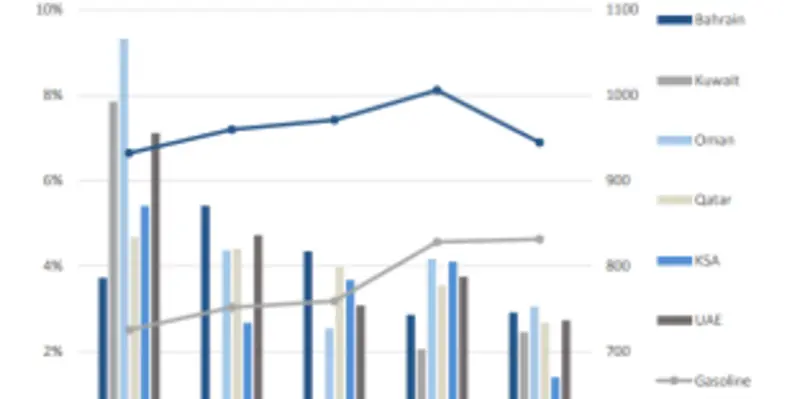

An economic slowdown coupled with energy reforms has adversely affected domestic fuel consumption growth across most of the GCC, and in some cases led to negative growth, according to a recent study by Apicorp Energy Research

Saudi Arabia, the region?s largest fuel consumer, saw a 10 per cent decrease in demand for diesel in 2016. The demand for gasoline consumption also dropped in Saudi Arabia, Kuwait, Qatar and Bahrain, since major reforms were introduced in 2016.

?Annual gasoline demand growth averaged 6.2 per cent between 2010 and 2015 but shrunk to 0.4 per cent in 2016. The change in diesel demand was even more significant, going from an average of four per cent growth between 2010 and 2015 to a six per cent decline in 2016,? the report stated.

Being the region?s largest economy, Saudi Arabia represents 70 per cent of the GCC?s total demand for diesel and gasoline. Gasoline demand in the Kingdom grew from 447k bpd in 2011 to 568k bpd in 2015, and at the same time diesel demand grew by 128k bpd from 2011 to reach 779k bpd in 2015.

The Kingdom became a net exporter of gasoline in 2016. The year 2017 shows a similar trend. Although gasoline demand recovered on the year before, net exports continued to increase and averaged 39k bpd.

?The impact on gasoline demand was less significant given Saudi Arabia?s reliance on personal transport and the lack of public transportation options. Instead, households, particularly those who had previously consumed high-grade gasoline, switched to lower grade options,? the report explained.

Oman, being the most vulnerable economic country in the region to the oil-price slump, is showing a fall in demand of both gasoline and diesel. Gasoline demand hit a peak of 82k bpd in 2013, but declined at an average rate of 14 per cent per year for the next two years, with diesel demand declining at a rate of eight per cent per year for the same period.

?Data for 2017 (until end of July) indicates further demand contraction, with consumption of gasoline and diesel both down three per cent and six per cent. Fuel switching also continued into 2017 as lower grade gasoline increased from seven per cent of total gasoline consumption in 2015 to 33 per cent of total consumption in 2017,? explained the report.

The demand for both gasoline and diesel in the UAE increased in 2016, as compared with the previous years. The country liberalised gasoline and diesel prices in August 2015.

For the rest of the GCC countries, Qatar showed decline in gasoline demand in 2016 by 12 per cent. Average demand for fuel in Kuwait dropped to 68k bpd in 2016, compared with 70k bpd in 2015. Bahrain showed a decline in demand for fuel from 18.4k bpd in 2015 to 17.6k bpd in 2016 and is currently averaging 17k bpd in 2017, said the report.