topics such as electrification, bioprocessing, artificial intelligence-enabled operations and circular economy models.

Dr Björn Mathes, chief executive of DECHEMA Exhibitions, described the Riyadh edition as a strategic evolution. “By bringing ACHEMA to Riyadh, we are creating a platform where science, engineering and industrial innovation align with the ambitions of one of the world’s most dynamic industrial economies,” he said.

Azzan Mohammed, managing director of Messe Frankfurt Saudi Arabia, said the event would foster knowledge exchange and support the development of sustainable and competitive industrial ecosystems.

Early confirmed exhibitors include Yokogawa, GMM Pfaudler, Hach, Beckhoff, Aptek, Pharmadule Morimatsu, Tofflon and Sealmatic, signalling strong international interest ahead of the show’s first edition.

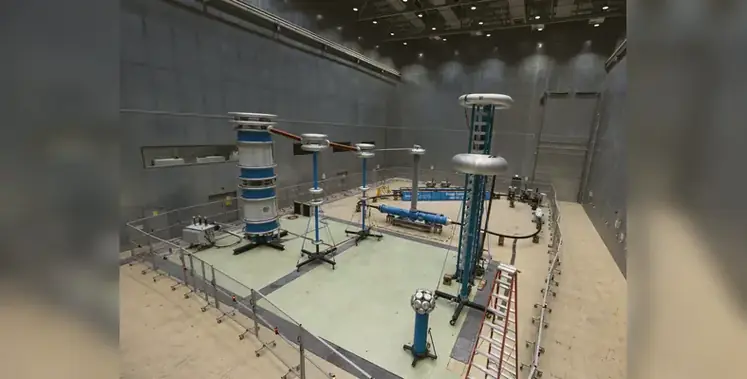

Ducab, a leading UAE-based manufacturer of high-quality cables and energy solutions, has achieved a major technical milestone with the Middle East’s first Extended Pre-qualification (EPQ) test for an Extra-High Voltage (EHV) 400kV cable system at 105°C emergency temperature.

The achievement, completed in collaboration with Swiss specialist Brugg Cables, reinforces Ducab’s reputation for technical excellence and positions the company for global expansion.

The EPQ and system type test represents a regional first and demonstrates Ducab’s ability to meet the most stringent international standards, including IEEE, IEC, and AEIC. The testing was conducted in partnership with Brugg Cables, a recognised leader in high-voltage accessories; TAQA, Abu Dhabi’s government-controlled energy holding company; and DEKRA, the world’s largest independent testing, inspection and certification organisation.

“This successful Brugg test cements Ducab’s reputation for technical leadership and innovation, opening new opportunities in Europe,” said Charles Edouard Mellagui, CEO of Ducab Cables Business. “We are delighted to accelerate our efforts to take our quality HV cables from the UAE to the world.”

The collaboration offers strategic advantages for Ducab, which is now the only supplier on TAQA’s vendor list with two approved accessory suppliers – SEI and Brugg Cables. The EPQ milestone enhances Ducab’s competitiveness for EHV cable system projects across the region and internationally, enabling faster, more effective service for TAQA, regional utilities, and new clients in Europe and the US.

Gianluca Vettese, CEO of Brugg Cables, said: “We are proud to support Ducab in achieving this significant EPQ test, highlighting the strength of our technical collaboration and our shared commitment to delivering world-class high-voltage cable systems that meet the highest international standards.”

Brugg Cables’ specialised testing services for HV and EHV cables, up to 550kV, incorporate a large Faraday cage and on-site diagnostics to ensure insulation integrity and performance. Key elements of the testing process include AC voltage tests, partial discharge measurements for joints, and sheath testing, all designed to ensure reliable, long-term operation of high-voltage cable systems.

With this milestone, Ducab strengthens its technical leadership in the Middle East and sets the stage for international growth, offering utilities and industrial clients high-quality, globally certified EHV cable solutions.

A key highlight of the company’s presence at LogiMAT will be the launch of LOXrail smartCURVE. (Image source: LOSYCO)

LOSYCO will present a new generation of rail-based intra-logistics and production transport systems at LogiMAT 2026, taking place in Stuttgart, Germany, from 24-26 March 2026.

Exhibiting at booth 7-F09, the German manufacturer will showcase developments extending its LOXrail system, designed to provide complete transport and handling solutions from a single source. The company specialises in heavy-duty rail-based logistics for industrial environments, with systems tailored to specific customer production processes.

LOXrail tracks, available in two sizes, are engineered to handle payloads of up to 60 tonnes and beyond. The system enables energy-efficient and cost-effective movement of heavy loads on customised trolleys across a wide range of manufacturing applications. These include the production of tools and agricultural machinery, wind turbine assembly and modular house prefabrication.

According to LOSYCO, even multi-tonne loads can be transported manually due to the low rolling resistance of the rail system. Alternatively, battery-powered drive units can be integrated, offering flexible propulsion options depending on operational requirements.

Show highlights

A key highlight of the company’s presence at LogiMAT will be the launch of LOXrail smartCURVE, described as the next stage in rail-based production logistics. The system combines the load-bearing strength of fixed intra-logistics rails with automation features commonly associated with automated guided vehicle (AGV) technology.

The smartCURVE solution has already been deployed at an automotive production plant, where it operates as a fully autonomous transport system. It comprises self-propelled transport trolleys equipped with sensor-based position detection, fail-safe low-latency Wi-Fi communication and inductive charging technology. The trolleys are capable of navigating factory layouts independently, transporting materials or assemblies between workstations, positioning themselves with precision and recharging without manual intervention.

LOSYCO said the system is designed to meet growing demand for smart factory solutions capable of handling heavy loads while integrating seamlessly into automated production environments.

In addition to its rail innovations, the company will display floor-level crossing systems, AllRounder steering platforms and material feeding and warehouse logistics solutions. These systems are intended to enhance flexibility and efficiency across manufacturing and storage operations.

Company representatives said they are looking forward to engaging with industry professionals at the Stuttgart exhibition, as manufacturers increasingly seek scalable and automated solutions for heavy-duty internal logistics.

Read more:

Dubai partners with The Boring Company on Dubai Loop project

Emerson has been awarded the 2026 Saudi Aramco Local Manufacturers Quality Award, recognising its performance in manufacturing excellence and long-term alignment with Saudi Arabia’s national industrial strategy.

The award was presented during an official ceremony on 29 January 2026 at the Dhahran Plaza Conference Center. The event was hosted by Saudi Aramco and led by its Technical Services executive vice president, Wail A. Al Jaafari, who honoured companies demonstrating high standards in local manufacturing and product quality.

The accolade followed a formal assessment process conducted in coordination with Saudi Aramco’s technical teams. Emerson’s Control and Safety Systems (CSS) division spearheaded the company’s participation in the evaluation and represented the group at the ceremony in Dhahran.

Hussein Zein, vice president of Emerson in Saudi Arabia, said the recognition reflected a long-standing partnership built on trust and technical discipline. He added that Emerson’s emphasis on governance, leadership accountability and in-Kingdom manufacturing supports the objectives of Saudi Arabia’s Vision 2030 economic diversification programme.

The Saudi Aramco Local Manufacturers Quality Award is presented to organisations that achieve high performance across technical, operational and quality benchmarks, in line with the In-Kingdom Total Value Add (IKTVA) programme. IKTVA is designed to increase local content, strengthen domestic supply chains and foster sustainable industrial growth within the Kingdom.

Emerson has expanded its footprint in Saudi Arabia steadily over the past 16 years. Key milestones include the opening of facilities in Jubail, Dammam and Dhahran, as well as the launch of a major manufacturing hub at King Salman Energy Park (SPARK) in 2024. The SPARK development has been positioned as a cornerstone of Saudi Arabia’s strategy to localise energy sector manufacturing and services.

The company’s growing presence in the Kingdom aligns with national efforts to enhance industrial capabilities, reduce reliance on imports and generate skilled employment opportunities for Saudi nationals. By increasing local production of automation and control systems, Emerson is contributing to the resilience and competitiveness of the country’s energy and industrial sectors.

Industry observers note that such awards play a role in encouraging international suppliers to deepen their in-country commitments, particularly as Saudi Arabia accelerates reforms aimed at strengthening its non-oil economy.

For Emerson, the recognition underscores its strategy of combining global technical expertise with local manufacturing capacity, reinforcing its position as a long-term partner to Saudi Arabia’s energy and industrial transformation.

Tahweel Metal Industry Company (TMIC) has signed a contract with SMS group for the engineering, manufacturing and delivery of a six-high aluminium cold rolling mill to produce high-quality aluminium strips. The facility will serve as the centrepiece of an integrated aluminium foil complex to be developed in Dammam Third Industrial City (Modon-III) on the Arabian Gulf.

TMIC’s parent company, Tahweel Holding, is a leading supplier of material solutions across the Middle East and North Africa (MENA) region. Through this investment, TMIC is advancing its expansion into the flexible packaging sector, with a particular focus on aluminium foil rolling.

The new six-roll stand is designed to process strips up to 2,200 millimetres wide and eight millimetres thick, reducing them to a final thickness of 0.15 millimetres. The majority of output will be converted into aluminium foil for food and pharmaceutical packaging, as well as other industrial applications.

According to the companies, the cold rolling mill will deliver consistently high product quality by combining precise thickness control, flexible rolling capabilities and energy-efficient operations. The plant will also incorporate advanced automation systems and robust engineering to ensure long-term production reliability and operational efficiency.

TMIC cited SMS group’s technical expertise and decades of experience in rolling mill technology as key factors in the partnership. The company said the collaboration will provide the flexibility, reliability and future-ready solutions required to support its growth ambitions in the aluminium and packaging markets.

The official announcement of the contract was made in Riyadh in the presence of senior government officials and company representatives. The investment aligns with Saudi Vision 2030, which aims to diversify the Kingdom’s economy by promoting industrial innovation, localising production and encouraging the sustainable use of resources.

SMS group described its role in the project as that of a long-term technology partner, supporting the development of advanced manufacturing capabilities in the Kingdom. The project is expected to strengthen Saudi Arabia’s position in the regional aluminium value chain while meeting rising demand for high-quality foil products across the food, pharmaceutical and industrial sectors.

The Middle East and North Africa (MENA) is set to become the world’s largest hydrogen exporter by 2060, while maintaining a dominant position in global oil and gas markets, according to DNV’s Oil & Gas Decarbonization in the Gulf Region report

The report highlights how Gulf Cooperation Council (GCC) countries are cutting the emissions intensity of their core oil and gas production while continuing to play a central role in global energy supply, presenting a picture of a region approaching the energy transition from a position of confidence and capital strength. Reductions in emissions intensity are occurring alongside continued hydrocarbon production and investment across renewables, electrification, hydrogen, methane abatement, digitalisation, and carbon capture.

Since 2005, the GCC has produced nearly 18% of global oil and gas, a share expected to increase as investment continues in low-cost, advantaged resources. As global energy demand increasingly shifts toward Asia, the region’s location and cost competitiveness strengthen its position as a preferred supplier. At the same time, decarbonization measures are becoming an integral part of long-term competitiveness.

“The global energy transition will not progress at the same pace across regions, nor will it follow a single pathway,” said Brice Le Gallo, vice-president & regional director for Southern Europe, MEA & LATAM, Energy Systems at DNV. “In the Middle East, oil and gas remain central to economic stability and global energy security. The key challenge is to reduce their emissions footprint while accelerating investment in the technologies needed for a lower-carbon energy system.”

Electrification is being used to cut Scope 2 emissions from pumps, compressors, and offshore facilities, through grid connections, renewable power, and hybrid solutions. These efforts are supported by energy-efficiency measures and the use of digital tools and artificial intelligence to optimise drilling, reservoir management, and asset operations, reducing energy intensity and emissions per barrel produced.

Methane reduction remains one of the most immediate and cost-effective options for lowering emissions. Across the GCC, routine flaring is planned to be phased out by 2030 and leak detection and repair (LDAR) programmes are increasingly standard. National oil companies are also aligning with international methane initiatives, enabling continued production growth while reducing methane intensity in line with national net-zero targets.

GCC countries are realigning domestic energy systems to reduce oil and gas use domestically and free up volumes for export and low-carbon fuel production. Growth in renewables, electrification of transport and buildings, and efficiency gains are driving this shift. Investment in downstream industries, petrochemicals, and low-carbon fuels is also changing export profiles, moving beyond crude oil toward higher-value and lower-carbon energy products.

With access to low-cost natural gas, strong solar resources, and established industrial and export infrastructure, the region is well placed to scale both low-carbon hydrogen (produced from natural gas with carbon capture) and renewable hydrogen produced through electrolysis. By 2060, the Middle-East and North Africa region is projected to produce around 19 million tonnes of hydrogen and 13 million tonnes of ammonia per year, exporting about 50%, mainly toward Europe and advanced Asian economies.

“Hydrogen, ammonia, and carbon capture are becoming core elements of the GCC’s energy export model,” said Jan Zschommler, market area manager for the Middle East, Energy Systems at DNV. “As emissions requirements tighten, access to international markets will increasingly depend on carbon intensity. Integrating hydrogen production with renewable power, carbon capture, and existing industrial clusters allows the region to remain competitive while meeting these requirements.”

Carbon capture, utilization and storage (CCUS) is also set to grow. In January 2026, the UAE's Supreme Council for Financial and Economic Affairs has introduced Carbon Capture Policy as a further commitment to meeting their carbon reduction targets. Captured CO₂ volumes (including CO₂ removal) are expected to reach around 250 million tonnes per year by 2060, equivalent to roughly 8% of regional energy-related and industrial emissions.

Bioenergy with carbon capture (BECCS) and direct air capture (DAC) combined are expected to remove around 81 million tonnes of CO₂ per year by 2060, helping to offset emissions from sectors that are more difficult to decarbonise.

The full report is available at https://www.dnv.com/energy-transition-outlook/oil-and-gas-decarbonization-in-the-gulf-region/

Ecolab, a global leader in sustainability solutions for water, hygiene and infection prevention, has signed a non-binding MoU with the Saudi Water Authority (SWA) aimed at accelerating water innovation and supporting the Kingdom’s long-term sustainability ambitions.

The agreement reflects a shared commitment to advancing more efficient, resilient and circular water systems in line with Saudi Arabia’s Vision 2030.

The MoU was formalised during the US-Saudi Water Summit 2025, held last month in Palo Alto, California. The summit brought together international water sector leaders to discuss emerging challenges, technological advances and collaborative models capable of transforming water management across the Kingdom. Against a backdrop of rising demand, climate pressures and industrial expansion, the agreement highlights the growing importance of public-private partnerships in securing Saudi Arabia’s water future.

Under the MoU, SWA and Ecolab will collaborate to position sustainable water management as a strategic enabler of national development. By improving water efficiency and reuse, the partnership aims to help safeguard scarce water resources while enhancing water quality across key sectors. These efforts are also expected to deliver wider environmental and economic benefits, including reduced energy consumption, lower CO2 emissions and improved operational efficiency for industrial and commercial operators.

The framework for cooperation includes the exchange of technical insights and best practices across sectors such as data centres, refineries, petrochemicals, heavy industry, desalination, manufacturing, food and beverage, and hospitality.

Key areas of partnership

The collaboration also covers support for water source selection, regulatory development and performance monitoring, alongside workshops focused on advanced digital solutions such as smart water systems and predictive maintenance. In addition, the partners will explore pilot projects within Saudi industrial cities, applying Ecolab’s global technologies under local operating conditions, and identify opportunities to support innovation initiatives, including Rabigh Oasis, the Global Water Innovation Prize (GWIP), collaborative research and development roundtables, and broader innovation promotion programmes.

Ecolab has maintained a strong presence in Saudi Arabia for more than four decades through its Nalco Water business, supporting major industrial players in optimising water use. Today, its solutions are deployed across energy, manufacturing, food and hospitality, helping organisations conserve water, reduce energy consumption and strengthen long-term business resilience while meeting sustainability goals.

His Excellency Abdullah bin Ibrahim Al-Abdulkarim, President of the Saudi Water Authority, highlighted the partnership as a step toward building a world-class water sector that safeguards resources, supports national growth, and demonstrates how innovation and sustainability can secure water for future generations in line with Vision 2030.

Stefan Umiastowski, Ecolab’s Senior Vice President & CEO for India, Middle East, and Africa, said, “This collaboration represents an important step in advancing Saudi Arabia’s Vision 2030 commitment to long-term water sustainability in a region where water is one of the most critical resources. As digitalization and AI reshape economies and create new demand patterns, intelligent water management has become essential for sustainable growth. By combining Ecolab's global innovation capabilities with the SWA’s vision and local expertise, we're creating a powerful platform to scale water transformation across the Kingdom's most strategic industries.”

Overall, the MoU demonstrates how closer collaboration between government and industry can translate sustainability ambitions into measurable outcomes, supporting the transition towards Net Zero while enhancing industrial competitiveness and water security across Saudi Arabia.

Critical Metals Corp., a critical minerals company headquartered in New York, has signed a non-binding term sheet to form a 50/50 joint venture with Tariq Abdel Hadi Abdullah Al-Qahtani & Brothers Company (TQB), a 75-year-old industrial conglomerate based in Saudi Arabia.

The partnership aims to establish a state-of-the-art rare earth processing facility in the Kingdom, creating a fully integrated mine-to-processing supply chain and securing long-term offtake rights for 25% of the Tanbreez Project’s rare earth concentrate production.

The facility will produce separated rare earth oxides, metals, and downstream products, including magnet-grade materials for aerospace, defense, and advanced industrial applications. All finished materials are planned for shipment to the United States to support the country’s defense industrial complex, strengthening supply chain security for Western-aligned markets.

Tony Sage, Chairman of Critical Metals Corp., said, “This agreement represents a transformational milestone for Critical Metals Corp. By partnering with a leading Saudi Arabian industrial group and securing long-term offtake that brings Tanbreez to 100% committed production, we have effectively de-risked the project’s commercial pathway from mine to market. The establishment of an integrated processing platform in Saudi Arabia not only diversifies global rare earth processing capacity beyond China but also strengthens supply chain security for allied nations across Europe, the Middle East, and beyond. This transaction positions CRML as a cornerstone supplier of critical minerals essential to advanced manufacturing, energy transition technologies, and national security applications for decades to come.”

Under the JV framework, CRML will retain its 50% ownership interest on a carried-interest basis, without issuing equity or incurring debt for the construction of the processing facility. The partnership ensures 100% of Tanbreez production is now under long-term offtake agreements, providing full revenue visibility and supporting allied markets. A jointly governed development committee will oversee engineering, construction, commissioning, and market entry for the processed products.

Abdulmalik Tariq Al-Qahtani, CEO of TQB, commented, “Following the successful official visit of His Royal Highness Prince Mohammed bin Salman to the United States, we are pleased to announce the signing of a Memorandum of Understanding focused on cooperation in the development of critical materials. Critical materials—sourced from strategically important regions including Greenland and other resource-rich jurisdictions—form the foundation of modern technologies across energy, advanced manufacturing, artificial intelligence, defense, and data infrastructure. Securing diversified and resilient supply chains for these materials is essential to long-term technological progress.”

CRML and TQB will now work together to finalise the technical, commercial, and regulatory foundations of the JV, including plant design, development timelines, product specifications, and commercialisation strategy. The initiative is a major step toward diversifying rare earth processing capacity, reducing reliance on China, and strengthening global supply chain resilience.

Ras Al Khaimah has taken a major step to simplify industrial approvals with a new partnership between Ras Al Khaimah Economic Zone (RAKEZ) and the Environment Protection and Development Authority (EPDA). The two entities signed an MoU to establish a structured framework for environmental verification and approval in priority sectors, including cement, chemical, and general industries.

The MoU, signed by RAKEZ group CEO Ramy Jallad and EPDA acting director general H.E. Dr Abdulrahman Al Shayeb Al Naqbi, aims to speed up licensing procedures while ensuring compliance with environmental regulations. The framework has been developed in coordination with RAKEZ’s Health, Safety and Environment (HSE) Department to align regulatory oversight with operational processes.

Under the new system, industrial companies can expect a faster, more predictable approval process, with clear guidance on expansion or modification requests from the outset. Officials said the initiative would enhance transparency for investors and provide a smoother pathway for project development while safeguarding Ras Al Khaimah’s environment.

“The collaboration reflects our commitment to balancing industrial growth with environmental responsibility,” said Ramy Jallad. “By aligning processes with EPDA, we are creating a more efficient framework that benefits investors while upholding the highest environmental standards.”

H.E. Dr Abdulrahman Al Shayeb Al Naqbi added that the MoU represents a significant step in integrating world-class environmental practices with industrial development. “By establishing clear, time-bound approval frameworks, we are helping investors in the cement, chemical, and industrial sectors while protecting the emirate’s environment,” he said. “This approach ensures that faster business setup and expansion occur with strict compliance and technical oversight, fostering a sustainable and competitive industrial ecosystem.”

The agreement also includes joint initiatives for knowledge sharing, technical alignment, and training between EPDA and RAKEZ’s HSE teams, aimed at improving environmental governance across the emirate’s industrial base.

RAKEZ, home to nearly 40,000 companies, continues to strengthen its ecosystem through partnerships that enhance operational efficiency, regulatory clarity, and long-term sustainability. Industry observers say the new framework could significantly reduce delays in project approvals and reinforce Ras Al Khaimah’s reputation as an investor-friendly hub for sustainable industrial development.

Drydocks World has become the latest member of the Maritime Emissions Reduction Centre (MERC), strengthening the consortium’s technical expertise and collaborative capacity in advancing lower-carbon shipping solutions.

MERC, co-founded by the Lloyd’s Register Maritime Decarbonisation Hub and leading shipowners including Capital Group, Navios Maritime Partners, Neda Maritime Agency, Star Bulk, and Thenamaris (Ships Management) Inc., focuses on practical decarbonisation strategies, emissions reduction technologies and industry-wide collaboration to accelerate the maritime sector’s transition towards sustainable operations.

Drydocks World, recognised for its expertise in complex ship repair and retrofit projects, will bring hands-on engineering experience to MERC’s initiatives. The company has extensive experience integrating advanced technologies on operating vessels, a capability that is increasingly critical as shipyards become central to deploying energy efficiency systems. MERC officials expect Drydocks World’s insights to inform how technologies are assessed, prioritised and implemented across different vessel types.

Nikos Kakalis, MERC Managing Director, said: “Drydocks World’s involvement provides an essential layer of applied engineering experience that complements MERC’s technical and analytical work. The organisation brings practical insight gained through decades of major retrofit projects. This expertise will help us understand not only what is technically possible, but what can be delivered efficiently and safely in a real shipyard environment. That combination of deep engineering knowledge and hands-on experience will help MERC ensure that emerging technologies can be installed safely, efficiently and commercially viably.”

The partnership comes amid growing R&D efforts within MERC, including studies on emerging efficiency technologies, integration of advanced systems on existing vessels, and expanded work in hydrodynamics, wind-assisted propulsion, auxiliary power alternatives, and data-driven operational optimisation.

Captain Rado Antolovic, PhD, CEO of Drydocks World, said: “Joining MERC allows us to contribute our engineering and retrofit experience to a collaborative effort focused on solutions the industry can implement. Decarbonising the existing fleet requires practical, evidence-based approaches, and we see real value in working alongside MERC’s partners to shape technologies and integration strategies that work across different vessel types.”

As a Centre Member, Drydocks World will provide yard-level insight to ensure decarbonisation solutions are technically feasible, scalable, and deliverable within operational and drydocking constraints, while aligning retrofit and conversion capabilities with evolving regulatory and shipowner requirements, particularly in Europe.

Energy storage has moved to the forefront of global innovation activity. (Image source: Adobe Stock)

Energy security is emerging as a leading driver of innovation, according to a new IEA report

More than 150 technology breakthroughs are identified in the IEA’s latest State of Energy Innovation report, which finds that the energy sector is increasingly becoming an innovation powerhouse, with around one in 10 patents worldwide relating to energy, underlining the sector’s central role in national security, industrial strategy and economic performance.

Innnovation highlights

Innovation highlights include solid-state air conditioning, perovskite solar cells, fusion energy, sodium-ion batteries and next-generation geothermal systems. These advances contributed to 50 upgrades in technology readiness levels among emerging energy technologies tracked by the IEA. Innovations mentioned in the MENA region include thyssenkrupp Uhde’s cutting-edge hydrogen recovery unit (HRU) at Fertiglobe’s Fertil plant in Ruwais, UAE, which enables advanced hydrogen recovery from the ammonia synthesis purge gas, allowing for increased feedstock utilisation and a 6% increase in ammonia output. Also highlighted is the partnership between ADNOC Gas, Baker Hughes, and Levidian to deploy Levidian’s patented LOOP technology at ADNOC’s Habshan Gas Processing Plant. This captures carbon from methane and turns it into graphene and hydrogen.

The report highlights the shift in policy towards energy security, ahead of affordability and emissions reduction, with new initiatives such as the US Genesis Mission and the EU Competitiveness Fund reflecting growing emphasis on strengthening domestic technological capabilities and securing critical supply chains.

However, markets for some clean energy technologies weakened, the report says. For example, project delays and cancellations reduced expectations for the deployment of low-emissions hydrogen this decade. The IEA’s renewables deployment forecast for 2030 was downgraded by 5% in 2025 in response to policy and regulatory changes. Several major first-of-a-kind energy technology projects under construction, in areas such as near-zero emissions steel and direct air capture, were hit with higher costs and policy uncertainty.

“Energy innovation has become a strategic priority for governments around the world,” said IEA executive director Fatih Birol. “With energy security and industrial competitiveness at the top of the agenda, countries that sustain investment in research, demonstration and early deployment will be best positioned to lead the next generation of energy technologies.”

Energy storage tops global innovation activity, with batteries accounting for 40% of all energy patenting in 2023. China, Korea, and Japan remain leading sources of lithium-ion battery patents, with China’s share rising sharply over the past decade. In solar innovation, patenting has shifted toward perovskite solar cells, which now account for over 70% of solar cell patents by material.

The report underscores the importance of public support for energy innovation, but notes a decline in public and corporate R&D in 2025 as well as a drop in venture capital investment in energy technology, with high interest rates, macroeconomic uncertainly and competition from artificial intelligence ventures impacting energy capital flows. In the corporate sector Aramco is highlighted as a major R&D spender, with annual average R&D spending of US$1,300mn from 2022-2024.

Nevertheless, new growth areas are emerging. Funding for fusion, nuclear fission, critical minerals, geothermal, carbon dioxide removal and low-emissions industry has grown significantly, offsetting much of the decline in electric mobility investment. The report also highlights regional approaches to energy innovation, with China for example continuing to expand its footprint across corporate R&D and patenting, particularly in energy storage and industrial efficiency.

With shifting policy priorities and financial cutbacks, the report stresses that sustained and well-targeted public support remains critical, highlighting the transformative benefits brought about by energy innovation. Successful energy innovations can have major economic and social outcomes, impacting industrial competitiveness, trade, environmental health, infrastructure investment and security, the report notes. Aligning energy innovation strategies with broader competitiveness and resilience goals will be essential, particularly where technologies can strengthen domestic supply chains or reduce strategic dependencies. Ensuring access to funding across all stages of development – especially as private capital becomes more selective – and reinforcing partnerships across research, industry and finance will be key to maintaining momentum.

The inaugural IFAT Saudi Arabia aims to accelerate investment in sustainable waste and water infrastructure across the Kingdom. The event will focus on knowledge exchange, policy dialogue, and sector collaboration through a strategic summit and a CPD-certified conference programme.

Taking place from 26-28 January at the Riyadh Front Exhibition & Conference Center, IFAT Saudi Arabia is designed to support national development goals and market readiness. The Summit and conference stages will examine how policy, capital, and technology can enhance waste and water systems, promote circular economy models, and strengthen long-term environmental resilience.

“Strengthening waste management systems is a key priority for supporting environmental protection, operational efficiency and resource recovery,” said Dr. Abdullah Al Sebaei, CEO of the National Center for Waste Management (MWAN). “IFAT Saudi Arabia creates a focused environment for stakeholders to exchange knowledge, review international experience and align on strategic approaches that support the Kingdom’s regulatory direction and circular economy ambitions.”

The invite-only IFAT Saudi Arabia Summit on 26 January will bring together senior government officials, regulators, investors, and industry leaders to discuss the strategic direction of the Kingdom’s waste and water sectors. Sessions will focus on impact investment, public-private partnerships, stakeholder engagement, and future readiness, featuring regional and international case studies and policy insights.

Key discussions include the Leaders Panel, which will assess the evolving waste and water economy in Saudi Arabia, and the Water Security Panel, led by the Saudi Water Authority, focusing on governance and integrated strategies for national water security. “A secure and resilient water sector requires long-term planning, strong governance and close coordination across public and private stakeholders,” said Eng. Mamdooh Alshuaibi, Vice President of Sustainability and Water Sector Services at the Saudi Water Authority. “IFAT Saudi Arabia provides a timely setting to discuss policy priorities, investment frameworks and technical approaches that support efficient water use, system resilience and sustainable service delivery across the Kingdom.”

Complementing the Summit, the CPD-certified conference programme will run across two thematic stages. Orange Stage will focus on waste management, recycling, and circular economy practices, featuring sessions on smart municipal solid waste systems, operational efficiency, and the role of digitalization and cybersecurity. Highlights include a panel marking the launch of the World Bank’s latest report on Solid Waste Management in MENA, in collaboration with the International Solid Waste Association.

Blue Stage, running 27–28 January, will explore water resilience, desalination, reuse, and digital transformation for utilities and industrial users. Sessions include a panel on Middle East water resilience organized by German Water Partnership, a brine mining case study led by NEOM, and discussions on financing and PPP models led by the International Water Association.

By connecting policy, investment, and applied solutions, IFAT Saudi Arabia aims to drive informed decision-making, cross-sector collaboration, and practical delivery across the Kingdom’s environmental ecosystem.

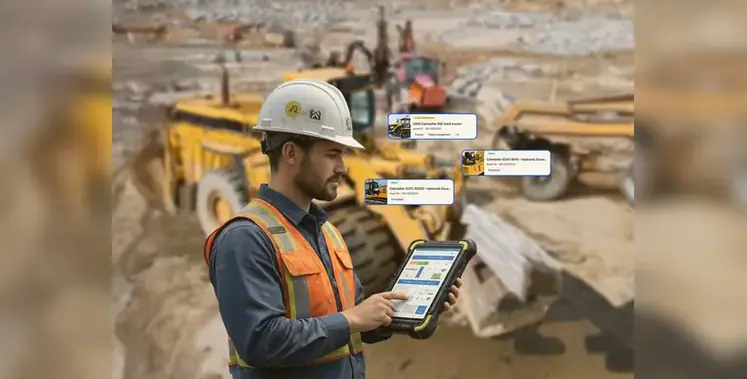

Technology firm Krank has introduced the Inspeq Platform, a modular operational layer designed to provide control-tower oversight of inspections, work order execution and fleet operations without replacing existing enterprise systems.

The platform is aimed at asset-intensive sectors including mining, construction, energy, utilities, insurance and heavy industry, where frontline teams face mounting pressure to maintain safe operations while improving efficiency. Despite widespread use of CMMS, EAM and ERP systems, many organisations continue to rely on fragmented, paper-based or disconnected inspection workflows, resulting in delayed reporting and slower decision-making.

Inspeq has been developed to bridge this operational gap. Rather than displacing established systems, it integrates with them, connecting frontline inspection activity directly to management in a unified, real-time environment. The platform consolidates inspections, work orders, site data and asset-level intelligence, enabling senior leadership to gain visibility across distributed operations without disrupting existing processes.

According to Khurram Mumtaz, Chief Technology Officer at Krank, the system was built around the realities of frontline conditions, including remote sites, harsh environments and limited connectivity. “We have developed the Inspeq Platform around what frontline teams need most on the job. It helps them catch issues faster, assign work instantly, and deliver the right insights to the right people at the right time,” he said.

A central feature of the platform is its Remote Work Orders capability, which allows senior inspectors or specialist technicians to conduct and supervise inspections remotely. Using live video calls, experienced personnel can guide on-site staff in real time, directing inspections and capturing high-definition images and video evidence. Findings are logged centrally as the inspection progresses, enabling reports to be completed remotely.

The approach is intended to maximise scarce technical expertise by extending oversight across multiple sites without requiring physical travel. Krank said the feature reduces travel costs, shortens inspection turnaround times and promotes consistent quality standards across geographically dispersed assets.

Inspection findings within Inspeq feed directly into live work order execution, ensuring that defects are addressed promptly and accountability is clearly assigned. Pre-start checks, maintenance schedules, discrepancy reporting and asset histories are consolidated within a single operational layer.

By sitting above existing enterprise systems, Inspeq aims to improve data accuracy, accelerate response times and reduce administrative burdens while supporting digital transformation without workforce retraining.

Krank said the platform was shaped by frontline feedback to create a scalable, mobile-first solution capable of aligning asset data, inspections and operational insight in real time.

A key focus at the show will be dust and spillage control at conveyor transfer points. (Image source: Martin Engineering)

Global bulk material handling specialist Martin Engineering has announced it will unveil a series of new conveyor accessories and flow technologies at CONEXPO-CON/AGG 2026, taking place from 3–7 March at the Las Vegas Convention Center.

Exhibiting at booth C30148 in the Central Hall, the company will present heavy-duty systems developed at its Center for Innovation, targeting safer and more efficient bulk handling operations across the aggregates and mining sectors.

Chris Schmelzer, Director of National Sales for the US and Canada, said the new portfolio has been tested in demanding real-world environments. He added that visitors will be able to explore solutions designed to support cleaner, safer and more productive material handling processes, from extraction through to final product.

Products on show

A key focus at the show will be dust and spillage control at conveyor transfer points, where emissions remain a persistent industry challenge.

Among the products on display is the Martin Skirtboard Liner, engineered to protect sealing systems by absorbing impact and abrasion inside transfer point skirtboards. The liner features a steel-reinforced urethane construction and a T-slot mounting interface that allows adjustment from outside the chute wall, reducing the need for confined space entry.

The company will also preview the Martin ApronSeal Urethane Skirting system, a dual-seal assembly combining a primary urethane seal with a self-adjusting secondary flap to contain fine material. Designed for belt speeds of up to 4.5 m/s, the system requires minimal maintenance and limited free belt space.

In addition, Martin’s modular A.I.R. Control Dust Curtains are designed to create controlled air recirculation zones within transfer enclosures, helping to reduce dust emissions compared with conventional rubber curtain systems. The curtains can be adjusted or replaced externally, cutting service times.

Flow improvement technologies will also feature prominently. The N2 Air Cannon Intelligence System monitors connected air cannons multiple times daily, detecting misfires, measuring blast efficiency and tracking pressure and temperature. A cloud-based dashboard enables predictive maintenance and reduces manual inspections.

An expanded line of electric vibrators will be introduced, aimed at improving material separation and preventing build-up in hoppers, silos and chutes. The new models offer increased power and efficiency while maintaining durability, backed by a three-year warranty.

The company will also present upgraded belt cleaning systems, including the Martin H1 Primary Belt Cleaner and P2 and R2 secondary cleaners, built with stainless steel components and tungsten carbide tips for use on abrasive materials and high-speed or reversing belts.

The exhibition will cover six core product groups spanning the full lifecycle of process industries. (Image source: ACHEMA)

Saudi Arabia’s expanding industrial and energy transition ambitions are set to gain a new international platform with the launch of ACHEMA Middle East, scheduled to take place from 26-28 October 2026 at the Riyadh International Convention & Exhibition Center.

The inaugural regional edition of the long-established ACHEMA exhibition comes as the Kingdom accelerates large-scale projects aimed at decarbonisation and advanced manufacturing. These include a major carbon capture hub in Jubail, designed to capture up to nine million tonnes of CO2 annually by 2028, and the US$8.4bn NEOM Green Hydrogen Project, which targets the production of 600 tonnes per day of clean hydrogen by 2027.

Held under the patronage of the Saudi Ministry of Industry and Mineral Resources and supported by ASAS, the event is organised by Messe Frankfurt and powered by DECHEMA. The exhibition extends ACHEMA’s century-long legacy in chemical engineering and process industries into the Middle East, Africa and South Asia (MEASA) region.

For more than 100 years, ACHEMA has served as a global meeting point for the chemical, pharmaceutical, biotechnology and laboratory sectors. Its debut in Riyadh is intended to connect international technology providers with regional manufacturers, policymakers and researchers at a time when Saudi Arabia is pursuing industrial diversification under Vision 2030.

Exhibition main themes

The exhibition will cover six core product groups spanning the full lifecycle of process industries, including industrial engineering, laboratory and analytical solutions, automation and digital systems, packaging and supply chain technologies, and research and development. Organisers say the integrated scope reflects the increasingly interconnected nature of modern industrial operations.

Conference programming will centre on six innovation themes: process, pharma, lab, digital, green and energy innovation. CPD-accredited sessions and expert-led discussions will address topics such as electrification, bioprocessing, artificial intelligence-enabled operations and circular economy models.

Dr Björn Mathes, chief executive of DECHEMA Exhibitions, described the Riyadh edition as a strategic evolution. “By bringing ACHEMA to Riyadh, we are creating a platform where science, engineering and industrial innovation align with the ambitions of one of the world’s most dynamic industrial economies,” he said.

Azzan Mohammed, managing director of Messe Frankfurt Saudi Arabia, said the event would foster knowledge exchange and support the development of sustainable and competitive industrial ecosystems.

Early confirmed exhibitors include Yokogawa, GMM Pfaudler, Hach, Beckhoff, Aptek, Pharmadule Morimatsu, Tofflon and Sealmatic, signalling strong international interest ahead of the show’s first edition.

The Etihad Rail has unveiled fresh details of its forthcoming passenger services. (Image source: Etihad Rail)

The Etihad Rail has unveiled fresh details of its forthcoming passenger services, offering insight into what travellers can expect when the UAE’s national rail network begins operations later this year.

The announcement follows confirmation of the country’s long-anticipated intercity passenger rail system, positioned as a modern alternative to driving between the Emirates.

The service has been designed to reflect changing lifestyles across the UAE, with a focus on reliability, comfort and sustainability.

Azza AlSuwaidi, deputy chief executive of Etihad Rail Mobility, said the next phase marks a shift from delivering infrastructure to shaping the overall travel experience.

She noted that the ambition is to create a service people actively choose because it integrates seamlessly into their daily routines.

For commuters, predictability is central to the offering. A consistent timetable and guaranteed seating are intended to provide peace of mind, enabling passengers to plan their schedules with greater certainty.

Quiet, calm onboard environments are also expected to allow travellers to use their journey time productively or as an opportunity to rest.

Key features

AlSuwaidi said reliability remains the defining factor for daily passengers, adding that the rail network is designed to give people “useful and usable time back” rather than adding to the pressures of the working day.

Business travellers are another key demographic. Trains will feature onboard Wi-Fi, power outlets at every seat and spacious interiors, creating what the operator describes as a professional and connected setting.

The aim is to allow passengers to work, prepare for meetings or unwind while travelling between the UAE’s major commercial hubs.

Families and leisure travellers are also being targeted as core users of the service. Dedicated family seating areas and generous luggage storage are intended to make weekend breaks, holidays and visits to relatives easier and less stressful.

By removing the demands of driving, such as navigating traffic and long hours at the wheel, the operator believes rail travel can help families spend more meaningful time together.

AlSuwaidi highlighted that 2026 has been designated the UAE Year of the Family, noting that rail journeys can offer uninterrupted shared time that is increasingly rare in modern life.

The passenger experience has also been developed to reflect a distinct Emirati identity. From station architecture to onboard design, the network aims to embody national values centred on safety, quality and hospitality.

Officials say international best practice and rigorous operational standards will underpin the system, reinforcing confidence among citizens and residents alike.

Most Read

-

-

-

-

-

-

-

-

-

- Details

-

-

-

-

Latest News

Most Read

Latest News

More Articles

Smart cleaning innovation elevates QAIA passenger experience. (Image source: Queen Alia International Airport)