The energy investments in the MENA region is estimated to reach US$1tn, according to the Arab Petroleum Investments Corporations (APICORP) MENA Annual Energy Investment Outlook 2019

According to APICORP?s Chief Economist?s Top Picks 2020, MENA is expected to see the surge in energy investment despite a set of recent regional geopolitical events as well as global health concerns, such as the coronavirus, which has impacted China and prompted the Central Bank of China to inject US$174bn via reverse repo operations to support the economy.

?For once, oil prices could be the least volatile market signal, barring other unthinkable developments. Coronavirus will impact demand growth in 2020 but we still do not know by how much, with early estimates indicating a downward revision of 300,000 bpd to 2020 global liquids demands. Assuming certain other factors continue to balance each other out, particularly post-Q2 2020, we expect Brent prices to trade in the USD55-65 range,? Dr Leila R Benali, chief economist at APICORP, noted.

The real cause for concern is the prevalent ?attentisme? (wait-and-see attitude) on various major geopolitical and monetary policies, which is, in turn, affecting the market and investors? mindsets.

Market players are looking for clear signals on three ambiguous issues. These are macroeconomic complacency, climate change and the tit-for-tat retaliation between the USA and Iran.

Carbon pricing helps level the playing field for energy technologies

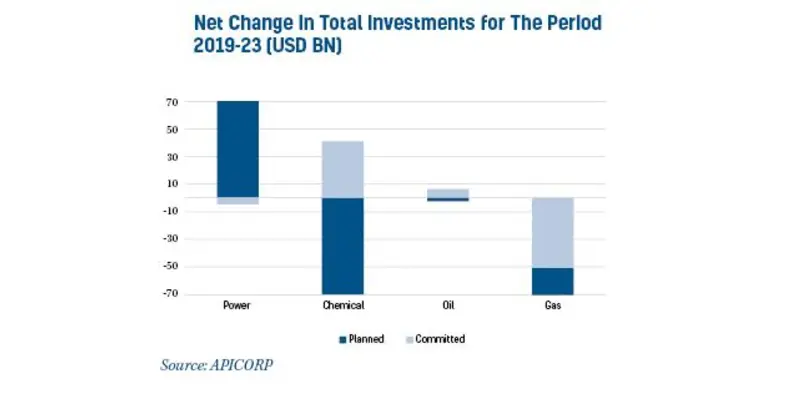

?With regards to carbon pricing, the attentisme recently translated into calls to divest away from hydrocarbons. But we have to highlight the US$70bn drop in investments as per our Gas Investment Outlook 2019-2023 compared to the previous 2018 report,? Dr Benali said.

Furthermore, as highlighted in APICORP?s November 2019 White Paper, ?The Energy Transition: Reshaping Investments and Strategies,? carbon pricing helps level the playing field for energy technologies and provides finance stakeholders, particularly from the private sector, greater visibility.

?In the light of dwindling returns across investment assets, a fascinating transformation is materialising in the relationship between energy companies and investors that may shape what the energy company of the future looks like,? Dr Benali added.