In The Spotlight

Siemens Smart Infrastructure has expanded its portfolio of industrial control and protection technologies with new developments aimed at improving electrical safety, operational reliability and sustainability in industrial environments.

The company has enhanced the capabilities of its semiconductor-based circuit protection technology while also introducing a refurbished soft starter developed under circular economy principles. The announcements reflect a broader push by Siemens to combine advanced electrical engineering with environmentally responsible manufacturing.

Central to the update is the continued development of the SENTRON Electronic Circuit Protection Device (ECPD), which was first launched in 2024. The device uses semiconductor technology to perform electronic switching far faster than traditional protection systems, helping to reduce short-circuit energy and safeguard connected equipment.

The ECPD can deliver switching speeds up to 1,000 times faster than conventional solutions. It also integrates more than ten configurable functions into a single unit, allowing operators to significantly reduce the space required within distribution boards while enabling software-based configuration.

Siemens plans to expand the product range with a single-phase version that will include integrated residual current monitoring. This function enables continuous supervision of electrical circuits to detect faults at an early stage without disrupting operations. Such monitoring is particularly relevant for facilities that require high levels of reliability, including data centres, exhibition venues and lighting installations, where uninterrupted power supply is essential.

A three-phase version of the ECPD is also under development to address higher-voltage systems operating at 400V and 32A. This model is expected to support a wider range of infrastructure and industrial applications, including conveyor systems, elevators, heat pumps, air conditioning installations and event power distribution networks.

According to Andreas Matthé, the company’s use of semiconductor technology is reshaping industry expectations for circuit protection by delivering faster response times, compact designs and improved system uptime.

Alongside the circuit protection developments, Siemens has also introduced its first refurbished soft starter designed according to circular economy principles. The SIRIUS 3RW5 -Z R11 refurbished soft starter is created through a controlled refurbishment process in which used devices are thoroughly tested, key components replaced and performance validated to meet the same standards as new equipment.

This remanufacturing process typically reduces carbon emissions by as much as 50% compared with producing a new device, primarily due to lower resource consumption. Environmental Product Declarations document the environmental benefits and ensure transparency.

The refurbished soft starter retains full compatibility with new units in terms of installation, parameterisation and functionality, enabling straightforward integration into existing systems. The product also incorporates traceability features such as a QR-based ID Link, allowing lifecycle monitoring across both its initial and refurbished service phases.

Siemens is showcasing the technology at the Light + Building 2026 in Frankfurt, where the company is highlighting how digitalisation and circular design can work together to support more sustainable industrial operations.

Airlines and aviation authorities across the Middle East are adjusting operations as regional tensions and airspace restrictions continue to disrupt travel, forcing carriers to reduce schedules while governments coordinate support for affected passengers.

Emirates confirmed it is operating a reduced flight schedule until further notice following the partial reopening of some regional airspace. The airline said it plans to run more than 100 flights to and from Dubai on 5 and 6 March in order to transport passengers and move essential cargo such as pharmaceuticals and perishables.

A spokesperson said the carrier will progressively rebuild its timetable as more airspace becomes available and operational requirements are met. Safety, the airline emphasised, remains its primary priority while it continues to monitor developments across the region.

Passengers have been advised to travel to the airport only if they hold confirmed bookings and to check the airline’s website and social media channels for the latest updates.

Meanwhile, Dubai-based carrier flydubai has resumed flights across parts of its network but is currently operating a scaled-back schedule. The airline said it is gradually adding services as restrictions on regional airspace begin to ease.

However, flight times may be longer than usual as aircraft are temporarily rerouted to avoid restricted zones. The airline also urged customers not to travel to the airport without confirmation of a booking or rebooked flight. Travellers connecting through Dubai will only be accepted if their onward flight is operating.

Despite wider disruptions, aviation activity in Jordan has remained comparatively stable. The Civil Aviation Regulatory Commission reported that airports across the Kingdom continued operating normally on Wednesday despite the closure of airspace in several neighbouring countries.

According to commission chairman Deifallah Farajat, Queen Alia International Airport recorded 67 inbound flights and 58 departures during the day, with national carrier Royal Jordanian accounting for the largest share of operations. Authorities said technical teams remain on standby to respond to any developments affecting airspace safety.

Elsewhere, the government of Oman has begun assisting foreign nationals stranded across the Gulf as the travel disruption intensifies. Foreign Minister Sayyid Badr bin Hamad Albusaidi said the country is working with governments and international airlines to organise flights for travellers seeking to leave the region.

Omani authorities are coordinating with diplomatic missions and carriers to ensure safe and orderly departures for affected passengers. The initiative reflects the Sultanate’s longstanding diplomatic approach of prioritising humanitarian assistance during regional crises.

The aviation disruption follows the escalation of the US-Israel-Iran conflict, which has prompted several countries to close or restrict their airspace. Airlines have been forced to cancel services or divert aircraft along longer routes to avoid conflict zones.

Industry observers warn that flight disruptions could persist in the coming weeks if hostilities continue, with travellers across the Middle East advised to monitor airline updates as schedules remain subject to rapid change.

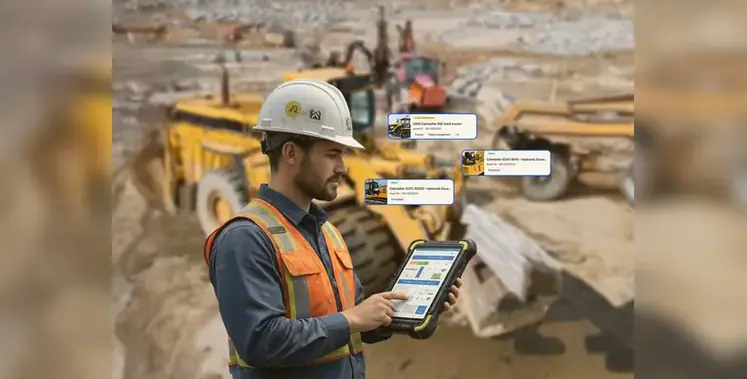

Digital concrete technology company Giatec has announced a commercial partnership with specialty chemicals manufacturer Sika aimed at accelerating the adoption of data-driven solutions across the global concrete value chain.

The collaboration will combine Giatec’s digital monitoring and analytics platforms with Sika’s extensive global presence and expertise in construction materials. Through the partnership, the companies intend to expand the use of intelligent technologies in concrete production, transportation, placement and long-term performance monitoring.

Sika operates in more than 100 countries and offers a broad portfolio of construction solutions, including high-performance concrete admixtures and advanced building systems. By integrating Giatec’s digital tools into Sika’s global network, the two companies expect to broaden access to technologies that help construction firms optimise quality control, efficiency and sustainability.

Ivo Schädler, Head Construction at Sika, said the collaboration reflects a shared ambition to support the industry’s transition towards more digitally enabled operations.

“By combining Sika’s materials science and construction expertise with Giatec’s innovative digital concrete solutions, we aim to help the sector move away from reactive methods towards proactive, data-enabled decision-making,” he said. “This approach can improve project quality, boost productivity and support more sustainable construction outcomes.”

The announcement comes as the construction sector increasingly embraces digital tools and artificial intelligence. Industry forecasts indicate that the global market for AI-driven construction technologies could expand significantly over the next decade, driven by demand for improved productivity, cost control and environmental performance.

Giatec’s technology ecosystem includes wireless concrete sensors, artificial intelligence-based software platforms and in-transit monitoring tools designed to provide real-time data on concrete behaviour during transport and placement. According to the company, these systems help contractors and producers improve consistency, reduce material waste and make faster operational decisions.

Pouria Ghods, CEO and co-founder of Giatec, described the agreement as a key step in expanding the company’s global impact. He noted that combining Sika’s global reach with Giatec’s digital expertise will help address long-standing challenges related to efficiency, performance and sustainability within the construction sector.

“Together we can deliver measurable value for producers, contractors and project owners by providing greater transparency and insight into concrete performance,” Ghods said.

Both companies are showcasing their technologies and discussing the partnership with industry stakeholders at CONEXPO-CON/AGG 2026, where representatives are presenting solutions designed to support the digital transformation of construction practices.

Middle East Energy has been rescheduled from 7-9 April to 1-3 September 2026 at the Dubai World Trade Centre, organisers have confirmed via an official statement.

The new dates have also been updated on the Middle East Energy official website.

The 50th edition is now expected to welcome nearly 50,000 attendees from 178 countries, with the revised dates said to provide greater flexibility for travel, logistics and full-scale solution showcases across the power value chain.

While no reason has been formally stated for the change, the move comes amid ongoing regional tensions in the Middle East.

The statement added, "Hosting this landmark event in September 2026 will provide additional space at DWTC and an extended period for all participants to organise logistics and travel and prepare product, machinery and technology showcases, to maximise value for everyone."

Organisers said the team is committed to supporting participants and addressing any queries ahead of the September gathering.

Mark Ring, Group Director – Energy & Power, Informa, said, "This event has always been about bringing the global energy and power community together to share ideas, showcase innovation and drive progress. By hosting the 2026 edition in September, we are ensuring that exhibitors and attendees have the opportunity to make the most of this important event. We remain committed to delivering an exceptional experience for everyone and look forward to welcoming the energy sector to Dubai this September.”

Road construction equipment manufacturer Wirtgen has introduced the W 200 F, a new-generation large milling machine designed to improve efficiency, operational precision and sustainability in road rehabilitation projects.

The machine forms part of Wirtgen’s latest portfolio of intelligent cold milling machines, developed to help contractors achieve a balance between productivity, milling quality and operating costs. With flexible milling widths of 2.0 m and 2.2 m and a maximum milling depth of 330 mm, the W 200 F is suited to a wide range of road maintenance applications, from removing surface layers to full-depth rehabilitation and fine milling tasks.

At the core of the machine’s capabilities is the company’s MILL ASSIST control technology, which automates many operational adjustments typically carried out manually by machine operators. Milling operations often require continuous parameter changes due to varying road surfaces and working conditions. These include adjustments to milling speed, drum rotation and water flow.

Using digital monitoring and real-time data analysis, MILL ASSIST automatically optimises these parameters while the machine is operating. According to Wirtgen, the system identifies the most efficient balance between production output and resource consumption, allowing the equipment to respond dynamically to changing site conditions. The automation helps reduce fuel use, water consumption and tool wear while also lowering noise and carbon emissions.

The W 200 F also introduces a revised operating interface designed to simplify machine control. Instead of monitoring several separate displays, operators can now access key operational data through a single 7-inch control panel that provides an overview of machine performance and milling progress. A secondary 5-inch panel manages the LEVEL PRO ACTIVE levelling system, which ensures precise surface results during milling operations.

LEVEL PRO ACTIVE is fully integrated with the machine’s control system and includes automated functions to improve productivity. For example, the system allows the machine to automatically raise itself when passing over obstacles such as manhole covers. It also assists operators when positioning the machine for subsequent milling passes, helping to maintain consistent surface quality.

Another notable feature is the optional Multiple Cutting System (MCS), which allows milling drums with different tool spacings to be replaced without additional tools. Using this system, a milling drum can be removed and replaced in approximately 15 minutes. The ability to quickly change drums enables contractors to adapt the machine to different project requirements and minimise downtime.

In addition, the W 200 F supports rapid replacement of entire milling drum assemblies. Pre-assembled units with different milling widths can be swapped in around one hour, allowing contractors to respond more quickly to changing project specifications on site.

Etihad Rail has operated a passenger train on a trial basis between Al Ghuwaifat, near the Saudi border, and Al Faya in Abu Dhabi, as part of contingency planning linked to current regional developments.

The test run forms part of wider preparedness measures aimed at safeguarding essential services and ensuring alternative transport options remain available if required. The initiative was carried out in coordination with the Abu Dhabi Emergencies, Crises and Disasters Management Centre (ADCMC).

Officials said the route connecting the two stations holds strategic significance, strengthening transport links between the UAE and Saudi Arabia while facilitating access to key ports and logistics hubs. The connection is designed to support the movement of citizens and residents and provide additional flexibility within approved response frameworks.

The operation sits within a broader package of integrated measures implemented by relevant authorities to reinforce logistical security and business continuity. These efforts are aligned with multi-scenario risk management strategies intended to ensure that critical infrastructure remains resilient under changing circumstances.

Matar Saeed Al Nuaimi, Director-General of ADCMC, said transport readiness is central to Abu Dhabi’s comprehensive emergency response system. He noted that developments are managed under structured governance and close coordination across sectors, allowing for rapid adjustments and efficient deployment of resources.

Al Nuaimi added that maintaining flexibility within the transport network is vital to sustaining essential services and preserving societal stability. The Centre, he said, continues to monitor developments around the clock to strengthen preparedness and public confidence.

From Etihad Rail’s side, Chief Projects Officer Eng Mohammed Al Shehhi said the trial demonstrates the adaptability of the UAE’s national railway network. He noted that operating passenger services along the Al Ghuwaifat–Al Faya corridor highlights the system’s ability to support national requirements under various scenarios.

Al Shehhi said the initiative aligns with directives to bolster the national transport ecosystem and enhance its strategic contribution to community resilience. He confirmed that Etihad Rail teams remain in close coordination with government partners to maintain operational continuity.

Authorities stressed that the move reflects proactive planning rather than reactive measures, translating risk assessments into practical solutions that enhance infrastructure resilience and ensure the smooth movement of people when needed.

Dubai Municipality has awarded five major contracts under the second phase of its Tasreef Programme, committing AED2.5bn to expand and reinforce the emirate’s stormwater drainage network.

The move follows directives from Mohammed bin Rashid Al Maktoum to strengthen critical infrastructure and ensure drainage systems are fit to serve Dubai for the next century. The newly announced package will cover 30 key districts across approximately 430mn sq m, supporting a projected population of three million residents by 2040.

Contracts have been signed with international contractors including DeTech Contracting and China State Construction Engineering Corporation, alongside specialist consultants. The scope comprises three construction agreements and two design and study contracts focused on selected locations across the city.

The latest awards build on Phase One allocations announced in April 2025 and form part of a phased delivery strategy aimed at improving flood resilience amid rapid urbanisation and intensifying climate pressures. Dubai Municipality said the projects are aligned with the objectives of the Dubai 2040 Urban Master Plan and broader national climate neutrality ambitions.

Marwan Ahmed bin Ghalita, Director General of Dubai Municipality, described Tasreef as one of the emirate’s flagship infrastructure initiatives, designed to embed long-term sustainability into urban planning. He said the programme seeks to establish an integrated stormwater management system that enhances preparedness, safeguards resources and improves quality of life.

Adel Al Marzouqi, CEO of the Waste and Sewerage Agency, added that Phase Two will raise network capacity in priority areas, improve service continuity and elevate safety standards.

Among the headline schemes is the construction of a main tunnel up to four metres in diameter, linking communities along Sheikh Mohammed bin Zayed Road and Al Yalayis Road to the primary drainage backbone. A separate 27 km integrated network will extend between Sheikh Zayed Road and Al Jamayel Road, incorporating advanced tunnels to protect a strategic industrial and logistics corridor.

Additional works include a new drainage tunnel and pumping station along Dubai–Al Ain Road and Sheikh Zayed bin Hamdan Al Nahyan Street, as well as a stormwater collection lake. Design contracts have also been issued for an integrated stormwater and groundwater system in Al Marmoom and Saih Al Salam, connected to the main line along Al Qudra Road.

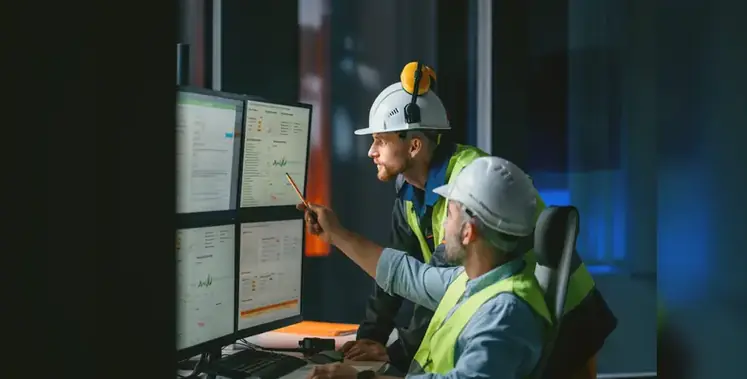

In its recent white paper, The State of Global Sustainability Disclosures, Sprih Inc. analysed more than 200,000 reports from over 80,000 companies worldwide, creating one of the largest repositories of corporate sustainability data ever assembled. The findings show that sustainability reporting is no longer a fringe exercise.Yet comparability and consistency remain mainly out of reach for many businesses.

According to Sprih, this is where artificial intelligence must move from being a reporting tool to becoming the backbone of ESG intelligence.

Increasing visibility

The white paper, powered by SustainSense, Sprih’s climate AI engine, reveals a paradox. Disclosure rates for Scope 1 and Scope 2 emissions are relatively mature across many regions and sectors and near-term targets are widely adopted. Energy consumption is commonly reported in aggregate.

Yet when we move beyond headline figures, fragmentation becomes obvious.

Scope 3 emissions, which are often the largest share of a company’s footprint, remain inconsistently disclosed. Water reuse and rainwater harvesting data are scarce and waste categorisation varies widely. Smaller firms, particularly those under US$100mn in revenue, lag significantly in both completeness and consistency.

The paper explains that without standardisation, sustainability disclosures risk becoming a patchwork of narratives rather than a coherent dataset. This makes investors struggle to benchmark risk, while regulators face uneven compliance landscapes. Moreover, procurement leaders lack visibility across supply chains and executives are left navigating strategy with incomplete maps.

But AI can help change this equation.

Teaching machines the language of sustainability

One of the most powerful insights from the white paper is methodological. SustainSense does not merely collect documents; it extracts, classifies, validates and normalises data across languages, formats and reporting frameworks. In other words, it teaches machines to understand sustainability.

This matters because ESG data is not structured by default. It sits inside PDFs, integrated annual reports, regulatory filings and standalone sustainability documents. Terminology can differ across jurisdictions and definitions evolve. Units can vary and even the placement of data within reports is inconsistent.

Agentic AI architectures, as described in the paper, create a structured layer on top of this chaos. They identify emissions figures, distinguish between location-based and market-based Scope 2 data, harmonise water metrics and align targets to recognised definitions such as near-term, long-term and net zero.

The result is not just a larger dataset, but a comparable one.

When thousands of disclosures are translated into a common analytical framework, patterns emerge. Europe’s leadership in comprehensive target-setting becomes quantifiable. Asia’s relative lag in Scope 3 transparency becomes measurable. The maturity gradient between large enterprises and SMEs becomes visible at scale.

According to Sprih, this is not anecdotal ESG, but rather "it is systemic ESG intelligence."

A strategic asset

For many companies, sustainability reporting continues to feel like a compliance obligation. But the white paper offers some hope.

Executives can use AI-driven benchmarking to understand where their disclosure quality signals strength – or exposes weakness. Investors can assess governance resilience by examining not just target announcements, but the consistency of underlying metrics. Regulators can identify sectors where harmonisation efforts must intensify.

Crucially, AI can also surface blind spots. The analysis shows that while total energy consumption is widely reported, the breakdown between renewable and non-renewable energy is less consistent. Water withdrawal is commonly disclosed, but treatment and reuse metrics are rare. Waste generation is more visible than circularity performance.

These gaps, it seems, are not simply technical. They represent risk. In a climate-constrained world, incomplete value-chain data or poor resource visibility translates into financial exposure. AI could help transform ESG into static into dynamic risk management.

Better AI systems

Perhaps the most compelling idea in the white paper is the call for a global climate intelligence layer. If corporate disclosures are the raw material, AI is the infrastructure that makes them usable.

Imagine a landscape where investors can benchmark Scope 3 intensity across sectors in seconds; where procurement teams can map supplier emissions maturity; where policymakers can evaluate regional adoption of net-zero commitments with precision rather than estimates. Sprih says that this is not speculative, as it is already emerging.

However, the technology community must recognise that scale alone is insufficient. AI systems must be transparent, auditable and continuously learning. They must adapt as reporting frameworks evolve and new regulatory requirements emerge. They must balance automation with validation to ensure trust.

Equally, companies must view AI not as a shortcut to green credentials, but as a tool for accountability. The question for the market is no longer whether AI will shape ESG. It is whether organisations are ready to operate in a world where sustainability performance is no longer hidden in footnotes, but illuminated by intelligence at scale.

The UAE Research Program for Rain Enhancement Science (UAEREP), overseen by the National Center of Meteorology (NCM), will unveil three new awardees for its Sixth Cycle grants at a press conference on 21 January at the NCM headquarters in Abu Dhabi.

The selected projects align with UAEREP’s key research priorities, which underpin the programme’s 10-year roadmap: Optimised Seeding Materials, Autonomous UAS, Limited-Area Climate Interventions, and Advanced Models, Software, and Data. Each awardee will present an overview of their winning proposal, highlighting their scientific methodology, expected outcomes, and potential contributions to global water security.

Research into optimised seeding materials aims to develop advanced cloud-seeding substances and innovative delivery techniques to enhance rainfall stimulation. Limited-area climate interventions explore localised methods such as solar radiation management and exploiting regional atmospheric conditions to improve cloud formation and precipitation.

Meanwhile, work on advanced models, software, and data focuses on creating sophisticated forecasting tools and decision-support systems that leverage data assimilation and machine learning to refine cloud dynamics modelling and operational efficiency.

Each grant recipient will receive up to US$1.5mn (AED5.511mn) over three years, with a maximum annual allocation of US$550,000. The funding is intended to accelerate next-generation rain enhancement technologies and address emerging challenges in water security worldwide, positioning the UAE at the forefront of climate innovation.

The announcement continues UAEREP’s commitment to fostering scientific research that supports sustainable water resources and strengthens the country’s expertise in cloud-seeding and rainfall enhancement technologies.

Road construction equipment manufacturer Wirtgen has introduced the W 200 F, a new-generation large milling machine designed to improve efficiency, operational precision and sustainability in road rehabilitation projects.

The machine forms part of Wirtgen’s latest portfolio of intelligent cold milling machines, developed to help contractors achieve a balance between productivity, milling quality and operating costs. With flexible milling widths of 2.0 m and 2.2 m and a maximum milling depth of 330 mm, the W 200 F is suited to a wide range of road maintenance applications, from removing surface layers to full-depth rehabilitation and fine milling tasks.

At the core of the machine’s capabilities is the company’s MILL ASSIST control technology, which automates many operational adjustments typically carried out manually by machine operators. Milling operations often require continuous parameter changes due to varying road surfaces and working conditions. These include adjustments to milling speed, drum rotation and water flow.

Using digital monitoring and real-time data analysis, MILL ASSIST automatically optimises these parameters while the machine is operating. According to Wirtgen, the system identifies the most efficient balance between production output and resource consumption, allowing the equipment to respond dynamically to changing site conditions. The automation helps reduce fuel use, water consumption and tool wear while also lowering noise and carbon emissions.

The W 200 F also introduces a revised operating interface designed to simplify machine control. Instead of monitoring several separate displays, operators can now access key operational data through a single 7-inch control panel that provides an overview of machine performance and milling progress. A secondary 5-inch panel manages the LEVEL PRO ACTIVE levelling system, which ensures precise surface results during milling operations.

LEVEL PRO ACTIVE is fully integrated with the machine’s control system and includes automated functions to improve productivity. For example, the system allows the machine to automatically raise itself when passing over obstacles such as manhole covers. It also assists operators when positioning the machine for subsequent milling passes, helping to maintain consistent surface quality.

Another notable feature is the optional Multiple Cutting System (MCS), which allows milling drums with different tool spacings to be replaced without additional tools. Using this system, a milling drum can be removed and replaced in approximately 15 minutes. The ability to quickly change drums enables contractors to adapt the machine to different project requirements and minimise downtime.

In addition, the W 200 F supports rapid replacement of entire milling drum assemblies. Pre-assembled units with different milling widths can be swapped in around one hour, allowing contractors to respond more quickly to changing project specifications on site.

Critical Metals Corp., a critical minerals company headquartered in New York, has signed a non-binding term sheet to form a 50/50 joint venture with Tariq Abdel Hadi Abdullah Al-Qahtani & Brothers Company (TQB), a 75-year-old industrial conglomerate based in Saudi Arabia.

The partnership aims to establish a state-of-the-art rare earth processing facility in the Kingdom, creating a fully integrated mine-to-processing supply chain and securing long-term offtake rights for 25% of the Tanbreez Project’s rare earth concentrate production.

The facility will produce separated rare earth oxides, metals, and downstream products, including magnet-grade materials for aerospace, defense, and advanced industrial applications. All finished materials are planned for shipment to the United States to support the country’s defense industrial complex, strengthening supply chain security for Western-aligned markets.

Tony Sage, Chairman of Critical Metals Corp., said, “This agreement represents a transformational milestone for Critical Metals Corp. By partnering with a leading Saudi Arabian industrial group and securing long-term offtake that brings Tanbreez to 100% committed production, we have effectively de-risked the project’s commercial pathway from mine to market. The establishment of an integrated processing platform in Saudi Arabia not only diversifies global rare earth processing capacity beyond China but also strengthens supply chain security for allied nations across Europe, the Middle East, and beyond. This transaction positions CRML as a cornerstone supplier of critical minerals essential to advanced manufacturing, energy transition technologies, and national security applications for decades to come.”

Under the JV framework, CRML will retain its 50% ownership interest on a carried-interest basis, without issuing equity or incurring debt for the construction of the processing facility. The partnership ensures 100% of Tanbreez production is now under long-term offtake agreements, providing full revenue visibility and supporting allied markets. A jointly governed development committee will oversee engineering, construction, commissioning, and market entry for the processed products.

Abdulmalik Tariq Al-Qahtani, CEO of TQB, commented, “Following the successful official visit of His Royal Highness Prince Mohammed bin Salman to the United States, we are pleased to announce the signing of a Memorandum of Understanding focused on cooperation in the development of critical materials. Critical materials—sourced from strategically important regions including Greenland and other resource-rich jurisdictions—form the foundation of modern technologies across energy, advanced manufacturing, artificial intelligence, defense, and data infrastructure. Securing diversified and resilient supply chains for these materials is essential to long-term technological progress.”

CRML and TQB will now work together to finalise the technical, commercial, and regulatory foundations of the JV, including plant design, development timelines, product specifications, and commercialisation strategy. The initiative is a major step toward diversifying rare earth processing capacity, reducing reliance on China, and strengthening global supply chain resilience.

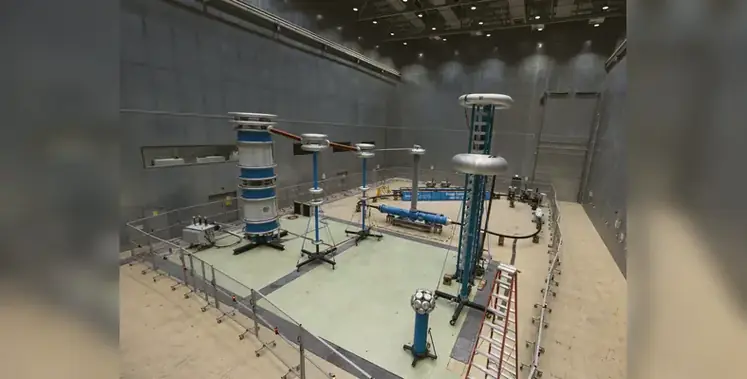

Ducab, a leading UAE-based manufacturer of high-quality cables and energy solutions, has achieved a major technical milestone with the Middle East’s first Extended Pre-qualification (EPQ) test for an Extra-High Voltage (EHV) 400kV cable system at 105°C emergency temperature.

The achievement, completed in collaboration with Swiss specialist Brugg Cables, reinforces Ducab’s reputation for technical excellence and positions the company for global expansion.

The EPQ and system type test represents a regional first and demonstrates Ducab’s ability to meet the most stringent international standards, including IEEE, IEC, and AEIC. The testing was conducted in partnership with Brugg Cables, a recognised leader in high-voltage accessories; TAQA, Abu Dhabi’s government-controlled energy holding company; and DEKRA, the world’s largest independent testing, inspection and certification organisation.

“This successful Brugg test cements Ducab’s reputation for technical leadership and innovation, opening new opportunities in Europe,” said Charles Edouard Mellagui, CEO of Ducab Cables Business. “We are delighted to accelerate our efforts to take our quality HV cables from the UAE to the world.”

The collaboration offers strategic advantages for Ducab, which is now the only supplier on TAQA’s vendor list with two approved accessory suppliers – SEI and Brugg Cables. The EPQ milestone enhances Ducab’s competitiveness for EHV cable system projects across the region and internationally, enabling faster, more effective service for TAQA, regional utilities, and new clients in Europe and the US.

Gianluca Vettese, CEO of Brugg Cables, said: “We are proud to support Ducab in achieving this significant EPQ test, highlighting the strength of our technical collaboration and our shared commitment to delivering world-class high-voltage cable systems that meet the highest international standards.”

Brugg Cables’ specialised testing services for HV and EHV cables, up to 550kV, incorporate a large Faraday cage and on-site diagnostics to ensure insulation integrity and performance. Key elements of the testing process include AC voltage tests, partial discharge measurements for joints, and sheath testing, all designed to ensure reliable, long-term operation of high-voltage cable systems.

With this milestone, Ducab strengthens its technical leadership in the Middle East and sets the stage for international growth, offering utilities and industrial clients high-quality, globally certified EHV cable solutions.

The Etihad Rail has unveiled fresh details of its forthcoming passenger services. (Image source: Etihad Rail)

The Etihad Rail has unveiled fresh details of its forthcoming passenger services, offering insight into what travellers can expect when the UAE’s national rail network begins operations later this year.

The announcement follows confirmation of the country’s long-anticipated intercity passenger rail system, positioned as a modern alternative to driving between the Emirates.

The service has been designed to reflect changing lifestyles across the UAE, with a focus on reliability, comfort and sustainability.

Azza AlSuwaidi, deputy chief executive of Etihad Rail Mobility, said the next phase marks a shift from delivering infrastructure to shaping the overall travel experience.

She noted that the ambition is to create a service people actively choose because it integrates seamlessly into their daily routines.

For commuters, predictability is central to the offering. A consistent timetable and guaranteed seating are intended to provide peace of mind, enabling passengers to plan their schedules with greater certainty.

Quiet, calm onboard environments are also expected to allow travellers to use their journey time productively or as an opportunity to rest.

Key features

AlSuwaidi said reliability remains the defining factor for daily passengers, adding that the rail network is designed to give people “useful and usable time back” rather than adding to the pressures of the working day.

Business travellers are another key demographic. Trains will feature onboard Wi-Fi, power outlets at every seat and spacious interiors, creating what the operator describes as a professional and connected setting.

The aim is to allow passengers to work, prepare for meetings or unwind while travelling between the UAE’s major commercial hubs.

Families and leisure travellers are also being targeted as core users of the service. Dedicated family seating areas and generous luggage storage are intended to make weekend breaks, holidays and visits to relatives easier and less stressful.

By removing the demands of driving, such as navigating traffic and long hours at the wheel, the operator believes rail travel can help families spend more meaningful time together.

AlSuwaidi highlighted that 2026 has been designated the UAE Year of the Family, noting that rail journeys can offer uninterrupted shared time that is increasingly rare in modern life.

The passenger experience has also been developed to reflect a distinct Emirati identity. From station architecture to onboard design, the network aims to embody national values centred on safety, quality and hospitality.

Officials say international best practice and rigorous operational standards will underpin the system, reinforcing confidence among citizens and residents alike.

Electric mobility firm Ampere has signed a joint development agreement with Spanish battery technology company Basquevolt to accelerate the development of lithium metal-based batteries for future electric vehicles.

The collaboration will focus on advancing and validating a new generation of battery technology designed to improve energy density, charging performance and overall efficiency in electric cars. The project will be carried out in Spain and forms part of wider efforts to support innovation within Europe’s rapidly evolving electric mobility sector.

Basquevolt’s lithium metal-based batteries are based on polymer electrolyte technology, which differs from the liquid electrolyte systems used in most current lithium-ion batteries. According to the company, this design could significantly increase the amount of energy stored in each battery while also enabling lighter and more compact battery packs.

Industry specialists say such improvements are essential for the next generation of electric vehicles, where manufacturers are seeking longer driving ranges, faster charging times and improved thermal safety.

By combining Basquevolt’s advanced battery research with Ampere’s engineering and vehicle integration expertise, the two companies aim to accelerate the path towards commercial deployment of the technology in passenger vehicles.

Pablo Fernández, Chief Executive Officer of Basquevolt, said the agreement represents an important step in bringing polymer electrolyte battery technology closer to large-scale production. He noted that working with Ampere will help validate the performance of the batteries under real-world automotive conditions.

Nicolas Racquet, Vice President for Vehicle and Powertrain Engineering at Ampere, added that the partnership highlights the growing role of collaboration in the development of next-generation energy storage systems.

“Together we aim to accelerate the development of advanced EV batteries capable of meeting the evolving expectations of customers,” Racquet said.

The two companies have already worked together for more than a year to refine the technology. Early tests indicate that the batteries could achieve high energy density while also reducing the cost of battery packs compared with traditional lithium-ion solutions.

Basquevolt says its polymer electrolyte approach simplifies the battery cell manufacturing process, potentially lowering production costs and energy consumption at gigafactories. The company estimates that facilities producing the cells could require around 30% less capital investment per gigawatt-hour of capacity, while energy use per kilowatt-hour of battery output could fall by a similar margin.

If successfully commercialised, the technology could help manufacturers produce more efficient and affordable electric vehicles, supporting the broader transition to low-emission transport across global markets.

Dubai Municipality has awarded five major contracts under the second phase of its Tasreef Programme, committing AED2.5bn to expand and reinforce the emirate’s stormwater drainage network.

The move follows directives from Mohammed bin Rashid Al Maktoum to strengthen critical infrastructure and ensure drainage systems are fit to serve Dubai for the next century. The newly announced package will cover 30 key districts across approximately 430mn sq m, supporting a projected population of three million residents by 2040.

Contracts have been signed with international contractors including DeTech Contracting and China State Construction Engineering Corporation, alongside specialist consultants. The scope comprises three construction agreements and two design and study contracts focused on selected locations across the city.

The latest awards build on Phase One allocations announced in April 2025 and form part of a phased delivery strategy aimed at improving flood resilience amid rapid urbanisation and intensifying climate pressures. Dubai Municipality said the projects are aligned with the objectives of the Dubai 2040 Urban Master Plan and broader national climate neutrality ambitions.

Marwan Ahmed bin Ghalita, Director General of Dubai Municipality, described Tasreef as one of the emirate’s flagship infrastructure initiatives, designed to embed long-term sustainability into urban planning. He said the programme seeks to establish an integrated stormwater management system that enhances preparedness, safeguards resources and improves quality of life.

Adel Al Marzouqi, CEO of the Waste and Sewerage Agency, added that Phase Two will raise network capacity in priority areas, improve service continuity and elevate safety standards.

Among the headline schemes is the construction of a main tunnel up to four metres in diameter, linking communities along Sheikh Mohammed bin Zayed Road and Al Yalayis Road to the primary drainage backbone. A separate 27 km integrated network will extend between Sheikh Zayed Road and Al Jamayel Road, incorporating advanced tunnels to protect a strategic industrial and logistics corridor.

Additional works include a new drainage tunnel and pumping station along Dubai–Al Ain Road and Sheikh Zayed bin Hamdan Al Nahyan Street, as well as a stormwater collection lake. Design contracts have also been issued for an integrated stormwater and groundwater system in Al Marmoom and Saih Al Salam, connected to the main line along Al Qudra Road.

Digital concrete technology company Giatec has announced a commercial partnership with specialty chemicals manufacturer Sika aimed at accelerating the adoption of data-driven solutions across the global concrete value chain.

The collaboration will combine Giatec’s digital monitoring and analytics platforms with Sika’s extensive global presence and expertise in construction materials. Through the partnership, the companies intend to expand the use of intelligent technologies in concrete production, transportation, placement and long-term performance monitoring.

Sika operates in more than 100 countries and offers a broad portfolio of construction solutions, including high-performance concrete admixtures and advanced building systems. By integrating Giatec’s digital tools into Sika’s global network, the two companies expect to broaden access to technologies that help construction firms optimise quality control, efficiency and sustainability.

Ivo Schädler, Head Construction at Sika, said the collaboration reflects a shared ambition to support the industry’s transition towards more digitally enabled operations.

“By combining Sika’s materials science and construction expertise with Giatec’s innovative digital concrete solutions, we aim to help the sector move away from reactive methods towards proactive, data-enabled decision-making,” he said. “This approach can improve project quality, boost productivity and support more sustainable construction outcomes.”

The announcement comes as the construction sector increasingly embraces digital tools and artificial intelligence. Industry forecasts indicate that the global market for AI-driven construction technologies could expand significantly over the next decade, driven by demand for improved productivity, cost control and environmental performance.

Giatec’s technology ecosystem includes wireless concrete sensors, artificial intelligence-based software platforms and in-transit monitoring tools designed to provide real-time data on concrete behaviour during transport and placement. According to the company, these systems help contractors and producers improve consistency, reduce material waste and make faster operational decisions.

Pouria Ghods, CEO and co-founder of Giatec, described the agreement as a key step in expanding the company’s global impact. He noted that combining Sika’s global reach with Giatec’s digital expertise will help address long-standing challenges related to efficiency, performance and sustainability within the construction sector.

“Together we can deliver measurable value for producers, contractors and project owners by providing greater transparency and insight into concrete performance,” Ghods said.

Both companies are showcasing their technologies and discussing the partnership with industry stakeholders at CONEXPO-CON/AGG 2026, where representatives are presenting solutions designed to support the digital transformation of construction practices.

A key focus at the show will be dust and spillage control at conveyor transfer points. (Image source: Martin Engineering)

Global bulk material handling specialist Martin Engineering has announced it will unveil a series of new conveyor accessories and flow technologies at CONEXPO-CON/AGG 2026, taking place from 3–7 March at the Las Vegas Convention Center.

Exhibiting at booth C30148 in the Central Hall, the company will present heavy-duty systems developed at its Center for Innovation, targeting safer and more efficient bulk handling operations across the aggregates and mining sectors.

Chris Schmelzer, Director of National Sales for the US and Canada, said the new portfolio has been tested in demanding real-world environments. He added that visitors will be able to explore solutions designed to support cleaner, safer and more productive material handling processes, from extraction through to final product.

Products on show

A key focus at the show will be dust and spillage control at conveyor transfer points, where emissions remain a persistent industry challenge.

Among the products on display is the Martin Skirtboard Liner, engineered to protect sealing systems by absorbing impact and abrasion inside transfer point skirtboards. The liner features a steel-reinforced urethane construction and a T-slot mounting interface that allows adjustment from outside the chute wall, reducing the need for confined space entry.

The company will also preview the Martin ApronSeal Urethane Skirting system, a dual-seal assembly combining a primary urethane seal with a self-adjusting secondary flap to contain fine material. Designed for belt speeds of up to 4.5 m/s, the system requires minimal maintenance and limited free belt space.

In addition, Martin’s modular A.I.R. Control Dust Curtains are designed to create controlled air recirculation zones within transfer enclosures, helping to reduce dust emissions compared with conventional rubber curtain systems. The curtains can be adjusted or replaced externally, cutting service times.

Flow improvement technologies will also feature prominently. The N2 Air Cannon Intelligence System monitors connected air cannons multiple times daily, detecting misfires, measuring blast efficiency and tracking pressure and temperature. A cloud-based dashboard enables predictive maintenance and reduces manual inspections.

An expanded line of electric vibrators will be introduced, aimed at improving material separation and preventing build-up in hoppers, silos and chutes. The new models offer increased power and efficiency while maintaining durability, backed by a three-year warranty.

The company will also present upgraded belt cleaning systems, including the Martin H1 Primary Belt Cleaner and P2 and R2 secondary cleaners, built with stainless steel components and tungsten carbide tips for use on abrasive materials and high-speed or reversing belts.

Siemens Smart Infrastructure has expanded its portfolio of industrial control and protection technologies with new developments aimed at improving electrical safety, operational reliability and sustainability in industrial environments.

The company has enhanced the capabilities of its semiconductor-based circuit protection technology while also introducing a refurbished soft starter developed under circular economy principles. The announcements reflect a broader push by Siemens to combine advanced electrical engineering with environmentally responsible manufacturing.

Central to the update is the continued development of the SENTRON Electronic Circuit Protection Device (ECPD), which was first launched in 2024. The device uses semiconductor technology to perform electronic switching far faster than traditional protection systems, helping to reduce short-circuit energy and safeguard connected equipment.

The ECPD can deliver switching speeds up to 1,000 times faster than conventional solutions. It also integrates more than ten configurable functions into a single unit, allowing operators to significantly reduce the space required within distribution boards while enabling software-based configuration.

Siemens plans to expand the product range with a single-phase version that will include integrated residual current monitoring. This function enables continuous supervision of electrical circuits to detect faults at an early stage without disrupting operations. Such monitoring is particularly relevant for facilities that require high levels of reliability, including data centres, exhibition venues and lighting installations, where uninterrupted power supply is essential.

A three-phase version of the ECPD is also under development to address higher-voltage systems operating at 400V and 32A. This model is expected to support a wider range of infrastructure and industrial applications, including conveyor systems, elevators, heat pumps, air conditioning installations and event power distribution networks.

According to Andreas Matthé, the company’s use of semiconductor technology is reshaping industry expectations for circuit protection by delivering faster response times, compact designs and improved system uptime.

Alongside the circuit protection developments, Siemens has also introduced its first refurbished soft starter designed according to circular economy principles. The SIRIUS 3RW5 -Z R11 refurbished soft starter is created through a controlled refurbishment process in which used devices are thoroughly tested, key components replaced and performance validated to meet the same standards as new equipment.

This remanufacturing process typically reduces carbon emissions by as much as 50% compared with producing a new device, primarily due to lower resource consumption. Environmental Product Declarations document the environmental benefits and ensure transparency.

The refurbished soft starter retains full compatibility with new units in terms of installation, parameterisation and functionality, enabling straightforward integration into existing systems. The product also incorporates traceability features such as a QR-based ID Link, allowing lifecycle monitoring across both its initial and refurbished service phases.

Siemens is showcasing the technology at the Light + Building 2026 in Frankfurt, where the company is highlighting how digitalisation and circular design can work together to support more sustainable industrial operations.

Airlines and aviation authorities across the Middle East are adjusting operations as regional tensions and airspace restrictions continue to disrupt travel, forcing carriers to reduce schedules while governments coordinate support for affected passengers.

Emirates confirmed it is operating a reduced flight schedule until further notice following the partial reopening of some regional airspace. The airline said it plans to run more than 100 flights to and from Dubai on 5 and 6 March in order to transport passengers and move essential cargo such as pharmaceuticals and perishables.

A spokesperson said the carrier will progressively rebuild its timetable as more airspace becomes available and operational requirements are met. Safety, the airline emphasised, remains its primary priority while it continues to monitor developments across the region.

Passengers have been advised to travel to the airport only if they hold confirmed bookings and to check the airline’s website and social media channels for the latest updates.

Meanwhile, Dubai-based carrier flydubai has resumed flights across parts of its network but is currently operating a scaled-back schedule. The airline said it is gradually adding services as restrictions on regional airspace begin to ease.

However, flight times may be longer than usual as aircraft are temporarily rerouted to avoid restricted zones. The airline also urged customers not to travel to the airport without confirmation of a booking or rebooked flight. Travellers connecting through Dubai will only be accepted if their onward flight is operating.

Despite wider disruptions, aviation activity in Jordan has remained comparatively stable. The Civil Aviation Regulatory Commission reported that airports across the Kingdom continued operating normally on Wednesday despite the closure of airspace in several neighbouring countries.

According to commission chairman Deifallah Farajat, Queen Alia International Airport recorded 67 inbound flights and 58 departures during the day, with national carrier Royal Jordanian accounting for the largest share of operations. Authorities said technical teams remain on standby to respond to any developments affecting airspace safety.

Elsewhere, the government of Oman has begun assisting foreign nationals stranded across the Gulf as the travel disruption intensifies. Foreign Minister Sayyid Badr bin Hamad Albusaidi said the country is working with governments and international airlines to organise flights for travellers seeking to leave the region.

Omani authorities are coordinating with diplomatic missions and carriers to ensure safe and orderly departures for affected passengers. The initiative reflects the Sultanate’s longstanding diplomatic approach of prioritising humanitarian assistance during regional crises.

The aviation disruption follows the escalation of the US-Israel-Iran conflict, which has prompted several countries to close or restrict their airspace. Airlines have been forced to cancel services or divert aircraft along longer routes to avoid conflict zones.

Industry observers warn that flight disruptions could persist in the coming weeks if hostilities continue, with travellers across the Middle East advised to monitor airline updates as schedules remain subject to rapid change.

Most Read

Latest News

Most Read

Latest News

More Articles

Smart cleaning innovation elevates QAIA passenger experience. (Image source: Queen Alia International Airport)