His Highness Sheikh Theyab bin Mohamed bin Zayed Al Nahyan, Deputy Chairman of the Presidential Court for Development and Fallen Heroes’ Affairs, has witnessed the groundbreaking of the world’s largest combined solar power and battery storage project, a landmark facility capable of delivering 1GW of continuous, baseload renewable energy around the clock.

Developed by Masdar and Emirates Water and Electricity Company (EWEC), the project reflects the vision of His Highness Sheikh Mohamed bin Zayed Al Nahyan, President of the United Arab Emirates, to drive sustainable development and energy diversification.

This world-first initiative will integrate a 5.2GW solar photovoltaic (PV) plant with a 19GWh battery energy storage system (BESS), the largest and most advanced of its kind globally. Employing AI-enhanced forecasting, intelligent dispatch, and predictive analytics, the facility will redefine the limits of renewable energy by overcoming intermittency and providing gigascale baseload power at a globally competitive tariff.

Once operational in 2027, the project will generate 1GW of steady, clean energy 24/7, offsetting approximately 5.7mn tonnes of carbon emissions annually. Representing a capital investment exceeding US$6bn, it will create more than 10,000 jobs and spur new manufacturing and service industries, supporting the UAE’s socioeconomic growth and energy transition goals.

By supplying reliable renewable power to meet growing demand from AI and the digital economy, the facility also aligns with the UAE’s National Artificial Intelligence Strategy 2031, which aims to position the country as a global leader in AI-driven innovation and sustainability.

Growing renewables

Masdar continues to expand its expertise in battery storage through projects in the United States, the United Kingdom and other global markets, including the world’s first storage system connected to a floating offshore wind farm. The company remains on track to achieve its target of reaching 100GW of clean energy capacity worldwide by 2030.

His Excellency Dr Sultan Al Jaber, Minister of Industry and Advanced Technology and Chairman of Masdar, said, "Masdar and EWEC are breaking ground on the future, here in Abu Dhabi. With the unwavering support of His Highness Sheikh Mohamed bin Zayed Al Nahyan, President of the UAE, and His Highness Sheikh Khaled bin Mohamed bin Zayed Al Nahyan, Crown Prince of Abu Dhabi and Chairman of the Abu Dhabi Executive Council, and in the presence of His Highness Sheikh Theyab bin Mohamed bin Zayed Al Nahyan, this gigascale project is a step towards redefining the role of renewable energy for the information age. This breakthrough is the culmination of Masdar's two decades of excellence in renewables and is testament to the power of collaboration in Abu Dhabi's energy ecosystem. As the world looks for secure, sustainable and affordable energy, the UAE is proud to offer a new vision for technologically enabled growth."

Mohamed Jameel Al Ramahi, CEO at Masdar, said, "This groundbreaking is a proud occasion for Masdar and the UAE, and represents a pivotal moment in clean energy transformation. This world-first project, the largest and most ambitious in Masdar's history, is a blueprint for the world, demonstrating that renewable energy can be dispatched around the clock. By overcoming the challenge of intermittency, we can provide sustainable power to meet fast-growing demand from advancements in artificial intelligence and other technologies. We look forward to working closely with EWEC and our partners to deliver this landmark project, which will set the global standard for renewable energy development and support other nations in delivering on their clean energy objectives."

Ahmed Ali Alshamsi, CEO at EWEC, said, "This landmark project is a testament to the vision of President His Highness Sheikh Mohamed bin Zayed Al Nahyan, and the unwavering commitment of EWEC and our partners in commissioning and developing transformative innovations that support national objectives. Abu Dhabi and the UAE are a global hub for artificial intelligence research, innovation, and adoption, and this project will ensure that the energy needs of this key sector are met sustainably, powering the next generation of economic growth. We are proud to have strategically collaborated with Masdar on this iconic project, and to break ground on a new era of energy in the UAE."

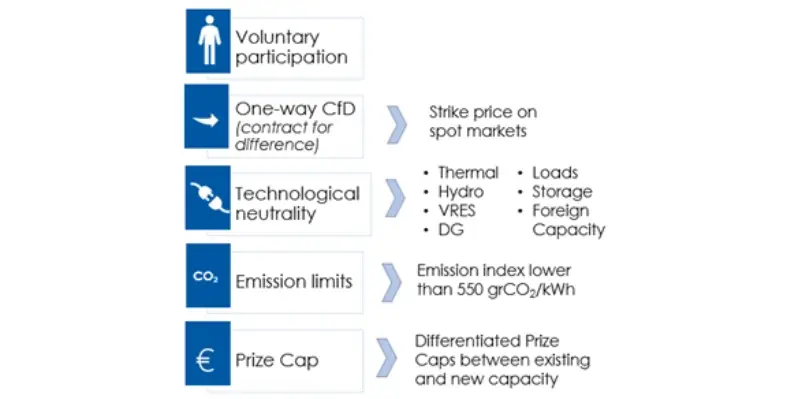

To address these concerns, Italy has gone beyond short-term energy markets and invested in forward-looking mechanisms that secure future capacity and flexibility. One of the country’s most innovative tools is the Capacity Market (CM), designed to ensure that enough “firm capacity”—power that can be counted on at any time—is available years in advance.

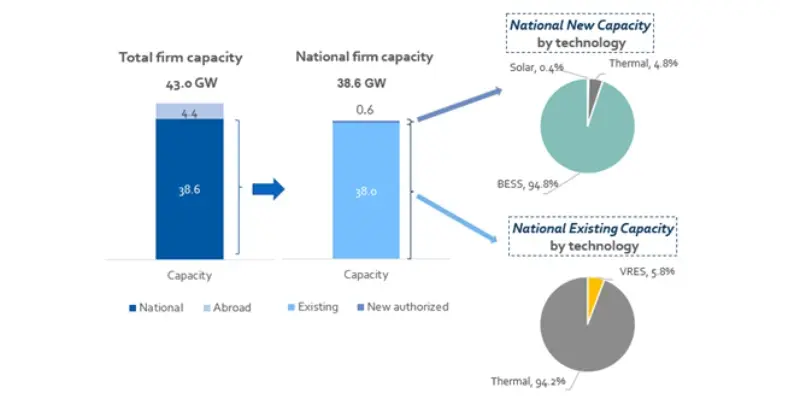

To address these concerns, Italy has gone beyond short-term energy markets and invested in forward-looking mechanisms that secure future capacity and flexibility. One of the country’s most innovative tools is the Capacity Market (CM), designed to ensure that enough “firm capacity”—power that can be counted on at any time—is available years in advance. Italy was among the first in the EU to launch a CM, holding its inaugural auction in 2019 for delivery in 2022. The most recent auction took place in February 2025, securing capacity for 2027. These auctions are open to

Italy was among the first in the EU to launch a CM, holding its inaugural auction in 2019 for delivery in 2022. The most recent auction took place in February 2025, securing capacity for 2027. These auctions are open to Importantly, the CM also welcomes cross-border participation, allowing foreign providers to contribute firm capacity if they secure transmission rights at Italy’s borders. Even variable renewable energy sources (VRES) like solar and wind are participating. While their awarded firm capacity may seem modest—just 5.8% or 2.2 GW—it represents around 14 GW of installed capacity when adjusted for reliability factors.

Importantly, the CM also welcomes cross-border participation, allowing foreign providers to contribute firm capacity if they secure transmission rights at Italy’s borders. Even variable renewable energy sources (VRES) like solar and wind are participating. While their awarded firm capacity may seem modest—just 5.8% or 2.2 GW—it represents around 14 GW of installed capacity when adjusted for reliability factors.