In The Spotlight

In its recent white paper, The State of Global Sustainability Disclosures, Sprih Inc. analysed more than 200,000 reports from over 80,000 companies worldwide, creating one of the largest repositories of corporate sustainability data ever assembled. The findings show that sustainability reporting is no longer a fringe exercise.Yet comparability and consistency remain mainly out of reach for many businesses.

According to Sprih, this is where artificial intelligence must move from being a reporting tool to becoming the backbone of ESG intelligence.

Increasing visibility

The white paper, powered by SustainSense, Sprih’s climate AI engine, reveals a paradox. Disclosure rates for Scope 1 and Scope 2 emissions are relatively mature across many regions and sectors and near-term targets are widely adopted. Energy consumption is commonly reported in aggregate.

Yet when we move beyond headline figures, fragmentation becomes obvious.

Scope 3 emissions, which are often the largest share of a company’s footprint, remain inconsistently disclosed. Water reuse and rainwater harvesting data are scarce and waste categorisation varies widely. Smaller firms, particularly those under US$100mn in revenue, lag significantly in both completeness and consistency.

The paper explains that without standardisation, sustainability disclosures risk becoming a patchwork of narratives rather than a coherent dataset. This makes investors struggle to benchmark risk, while regulators face uneven compliance landscapes. Moreover, procurement leaders lack visibility across supply chains and executives are left navigating strategy with incomplete maps.

But AI can help change this equation.

Teaching machines the language of sustainability

One of the most powerful insights from the white paper is methodological. SustainSense does not merely collect documents; it extracts, classifies, validates and normalises data across languages, formats and reporting frameworks. In other words, it teaches machines to understand sustainability.

This matters because ESG data is not structured by default. It sits inside PDFs, integrated annual reports, regulatory filings and standalone sustainability documents. Terminology can differ across jurisdictions and definitions evolve. Units can vary and even the placement of data within reports is inconsistent.

Agentic AI architectures, as described in the paper, create a structured layer on top of this chaos. They identify emissions figures, distinguish between location-based and market-based Scope 2 data, harmonise water metrics and align targets to recognised definitions such as near-term, long-term and net zero.

The result is not just a larger dataset, but a comparable one.

When thousands of disclosures are translated into a common analytical framework, patterns emerge. Europe’s leadership in comprehensive target-setting becomes quantifiable. Asia’s relative lag in Scope 3 transparency becomes measurable. The maturity gradient between large enterprises and SMEs becomes visible at scale.

According to Sprih, this is not anecdotal ESG, but rather "it is systemic ESG intelligence."

A strategic asset

For many companies, sustainability reporting continues to feel like a compliance obligation. But the white paper offers some hope.

Executives can use AI-driven benchmarking to understand where their disclosure quality signals strength – or exposes weakness. Investors can assess governance resilience by examining not just target announcements, but the consistency of underlying metrics. Regulators can identify sectors where harmonisation efforts must intensify.

Crucially, AI can also surface blind spots. The analysis shows that while total energy consumption is widely reported, the breakdown between renewable and non-renewable energy is less consistent. Water withdrawal is commonly disclosed, but treatment and reuse metrics are rare. Waste generation is more visible than circularity performance.

These gaps, it seems, are not simply technical. They represent risk. In a climate-constrained world, incomplete value-chain data or poor resource visibility translates into financial exposure. AI could help transform ESG into static into dynamic risk management.

Better AI systems

Perhaps the most compelling idea in the white paper is the call for a global climate intelligence layer. If corporate disclosures are the raw material, AI is the infrastructure that makes them usable.

Imagine a landscape where investors can benchmark Scope 3 intensity across sectors in seconds; where procurement teams can map supplier emissions maturity; where policymakers can evaluate regional adoption of net-zero commitments with precision rather than estimates. Sprih says that this is not speculative, as it is already emerging.

However, the technology community must recognise that scale alone is insufficient. AI systems must be transparent, auditable and continuously learning. They must adapt as reporting frameworks evolve and new regulatory requirements emerge. They must balance automation with validation to ensure trust.

Equally, companies must view AI not as a shortcut to green credentials, but as a tool for accountability. The question for the market is no longer whether AI will shape ESG. It is whether organisations are ready to operate in a world where sustainability performance is no longer hidden in footnotes, but illuminated by intelligence at scale.

Polynome AI Academy, in partnership with Abu Dhabi School of Management (ADSM), has unveiled the expanded global instructor lineup for the second cohort of its Executive Program for Chief AI Officers (CAIO), running from 10-21 April 2026 in Abu Dhabi.

The programme brings together leading AI experts from NVIDIA, Mubadala, Boston Consulting Group (BCG), G42, AI71, and top research institutions to equip senior executives with the frameworks and tools needed to lead AI initiatives at organisational and national scale.

It was created in response to growing demand from governments and large enterprises for structured AI leadership. It aims to provide CAIOs and senior executives with governance frameworks, operating models, and decision-making structures that can support AI strategy and deployment across complex environments.

“The first cohort confirmed what we’ve long believed: the CAIO role requires a dedicated programme built for the realities of leading AI at scale,” said Alexander Khanin, Founder of Polynome Group. “Executives came to Abu Dhabi and left with actionable strategies they are already putting into practice. By 2027, AI is expected to guide half of all business decisions. Cohort 2 builds on this momentum with a refined curriculum and fresh global perspectives.”

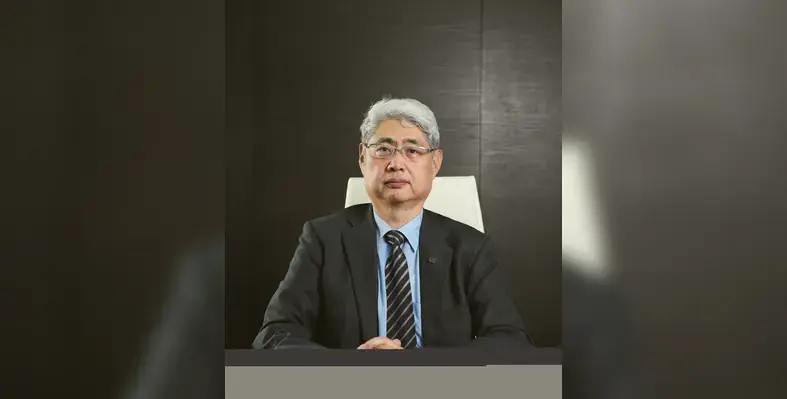

Dr. Tayeb Kamali, Chairman of Abu Dhabi School of Management, added, “The first cohort demonstrated the demand we anticipated; top executives across the region recognise that AI strategy cannot simply be delegated. The programme equips leaders with the skills to navigate AI adoption and translate technological potential into real business impact.”

The inaugural programme in November 2025 attracted 35 C-suite executives and senior technology leaders. Participants completed ten modules covering AI strategy, sovereign AI infrastructure, governance frameworks, agentic systems, Arabic NLP, AI investment strategy, and enterprise deployment methodology. The programmeme also included site visits to the UAE Cybersecurity Council, Core42’s Khazna data centres, ADNOC, and executive roundtables with policymakers.

“The Executive Chief AI programme is unlike any course I’ve attended,” said Dr. Noura AlDhaheri, Chairman of DNA Investments. “It brings us directly to the AI creators, experts, and leaders, offering insight into real challenges and the evolving AI landscape. AI is set to transform business, and staying ahead is essential.”

Confirmed instructors for Cohort 2 include Dr. George Tilesch, Dr. Andrew Jackson, Prof. Merouane Debbah, Prof. Nizar Habash, Dr. John Ashley, Charbel Aoun, Jean-Christophe Bernardini, Faris Al Mazrui, Chiara Marcati, and Jorge Colotto, with more to be announced.

The 10-day programme combines executive seminars, case labs, operating model workshops, site visits to AI institutions, and policymaker roundtables, offering lifetime access to the CAIO alumni network. It targets CAIOs, CTOs, CIOs, CISOs, public sector advisors, and senior digital transformation leaders, preparing them to lead AI strategy, governance, and enterprise deployment effectively.

Schneider Electric has announced the launch of EcoStruxure™ Foxboro Software Defined Automation (SDA), describing it as the industry’s first open, software-defined distributed control system (DCS).

The new platform combines the established reliability of Foxboro systems with the flexibility of software-defined automation, aimed at helping hybrid and process industry customers modernise operations more quickly and with lower risk.

For decades, Foxboro DCS has functioned as the core control system for complex industrial operations, enabling real-time coordination of processes. However, Schneider Electric said evolving industrial requirements now demand greater agility, simplified compliance and fewer costly system upgrades. EcoStruxure Foxboro SDA has been developed to address these needs by delivering enhanced scalability, flexibility and cost efficiency while maintaining high levels of reliability.

The importance of open industrial systems was underscored in Schneider Electric’s recent global research report with Omdia, which found that closed systems cost mid-sized industrial companies an estimated 7.5% of annual revenue due to downtime, inefficiencies and compliance-related retrofits.

Hany Fouda, Senior Vice President, Process Automation at Schneider Electric, said the launch represents a pivotal moment for the sector. “EcoStruxure™ Foxboro SDA marks a defining moment for industrial automation. By embracing openness and software-defined architecture, we’re giving our customers the agility to modernise without compromise, protecting their investments while unlocking future-ready capabilities. This evolution is a strategic enabler for digital transformation.”

Developed in response to customer challenges such as ageing systems and rising costs, Foxboro SDA decouples hardware from software, enabling organisations to retain existing infrastructure while adopting a smoother, lower-risk modernisation pathway. Schneider Electric said this approach simplifies workflows, accelerates access to operational insights and supports long-term performance improvements.

Powered by EcoStruxure Automation Expert, the system is designed to enable interoperability, rapid deployment and fit-for-purpose configurations while maintaining high availability. By separating control logic from hardware, it supports vendor independence and scalable architectures. Built in line with IEC 62443-3-3 cybersecurity standards, the platform is designed to support IT and OT convergence, artificial intelligence and machine learning integration, and the transition towards more autonomous Industry 4.0 operations.

The system also enables digital continuity across the plant lifecycle, from design and engineering through to production and maintenance. By keeping data consistent and connected, Foxboro SDA supports automated workflows, improved product quality and integration with advanced analytics tools to enable real-time business decision-making.

Craig Resnick, Vice President at ARC Advisory Group, said the launch represents a significant shift in process automation. “By decoupling control logic from hardware, Schneider Electric is providing manufacturers with the agility to scale, adapt and simplify their operations. This software-defined approach helps reduce maintenance costs, protect legacy automation investments and ensure digital continuity throughout the entire plant lifecycle,” he said.

“With cybersecurity built into its core and a commitment to open, interoperable standards, Foxboro SDA enables manufacturers to modernise at their own pace, accelerate IT and OT convergence and expand adoption of next-generation technologies such as AI, edge computing and autonomous operations.”

Schneider Electric said the platform provides customers with a future-ready upgrade path, embedded cybersecurity and simplified operations, positioning Foxboro SDA not just as a control system, but as a strategic foundation for long-term digital transformation.

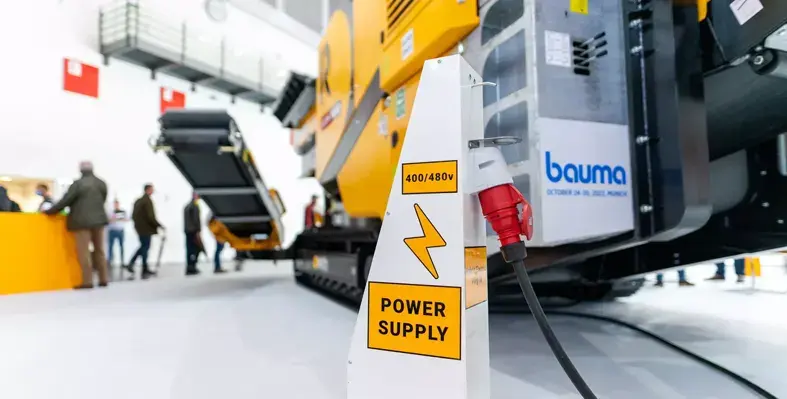

Sobha Realty has announced that its luxury villa community, Sobha Elwood, will deploy innovative clean energy systems from Positive Zero, including what is described as the region’s first mobile battery energy storage system (mBESS) for construction sites.

The fume-free and noise-free mobile battery units are designed to deliver electricity directly where it is needed on-site, replacing traditional diesel generators and reducing reliance on fossil fuels. Over the course of the two-year agreement, Positive Zero’s HYPR system is expected to offset the equivalent of more than 30,000 gallons of diesel.

Each mobile battery unit is charged using renewable solar energy and is swapped in and out as required to ensure a continuous and reliable electricity supply during construction. The system is projected to deliver approximately 219MWh of electricity per year at the development.

Ravi Menon, Chairman of Sobha Group, said the partnership reflects the company’s long-term sustainability strategy. “At Sobha Realty, sustainability is a fundamental pillar of how we build and how we envision the future of our communities. Our partnership with Positive Zero for Sobha Elwood marks another decisive step in integrating clean, renewable energy solutions across our developments,” he said.

“In alignment with the UAE Green Agenda 2030 and the Dubai 2040 Urban Master Plan, this initiative reinforces our commitment to shaping communities that are world-class, future-ready and environmentally resilient,” Menon added.

David Auriau, Chief Executive Officer of Positive Zero, said the collaboration demonstrates how clean energy can support more sustainable urban development. “We are delighted to support Sobha Realty in its pioneering approach to real estate development, powering more sustainable construction and lowering carbon emissions. Sobha Realty is setting a clear benchmark for developers and demonstrating that clean energy can make a transformative difference to the sustainable development of cities,” he said.

Sobha Elwood marks the second project in which Sobha Realty has partnered with Positive Zero. Following the earlier deployment of the HYPR clean energy system at Sobha One, the developer is expanding the use of renewable energy solutions as part of its broader efforts to support Dubai’s target of reducing carbon emissions by 50% by 2030.

The UAE’s industrial and logistics sector maintained strong momentum in 2025, with rents rising across all major submarkets, as tight supply conditions continued to shape market performance, according to Knight Frank’s latest UAE Industrial and Logistics Report.

High occupancy levels and sustained rental growth were recorded nationwide, supported by solid economic fundamentals and expanding activity from both domestic and overseas occupiers, particularly logistics operators from mainland China. Investor appetite for industrial and logistics assets also remained firm, underpinning transaction volumes across the sector.

Faisal Durrani, Partner and Head of Research, MENA at Knight Frank, said: “Investor appetite remains firm and competition for institutional-grade stock continues to strengthen, placing further downward pressure on prime yields towards sub-8% territory. This should support capital values, even as rental growth moderates in parts of the market.”

He added that while new supply due in 2026 could begin widening the rental performance gap between older and higher-specification facilities, rental levels are expected to remain firm overall. “We expect the demand drivers that have underpinned rental growth over the past few years to be sustained this year,” Durrani said.

Dubai rents continue upward trend

Dubai’s industrial and logistics rents climbed further in 2025, driven by strong occupier demand and rising land and construction costs.

Al Quoz remained the city’s most expensive industrial submarket, with rents reaching AED 100 per sq ft, supported by its central location. Dubai Industrial City recorded the strongest annual rental growth at 32%, with rents rising to AED 58 per sq ft amid constrained high-quality supply and growing manufacturing demand. Dubai South followed, with rents increasing 25% year-on-year to AED 45–55 per sq ft.

Grade-A assets in Jebel Ali Free Zone (JAFZA) also posted annual increases of around 22%, reaching AED 40–45 per sq ft. Meanwhile, more established inland areas such as National Industries Park and Dubai Investment Park saw rental stabilisation, as relatively higher vacancy levels tempered upward pressure.

Maxim Talmatchi, Partner and Head of Industrial and Logistics, Middle East, said JAFZA presents further upside potential. “With its proximity to Jebel Ali Port and appeal to multinational occupiers, we anticipate scope for further rental growth,” he said.

Knight Frank is tracking 6.6 million sq ftof new supply scheduled for delivery in 2026, with additional completions expected in 2027 and 2028. However, Talmatchi noted that near-term supply will remain relatively constrained in prime locations.

“We expect Dubai’s industrial and logistics supply pipeline between 2026 and 2029 to be relatively stable in the near term, before rising sharply towards the end of our forecast period,” he said. “This new supply should offer some relief to occupiers in the form of stabilisation, or softening in rents in some locations, which could begin towards the end of 2026.”

Demand in 2025 was led by logistics and manufacturing occupiers, each accounting for 21% of total requirements, followed by retailers and traders at 14% and technology-focused occupiers at 12%. Mid-sized warehouses between 10,000 and 50,000 sq ft accounted for the majority of demand in the second half of the year.

Abu Dhabi market anchored by diversification strategy

Abu Dhabi continued to advance its industrial diversification strategy, with 33% of the UAE’s US$5bn in awarded industrial contracts last year located in the emirate.

Rental growth was more measured than in Dubai, with performance largely driven by asset quality and proximity to key transport corridors. The Abu Dhabi Airports Free Zone recorded the highest average rents at AED 625 per sq m, followed by KEZAD Mussafah (ICAD) and Al Falah at AED 550 per sqm, and Mussafah at AED 500 per sqm.

Talmatchi said: “Market conditions in Abu Dhabi are likely to remain broadly stable through 2026, with demand anchored around the ICAD and KEZAD clusters. A disciplined approach to land release and development remains a key stabilising influence, restricting excess supply and limiting volatility in rental performance.”

Looking ahead, project completions in Abu Dhabi are expected to exceed US$1bn in Q1 2026, with another major peak forecast in 2029.

The growth trajectory is underpinned by the Abu Dhabi Industrial Strategy, which aims to more than double the emirate’s manufacturing sector to AED 172bn by 2031, with a focus on foreign direct investment and priority industries including chemicals, machinery, electronics and pharmaceuticals.

Durrani said the UAE’s industrial and logistics sector is entering a more mature phase. “Performance will increasingly be determined at the asset level. Location, specification, tenant quality and active management will matter more than scale alone,” he said. “The medium- to long-term outlook remains positive, with occupiers expected to continue gravitating towards high-specification and quality assets.”

SIBS AB has signed a strategic collaboration agreement with LINQ Modular, part of ALEC Holdings, to accelerate the delivery of large-scale modular developments across the Middle East, marking a significant step in the region’s industrialised construction landscape.

The partnership brings together SIBS’ international manufacturing expertise in volumetric modular construction with LINQ’s regional delivery capabilities and ALEC Holdings’ established on-site construction experience. The companies aim to deliver faster, more predictable and more sustainable residential, commercial and mixed-use developments as demand for high-quality housing continues to rise across the Gulf.

Building on LINQ’s early work in prefabricated and modular construction since its launch in 2020, the collaboration seeks to scale modular delivery across multiple sectors, including residential, hospitality and commercial developments. Subject to project awards and client approvals, the partners have set a shared ambition to deliver at least 1,500 modular units per year through an industrialised and repeatable production and delivery model.

Under the agreement, LINQ will continue to lead market engagement, regulatory approvals and in-country project delivery, supported by ALEC Holdings’ construction execution capabilities. SIBS will provide large-scale industrial production capacity, design-for-manufacture expertise and factory-controlled quality processes, drawing on its global experience in delivering modular housing at scale.

The collaboration is positioned to address one of the region’s most pressing challenges: the need to accelerate residential delivery without compromising on quality, safety or sustainability. Modular construction offers a solution by shifting a significant portion of construction activity into controlled factory environments, reducing on-site timelines and improving consistency.

A key factor underpinning the partnership is the modular construction licence granted by Dubai Municipality to LINQ, enabling the delivery of G+6 residential and commercial buildings in the emirate. Combined with SIBS’ experience in delivering large apartment complexes internationally, the partners are well placed to respond to strong residential demand across major urban centres in the UAE and wider Gulf.

SIBS brings an established international track record, having delivered approximately 7,000 apartments globally. Its modular systems have typically reduced project timelines by around 40%, lowered production costs by up to 30%, and cut energy consumption by up to 50% compared with traditional construction methods.

Erik Thomaeus, CEO of SIBS, said the collaboration represents a major step forward for modular construction in the UAE, combining SIBS’ industrialised production capacity with LINQ and ALEC Holdings’ regional delivery expertise to offer scalable and predictable modular solutions.

Graham Petty, Operations Manager at LINQ, said the partnership builds on years of groundwork to demonstrate the viability of modular construction at the premium end of the market, enabling the delivery of full-spectrum industrialised construction solutions that support speed, certainty and long-term value.

The collaboration is already progressing multiple near-term project opportunities, reflecting growing market momentum and a robust pipeline of modular-led developments across a range of building types.

Cleanova, a global provider of advanced industrial filtration solutions, has secured a contract to supply critical filtration systems for the Liverpool Bay Carbon Dioxide (CO2) Transportation and Storage project, part of the UK government’s HyNet North West low-carbon and hydrogen initiative.

The contract was awarded by Saipem, the international engineering, procurement and construction company responsible for converting an existing gas compression and treatment facility at Point of Ayr, North Wales, into a CO₂ Electrical Compression Station. The facility will enable the permanent storage of captured CO₂ emissions from heavy industry across North West England and North Wales, with compressed CO2 injected into depleted hydrocarbon fields beneath Liverpool Bay.

Under the agreement, Cleanova will supply purpose-engineered filtration units designed to ensure operational efficiency, safety and long-term reliability across the CO2 transportation and storage process. Each unit, weighing around 50 tonnes, will remove residual amines, water, hydrocarbons and other condensed liquids or particulates from the captured CO2 stream. Removing these impurities is critical to protecting compression equipment, maintaining process integrity and enabling safe, long-term storage.

The Liverpool Bay project is a cornerstone of the HyNet North West industrial decarbonisation cluster and is expected to support the capture and permanent storage of up to 4.5 million tonnes of CO2 per year. Once fully operational, the project will make a significant contribution to the UK’s net-zero targets and wider energy-transition objectives.

Macer Braidwood, Cleanova’s global market manager ‐ energy transition, said, “Our custom filtration systems already play a vital role in the energy transition by capturing emissions and purifying process streams across a wide-range of clean-energy applications. Being selected to support the UK's first large-scale carbon capture and storage project is an important milestone for Cleanova. We are proud to partner with Saipem on the Liverpool Bay CCS project and to contribute our filtration expertise to an initiative that will deliver meaningful, long-term environmental impact. It is another step to our mission to provide filtration solutions today for a better tomorrow.”

Vertiv unveils Next Predict, an AI-powered service that predicts and prevents data centre risks before they arise. (Image source: Vertiv)

Vertiv has launched Vertiv Next Predict, an AI-powered managed service designed to revolutionise data centre maintenance

Moving beyond traditional time-based and reactive approaches, the service industrialises operations by analysing asset behaviour before risks occur. Next Predict represents the latest enhancement in Vertiv’s integrated AI infrastructure portfolio, providing predictive intelligence across power, cooling, and IT systems to establish a unified, resilient foundation for AI-driven data centres.

As AI workloads transform the data centre environment, facilities require greater visibility and control over critical infrastructure to ensure continuous performance at scale. By adopting advanced analytics and predictive maintenance strategies, organisations can proactively address these challenges and maintain reliable operations across distributed environments.

“Data centre operators need innovative technologies to stay ahead of potential risks, as compute intensity rises and infrastructures evolve,” said Ryan Jarvis, vice president of the global services business unit at Vertiv.

“Vertiv Next Predict helps data centres unlock uptime, shifting maintenance from traditional calendar-based routines to a proactive, data-driven strategy. We move from assumptions to informed decisions, by continuously monitoring equipment condition and enabling risk mitigation before potential impacts to operations.”

Vertiv Next Predict uses AI-based anomaly detection to continuously monitor operating conditions and identify deviations from expected behaviour at an early stage. A predictive algorithm evaluates potential operational impacts to determine risk and prioritise response. Root cause analysis isolates contributing factors to support efficient, targeted resolution. Based on system data and the operational context, prescriptive actions are defined and executed, with corrective measures carried out by qualified Vertiv Services personnel.

Built for versatility and future growth, Vertiv Next Predict currently supports a broad and expanding range of Vertiv power and cooling platforms, including battery energy storage solutions and liquid cooling components. The service is designed for scalability, enabling seamless integration with future data centre technologies as part of a unified, grid-to-chip architecture. This approach allows customers to adopt Next Predict today while ensuring the service can evolve alongside their infrastructure requirements.

Vertiv Services brings decades of experience in critical digital infrastructure, a global network of trained technicians, and AI-powered analytics.

For more information about Vertiv Next Predict or Vertiv’s end-to-end power and thermal management solutions, including the OneCore scalable prefabricated data centre infrastructure solution, SmartRun modular overhead IT infrastructure system, and Vertiv’s expanding portfolio for AI and high-density workloads, visit Vertiv’s website.

Ecolab, a global leader in sustainability solutions for water, hygiene and infection prevention, has signed a non-binding MoU with the Saudi Water Authority (SWA) aimed at accelerating water innovation and supporting the Kingdom’s long-term sustainability ambitions.

The agreement reflects a shared commitment to advancing more efficient, resilient and circular water systems in line with Saudi Arabia’s Vision 2030.

The MoU was formalised during the US-Saudi Water Summit 2025, held last month in Palo Alto, California. The summit brought together international water sector leaders to discuss emerging challenges, technological advances and collaborative models capable of transforming water management across the Kingdom. Against a backdrop of rising demand, climate pressures and industrial expansion, the agreement highlights the growing importance of public-private partnerships in securing Saudi Arabia’s water future.

Under the MoU, SWA and Ecolab will collaborate to position sustainable water management as a strategic enabler of national development. By improving water efficiency and reuse, the partnership aims to help safeguard scarce water resources while enhancing water quality across key sectors. These efforts are also expected to deliver wider environmental and economic benefits, including reduced energy consumption, lower CO2 emissions and improved operational efficiency for industrial and commercial operators.

The framework for cooperation includes the exchange of technical insights and best practices across sectors such as data centres, refineries, petrochemicals, heavy industry, desalination, manufacturing, food and beverage, and hospitality.

Key areas of partnership

The collaboration also covers support for water source selection, regulatory development and performance monitoring, alongside workshops focused on advanced digital solutions such as smart water systems and predictive maintenance. In addition, the partners will explore pilot projects within Saudi industrial cities, applying Ecolab’s global technologies under local operating conditions, and identify opportunities to support innovation initiatives, including Rabigh Oasis, the Global Water Innovation Prize (GWIP), collaborative research and development roundtables, and broader innovation promotion programmes.

Ecolab has maintained a strong presence in Saudi Arabia for more than four decades through its Nalco Water business, supporting major industrial players in optimising water use. Today, its solutions are deployed across energy, manufacturing, food and hospitality, helping organisations conserve water, reduce energy consumption and strengthen long-term business resilience while meeting sustainability goals.

His Excellency Abdullah bin Ibrahim Al-Abdulkarim, President of the Saudi Water Authority, highlighted the partnership as a step toward building a world-class water sector that safeguards resources, supports national growth, and demonstrates how innovation and sustainability can secure water for future generations in line with Vision 2030.

Stefan Umiastowski, Ecolab’s Senior Vice President & CEO for India, Middle East, and Africa, said, “This collaboration represents an important step in advancing Saudi Arabia’s Vision 2030 commitment to long-term water sustainability in a region where water is one of the most critical resources. As digitalization and AI reshape economies and create new demand patterns, intelligent water management has become essential for sustainable growth. By combining Ecolab's global innovation capabilities with the SWA’s vision and local expertise, we're creating a powerful platform to scale water transformation across the Kingdom's most strategic industries.”

Overall, the MoU demonstrates how closer collaboration between government and industry can translate sustainability ambitions into measurable outcomes, supporting the transition towards Net Zero while enhancing industrial competitiveness and water security across Saudi Arabia.

Sobha Realty has announced that its luxury villa community, Sobha Elwood, will deploy innovative clean energy systems from Positive Zero, including what is described as the region’s first mobile battery energy storage system (mBESS) for construction sites.

The fume-free and noise-free mobile battery units are designed to deliver electricity directly where it is needed on-site, replacing traditional diesel generators and reducing reliance on fossil fuels. Over the course of the two-year agreement, Positive Zero’s HYPR system is expected to offset the equivalent of more than 30,000 gallons of diesel.

Each mobile battery unit is charged using renewable solar energy and is swapped in and out as required to ensure a continuous and reliable electricity supply during construction. The system is projected to deliver approximately 219MWh of electricity per year at the development.

Ravi Menon, Chairman of Sobha Group, said the partnership reflects the company’s long-term sustainability strategy. “At Sobha Realty, sustainability is a fundamental pillar of how we build and how we envision the future of our communities. Our partnership with Positive Zero for Sobha Elwood marks another decisive step in integrating clean, renewable energy solutions across our developments,” he said.

“In alignment with the UAE Green Agenda 2030 and the Dubai 2040 Urban Master Plan, this initiative reinforces our commitment to shaping communities that are world-class, future-ready and environmentally resilient,” Menon added.

David Auriau, Chief Executive Officer of Positive Zero, said the collaboration demonstrates how clean energy can support more sustainable urban development. “We are delighted to support Sobha Realty in its pioneering approach to real estate development, powering more sustainable construction and lowering carbon emissions. Sobha Realty is setting a clear benchmark for developers and demonstrating that clean energy can make a transformative difference to the sustainable development of cities,” he said.

Sobha Elwood marks the second project in which Sobha Realty has partnered with Positive Zero. Following the earlier deployment of the HYPR clean energy system at Sobha One, the developer is expanding the use of renewable energy solutions as part of its broader efforts to support Dubai’s target of reducing carbon emissions by 50% by 2030.

Seequent, the Bentley Subsurface Company, will participate in the fifth edition of the Future Minerals Forum (FMF), taking place in Riyadh, Saudi Arabia, from 13-15 January 2026.

The company will use the event to showcase its geoscience technologies, highlighting its role in advancing data-driven mineral exploration in Saudi Arabia and engaging with industry leaders on the future of the regional mining sector.

Seequent’s participation aligns with its commitment to supporting the objectives of Saudi Vision 2030 and will underline its involvement in major mining projects across the Kingdom. Visitors to the company’s stand will be able to explore its portfolio of solutions, including MX Deposit, Imago, Leapfrog, Evo platform and Oasis Montaj, and see how these technologies integrate to form a connected digital ecosystem for exploration and mining.

Dr. Janina Elliott, Segment Director for Mining at Seequent, said, “Seequent’s participation in this dynamic event underscores our longstanding vision to promote sustainable mining practices and digital innovation in the Middle East. It also highlights our expertise in the geoscience and data-driven exploration sector, as well as our position as a market leader trusted by nine of the world’s top ten mining companies.”

As part of the FMF 2026 programme, Dr. Elliott will take part in a panel discussion titled ‘Tackling the Data Challenge in Geological Surveying and Exploration’.

Ahead of the forum, Seequent will host a pre-FMF workshop in partnership with AGC Al Haytham Mining Company on 12 January 2026, prior to the signing of a memorandum of understanding between the two organisations. Titled ‘Unlocking Integrated Workflows – Seequent Solutions for Exploration and Resource Modelling’, the workshop will be led by Amjad Alashqar, Seequent’s Regional Manager of Business Development. The session will focus on how digital integration can reduce operational risks, improve decision-making and strengthen collaboration across exploration and mining teams.

FMF 2026 will provide a platform for Seequent to engage with C-suite executives, policymakers and international mining stakeholders. The company continues to expand its footprint in the Middle East, with offices in Saudi Arabia and the United Arab Emirates, and supports major industry players and regional giga-projects through its advanced geoscience technologies.

Once overshadowed by hydrocarbons, the UAE’s manufacturing sector has now become a driving force for innovation, investment, and sustainable growth across the country. Without a doubt, manufacturing is poised to take centre stage in the country’s long-term aspirations for economic growth and resilience.

Various initiatives from the UAE’s visionary leaders all point towards continuously building, enhancing and reinforcing conditions that will further encourage investments and enable industrialisation to thrive and prosper.

Among them is Operation 300bn, the UAE’s national industrial strategy launched in 2021 which aims to more than double the industrial sector’s GDP contribution from AED133 billion in 2021 to AED 300 billion by 2031.

In addition, programmes, projects and initiatives by the Ministry of Industry and Advanced Technology (MoIAT) such as the National In-Country Value Program (ICV), ‘Make it in the Emirates’, the Technology Transformation Program (TTP), and the Industrial Technology Transformation Index (ITTI) have all been designed and geared towards pro-actively pushing forward the UAE’s manufacturing and industrial ambitions.

Clearly, the UAE is well on track on achieving its industrialisation objectives and its relentless pursuit of economic diversification have already produced remarkable results.

In the first quarter of 2025, non-oil GDP grew 5.3% , reaching AED 352 billion, according to the UAE's Ministry of Economy and Tourism (MOET). The ministry also identified manufacturing as the fastest growing economic activity, registering 7.7% growth in Q1 2025.

According to the latest report by Abu Dhabi Customs, Abu Dhabi's non-oil foreign trade grew by 34.7% in H1 2025, reflecting a thriving manufacturing industry and a key source of UAE exports.

Driven by visionary leadership

It is quite evident that the vision of the UAE’s leadership for the future of this great nation is fuelled by a determination to thrive, succeed and lead.

Not only are they aiming and enabling the manufacturing sector to grow, but they also implement a deliberate governmental policy and strategy that focuses on strengthening the adoption of advanced manufacturing, sustainability, and Industry 4.0 technologies including artificial intelligence, the Internet of Things (IoT), and 3D printing.

Over the years, the UAE's manufacturing sector has continuously demonstrated its resilience. In 2022, manufacturing GDP growth surpassed pre-pandemic levels by tallying 8.75% growth.

With Abu Dhabi leading the way with a growth of 9.7% , the emirate even further sharpened its focus on manufacturing with the launch of the Abu Dhabi Industrial Strategy (ADIS) in the same year. As a result, in the first half of 2025, Abu Dhabi's non-oil GDP grew 6.37% year-on-year, according to the Statistics Centre - Abu Dhabi

The attractiveness and pull for foreign investment into the UAE’s manufacturing sector have also remained strong. At the fourth edition of 'Make it in the Emirates', a 122,000-strong participation of delegates from across the world was a clear indication of the global attention to the sector’s growing appeal.

With US$11bn committed to advanced manufacturing over five years, the UAE is sending a clear message: it is open for industrial business, and it is serious about reducing its reliance on oil.

Innovation and sustainability at the core

Recognising the need to catch up with countries with larger and more advanced manufacturing sectors in a globalised market, the UAE is not just building factories – it's building smart factories.

Industry 4.0 technologies are being integrated into production lines, making UAE manufacturing globally competitive. Sustainability is also a priority, with circular economy models becoming standard practice.

Solar-powered facilities take advantage of the abundant sunshine, while water recycling systems ensure efficient use of water in a desert climate.

These are supported by the MoIAT's ITTI, which measures the digital maturity and sustainability practices of factories, provides a roadmap for their digital transformation and encourages the adoption of Industry 4.0 solutions and sustainability best practices.

Turning challenges into opportunities

While there are indeed challenges in the UAE’s journey towards economic diversification and industrialisation, the country’s leaders have cleverly manoeuvred around them and have instead focused on capitalising on the opportunities presented by these challenges. An uneven manufacturing growth among the emirates is being addressed by the federal government through Operation 300bn, with a focus on equitable development.

Among its goals is to create 13,500 new industrial facilities and 25,000 specialised jobs, many of which are being directed toward less industrialised regions.

For instance, MoIAT is working to ensure that Northern Emirates like Ras Al Khaimah, Fujairah and Umm Al Quwain benefit from industrial expansion through tailored support and infrastructure upgrades.

Additionally, the ICV program provides incentives for companies sourcing locally, further benefiting the economy. These initiatives create numerous opportunities for businesses and individuals to widen their reach in the burgeoning manufacturing sector.

In line with the rapid adoption of Industry 4.0 technologies, the UAE is also strengthening partnerships among industry, academia and various vocational training programmes, in collaboration with global tech companies, to help bridge any skills gap and ensure a seamless transfer of the latest technological knowledge to the UAE workforce.

Today, the UAE’s manufacturing sector stands at a pivotal juncture. With the UAE's emphasis on attracting investments and prioritising inclusivity, innovation, and sustainability, the country is laying the foundation for long-term industrial leadership.

Alongside policy support, the UAE's strategic location and rapidly improving infrastructure position it as a rising global manufacturing hub.

Manufacturing is no longer just a supporting act in the UAE’s economic story. It’s now a lead character that plays a vital role in shaping a resilient, innovative, and sustainable future for the country.

By Noritsugu Mifune, CEO, Al Gharbia Pipe Company

UAE-based fuel technology company Fuelre4m has announced new results showing its fuel treatment can deliver consistent fuel efficiency and emissions reductions across buses, trucks, and heavy equipment operating in real-world conditions.

Independent testing led by the National Technical University of Athens (NTUA), one of Europe’s leading engineering and applied sciences universities, evaluated Fuelre4m’s technology under tightly controlled laboratory conditions using a commercial diesel engine running on standard B10 biodiesel. The tests recorded 3.5–6.7% lower fuel consumption at identical engine speed and mechanical torque, alongside consistent efficiency improvements of 15–21% in the dominant mid-load operating range of approximately 1,400–1,550 RPM.

“The laboratory result establishes a conservative baseline under fixed torque, while real-world operation allows the same efficiency improvement to reduce torque demand, improve gear behaviour, and compound over time, resulting in larger total fuel savings across a complete duty cycle. Crucially, the only variable introduced during testing was the treatment of the fuel itself, with no changes to engine hardware, electronic calibration, operating limits, or fuel specification,” Fuelre4m said.

The NTUA laboratory findings are now being reinforced by repeatable real-world trials across UAE transport and industrial fleets. These include city and intercity buses operating on Dubai service corridors, mixed fleets incorporating VDL and King Long buses, and heavy trucks and off-highway equipment operating under high-load conditions. Once sufficient fuel contact time is achieved, measured fuel efficiency improvements frequently match or exceed laboratory results. Fixed-route trials on UAE buses show directional fuel consumption reductions of approximately 14–17%, with the strongest improvements consistently appearing in the mid-RPM “working bands” that dominate urban and intercity duty cycles.

Trials were conducted across mixed fleets spanning multiple manufacturers, engine sizes, and emission standards, confirming that the benefits are not limited to a single platform or technology generation. No adverse impacts were observed on drivability, engine temperatures, or aftertreatment systems. Quarry and heavy-equipment trials, including large off-highway haul trucks, demonstrated reduced fuel consumed per unit of work, with several recording double-digit efficiency improvements while maintaining or increasing productivity.

Commenting on the findings, George Papalambrou, Associate Professor of Control Systems at NTUA, who oversaw the independent testing, said, “We were genuinely surprised by the consistency and magnitude of the mid-range efficiency improvements. The results were not isolated to a single operating point and were observed under multiple control regimes. This is a positive development not just for one sector, but potentially for all industries relying on internal combustion engines, including shipping and maritime transport.”

Rob Mortimer, CEO of Fuelre4m, said, “For decades, the industry has optimised engines around the assumption that fuel behaviour is fixed. These results show that when you improve how fuel behaves, efficiency and emissions improve immediately, using the engines already operating across the UAE today.”

Fuelre4m is expanding controlled in-service validation programmes across the UAE in collaboration with fleet operators, government entities, and industrial partners. These programmes will focus on high-utilisation routes, long-duration performance validation, and quantified emissions reduction under representative operating conditions. Further independent testing using fully instrumented dynamometer facilities is also planned to extend validation into transient operation and regulatory-grade certification environments.

In its recent white paper, The State of Global Sustainability Disclosures, Sprih Inc. analysed more than 200,000 reports from over 80,000 companies worldwide, creating one of the largest repositories of corporate sustainability data ever assembled. The findings show that sustainability reporting is no longer a fringe exercise.Yet comparability and consistency remain mainly out of reach for many businesses.

According to Sprih, this is where artificial intelligence must move from being a reporting tool to becoming the backbone of ESG intelligence.

Increasing visibility

The white paper, powered by SustainSense, Sprih’s climate AI engine, reveals a paradox. Disclosure rates for Scope 1 and Scope 2 emissions are relatively mature across many regions and sectors and near-term targets are widely adopted. Energy consumption is commonly reported in aggregate.

Yet when we move beyond headline figures, fragmentation becomes obvious.

Scope 3 emissions, which are often the largest share of a company’s footprint, remain inconsistently disclosed. Water reuse and rainwater harvesting data are scarce and waste categorisation varies widely. Smaller firms, particularly those under US$100mn in revenue, lag significantly in both completeness and consistency.

The paper explains that without standardisation, sustainability disclosures risk becoming a patchwork of narratives rather than a coherent dataset. This makes investors struggle to benchmark risk, while regulators face uneven compliance landscapes. Moreover, procurement leaders lack visibility across supply chains and executives are left navigating strategy with incomplete maps.

But AI can help change this equation.

Teaching machines the language of sustainability

One of the most powerful insights from the white paper is methodological. SustainSense does not merely collect documents; it extracts, classifies, validates and normalises data across languages, formats and reporting frameworks. In other words, it teaches machines to understand sustainability.

This matters because ESG data is not structured by default. It sits inside PDFs, integrated annual reports, regulatory filings and standalone sustainability documents. Terminology can differ across jurisdictions and definitions evolve. Units can vary and even the placement of data within reports is inconsistent.

Agentic AI architectures, as described in the paper, create a structured layer on top of this chaos. They identify emissions figures, distinguish between location-based and market-based Scope 2 data, harmonise water metrics and align targets to recognised definitions such as near-term, long-term and net zero.

The result is not just a larger dataset, but a comparable one.

When thousands of disclosures are translated into a common analytical framework, patterns emerge. Europe’s leadership in comprehensive target-setting becomes quantifiable. Asia’s relative lag in Scope 3 transparency becomes measurable. The maturity gradient between large enterprises and SMEs becomes visible at scale.

According to Sprih, this is not anecdotal ESG, but rather "it is systemic ESG intelligence."

A strategic asset

For many companies, sustainability reporting continues to feel like a compliance obligation. But the white paper offers some hope.

Executives can use AI-driven benchmarking to understand where their disclosure quality signals strength – or exposes weakness. Investors can assess governance resilience by examining not just target announcements, but the consistency of underlying metrics. Regulators can identify sectors where harmonisation efforts must intensify.

Crucially, AI can also surface blind spots. The analysis shows that while total energy consumption is widely reported, the breakdown between renewable and non-renewable energy is less consistent. Water withdrawal is commonly disclosed, but treatment and reuse metrics are rare. Waste generation is more visible than circularity performance.

These gaps, it seems, are not simply technical. They represent risk. In a climate-constrained world, incomplete value-chain data or poor resource visibility translates into financial exposure. AI could help transform ESG into static into dynamic risk management.

Better AI systems

Perhaps the most compelling idea in the white paper is the call for a global climate intelligence layer. If corporate disclosures are the raw material, AI is the infrastructure that makes them usable.

Imagine a landscape where investors can benchmark Scope 3 intensity across sectors in seconds; where procurement teams can map supplier emissions maturity; where policymakers can evaluate regional adoption of net-zero commitments with precision rather than estimates. Sprih says that this is not speculative, as it is already emerging.

However, the technology community must recognise that scale alone is insufficient. AI systems must be transparent, auditable and continuously learning. They must adapt as reporting frameworks evolve and new regulatory requirements emerge. They must balance automation with validation to ensure trust.

Equally, companies must view AI not as a shortcut to green credentials, but as a tool for accountability. The question for the market is no longer whether AI will shape ESG. It is whether organisations are ready to operate in a world where sustainability performance is no longer hidden in footnotes, but illuminated by intelligence at scale.

The inaugural IFAT Saudi Arabia aims to accelerate investment in sustainable waste and water infrastructure across the Kingdom. The event will focus on knowledge exchange, policy dialogue, and sector collaboration through a strategic summit and a CPD-certified conference programme.

Taking place from 26-28 January at the Riyadh Front Exhibition & Conference Center, IFAT Saudi Arabia is designed to support national development goals and market readiness. The Summit and conference stages will examine how policy, capital, and technology can enhance waste and water systems, promote circular economy models, and strengthen long-term environmental resilience.

“Strengthening waste management systems is a key priority for supporting environmental protection, operational efficiency and resource recovery,” said Dr. Abdullah Al Sebaei, CEO of the National Center for Waste Management (MWAN). “IFAT Saudi Arabia creates a focused environment for stakeholders to exchange knowledge, review international experience and align on strategic approaches that support the Kingdom’s regulatory direction and circular economy ambitions.”

The invite-only IFAT Saudi Arabia Summit on 26 January will bring together senior government officials, regulators, investors, and industry leaders to discuss the strategic direction of the Kingdom’s waste and water sectors. Sessions will focus on impact investment, public-private partnerships, stakeholder engagement, and future readiness, featuring regional and international case studies and policy insights.

Key discussions include the Leaders Panel, which will assess the evolving waste and water economy in Saudi Arabia, and the Water Security Panel, led by the Saudi Water Authority, focusing on governance and integrated strategies for national water security. “A secure and resilient water sector requires long-term planning, strong governance and close coordination across public and private stakeholders,” said Eng. Mamdooh Alshuaibi, Vice President of Sustainability and Water Sector Services at the Saudi Water Authority. “IFAT Saudi Arabia provides a timely setting to discuss policy priorities, investment frameworks and technical approaches that support efficient water use, system resilience and sustainable service delivery across the Kingdom.”

Complementing the Summit, the CPD-certified conference programme will run across two thematic stages. Orange Stage will focus on waste management, recycling, and circular economy practices, featuring sessions on smart municipal solid waste systems, operational efficiency, and the role of digitalization and cybersecurity. Highlights include a panel marking the launch of the World Bank’s latest report on Solid Waste Management in MENA, in collaboration with the International Solid Waste Association.

Blue Stage, running 27–28 January, will explore water resilience, desalination, reuse, and digital transformation for utilities and industrial users. Sessions include a panel on Middle East water resilience organized by German Water Partnership, a brine mining case study led by NEOM, and discussions on financing and PPP models led by the International Water Association.

By connecting policy, investment, and applied solutions, IFAT Saudi Arabia aims to drive informed decision-making, cross-sector collaboration, and practical delivery across the Kingdom’s environmental ecosystem.

As artificial intelligence reshapes global digital infrastructure, the Gulf is racing to build the high-density data centres needed to support it. But according to Greg Parker, senior managing director at FTI Consulting, the next generation of facilities is placing unprecedented pressure on construction sequencing, commissioning and programme certainty across the GCC.

“High-density data centre designs are fundamentally technology-led,” Parker explains. “The building envelope and MEP architecture are directly influenced by the type of power infrastructure, AI clusters, rack configurations, power density and redundancy targets being deployed.”

In the GCC, where extreme heat and wind-blown sand are persistent operational risks, that relationship is even more acute. Liquid cooling is rapidly emerging as the only scalable solution for high-density AI environments. However, the higher specification and extended lead times of associated MEP systems are reshaping delivery models.

Sequencing under desert conditions

Parker notes that much of the industry discussion centres on modularisation and manufacturing-style delivery. Yet he cautions that modular approaches alone do not guarantee cost or schedule benefits.

“Modularisation has existed in the construction industry for decades,” he says. “Without corresponding changes to capital delivery models, procurement strategies and flexibility to accommodate customer requirements, modularisation alone does not reliably deliver CAPEX efficiencies or materially accelerate Ready-for-Service dates.”

Where customer requirements and system architectures are tightly aligned, targeted modularisation can improve schedules. But benefits seen in cooler climates do not always translate easily to the Gulf. Environmental ingress, particularly sand, presents a serious threat to high-density cooling systems.

In AI facilities, Parker explains, tolerances are tight and thermal margins are minimal. “AI chips operate close to their thermal limits, and HVAC derating in extreme heat conditions becomes severe.” As a result, envelope performance and airtightness are critical-path issues. Wind-blown sand can clog high-density heat exchangers “in a matter of hours rather than months”, driving renewed focus on airlock access strategies and positive pressurisation.

Structural design is also shifting. High-density AI racks significantly increase pounds-per-square-foot loads, often necessitating deeper piling or slab-on-grade solutions. Meanwhile, higher-pressure refrigerant systems introduce heavier components and more complex welding requirements, increasing the risk of hard-to-detect leaks and complicating long-term reliability.

Summer construction further compounds these pressures. Regulatory work-hour restrictions and extreme temperatures reduce productivity and increase defect risk, particularly during commissioning and integrated testing, which remain site-based despite prefabrication gains.

Technical and labour constraints

AI workloads are driving what Parker describes as a “step-change” in rack density, power demand and cooling complexity. Electrical infrastructure must often be upgraded, with earlier engagement required to secure utility capacity. Structurally, thicker slabs, higher reinforcement ratios and deeper foundations add cost premiums compared to conventional facilities.

Cooling systems present equal challenges. Liquid-cooled environments demand pharmaceutical-grade cleanliness and ultra-tight installation tolerances. Yet there is a global shortage of highly specialised mechanical and electrical trades capable of delivering 80–100kW per rack environments.

“These challenges cannot be solved by increasing manpower alone,” Parker emphasises. “Progress is constrained by the availability of highly skilled teams.”

Lead times for critical equipment are extended and largely inflexible, making early procurement decisions central to programme certainty. Commissioning in desert climates is particularly complex. Liquid cooling systems require stringent flushing regimes and disciplined water-quality management, especially given regional variability.

Commissioning-led delivery

To mitigate risk, developers are shifting towards commissioning-led planning models. Selective modularisation, including E-houses and skid-mounted systems, is being combined with enhanced logistics management and, in some cases, parallel on-site pre-assembly yards.

Digital tools are also evolving. The use of digital twins now extends beyond design coordination into virtual commissioning and logistics simulation. This allows teams to validate buildability and test control logic before installation, reducing late-stage rework.

Hybrid remote commissioning models are emerging in response to specialist shortages. Using live telemetry and virtual control centres, experienced engineers can support multiple projects simultaneously, reducing mobilisation requirements and improving first-pass issue resolution.

Supply-chain engagement is moving upstream. Developers are aligning with MEP suppliers during early design phases to secure manufacturing slots and place long-lead orders ahead of EPC appointments. Defensive procurement strategies, including in-region warehousing of critical components, are increasingly common.

Energy strategy is equally central. On-site generation and Battery Energy Storage Systems (BESS) are no longer contingencies but core elements of programme certainty, particularly where grid upgrades lag behind development timelines.

Scaling at pace

Looking ahead, Parker sees a widening gap between announced capacity and actual construction output across the GCC. Since 2023, marketed capacity has grown sharply, while delivery rates in some markets have effectively flatlined.

To bridge this gap, he advocates greater standardisation through an “80:20 kit-of-parts approach” that enables rapid scaling while retaining flexibility. At the same time, developers are strengthening in-house capital delivery teams to maintain direct control over outcomes.

“The challenge for developers is not simply building ‘bigger’ or ‘denser’ facilities,” Parker concludes. “It is delivering highly engineered assets where power, structure, cooling, logistics and specialist labour must align precisely.”

As AI-driven demand accelerates, success in the GCC will depend on early design freeze, defensive procurement, digital validation and energy-aware design strategies. In a market defined by extreme climate and compressed schedules, certainty, resilience and scalability are fast becoming the defining competitive advantages.

DMCC has announced its intention to join the Natural Diamond Council (NDC) in 2026, aligning the world’s largest diamond trading hub with the industry body responsible for global category marketing of natural diamonds.

The announcement was made on the sidelines of Mining Indaba in Cape Town during the second high-level meeting of the Luanda Accord. Signed in Angola in June 2025, the Luanda Accord commits producer governments and industry participants to renewed, collective investment in the promotion of natural diamonds. The framework brings together key stakeholders including DMCC, De Beers Group and producer governments, and is led by the Natural Diamond Council.

Reflecting strong government engagement, the meeting was overseen by ministers from leading African diamond-producing countries, including H.E. Diamantino Pedro Azevedo, Minister of Mineral Resources, Petroleum and Gas of Angola; H.E. Bogolo Joy Kenewendo, Minister of Minerals and Energy of Botswana; H.E. Modestus Amutse, Minister of Industries, Mines and Energy of Namibia; and H.E. Julius Daniel Mattai, Minister of Mines and Mineral Resources of Sierra Leone.

DMCC’s move comes at a time of structural pressure for the global diamond industry, as shifting consumer preferences, increased competition and heightened scrutiny around provenance and responsible sourcing reshape demand. Founded and funded by leading diamond producers and industry stakeholders, the NDC aims to rebuild consumer confidence through coordinated global marketing and education initiatives, particularly in key consumer markets.

By declaring its intent to join the council, DMCC said it will support collective efforts to strengthen consumer demand for natural diamonds, in line with the principles of the Luanda Accord. The move forms part of Dubai’s broader strategy to reinforce its influence across the global diamond ecosystem as the sector seeks to stabilise trade flows and return to sustainable growth.

The Cape Town meeting also marked the formal accession of the Government of Namibia to the Luanda Accord, while India’s Gem and Jewellery Export Promotion Council (GJEPC) signed a memorandum of understanding outlining a pathway to join the NDC by May 2026. Alongside DMCC’s announcement, these developments signal growing momentum behind coordinated global marketing for natural diamonds. Membership of the NDC remains subject to agreement on financial contributions and the completion of internal legal and regulatory processes.

Ahmed Bin Sulayem, Executive Chairman and Chief Executive Officer of DMCC, said: “Our decision to join the Natural Diamond Council reflects both the scale of Dubai’s role in the global diamond trade and our responsibility to support the long-term integrity and demand of the natural diamond category. As the world’s leading diamond trade hub and home to more than 1,300 diamond companies, this step underscores our commitment to strengthening consumer confidence and safeguarding the future of the sector.

“At a time of structural change across the industry, collective action grounded in transparency, responsible sourcing and sustained consumer trust is essential. DMCC will continue to work closely with industry and producer governments, contributing our convening power and market insight to initiatives that support the resilience and long-term growth of the global diamond sector.”

Amber Pepper, Chief Executive Officer of the Natural Diamond Council, said: “Collective action is essential to protect the integrity and desirability of natural diamonds. I welcome the opportunity to work with DMCC to ensure that efforts to support the natural diamond sector are aligned and amplified globally.”

DMCC is home to the Dubai Diamond Exchange and a community of more than 1,300 diamond and precious stones companies. Over the past two decades, it has played a central role in shaping global diamond trade flows while contributing to international policy discussions on governance, traceability and compliance through its longstanding engagement with the Kimberley Process, which it has chaired on three occasions.

The Luanda Accord signatories and the Natural Diamond Council have called on stakeholders across the value chain, from miners and traders to manufacturers and retailers, to support the initiative, stressing that sustained investment in consumer demand will be critical to the long-term resilience of the natural diamond sector.

EMSTEEL Group, one of the region’s largest publicly traded integrated steel and building materials manufacturers, has signed a new long-term freight agreement with Oldendorff Carriers covering the import of key raw materials to the UAE.

Under the renewed five-year agreement, Oldendorff Carriers will continue to provide dedicated bulk shipping services for EMSTEEL’s raw material imports, ensuring safe, reliable and efficient maritime logistics. The contract, with a total indicative value of approximately AED 600 million over its term, reflects the scale and strategic importance of the partnership.

The agreement builds on more than 20 years of collaboration between the two companies, a relationship that has supported EMSTEEL’s industrial expansion and strengthened the resilience of its supply chain. As part of the arrangement, Oldendorff Carriers will manage the transportation of approximately 5.2 million tonnes of iron ore pellets annually from multiple global sources. The shipments represent a critical logistical link between EMSTEEL and its suppliers, enabling seamless coordination, dependable deliveries and close supply chain integration.

Eng. Saeed Ghumran Al Remeithi, Group CEO of EMSTEEL, said the agreement reinforces the company’s commitment to working with trusted partners. “This long-term agreement with Oldendorff Carriers reaffirms our focus on reliability, operational excellence and performance. It ensures the steady and efficient flow of raw materials required to produce the steel that underpins regional infrastructure, industrial development and sustainable growth,” he said.

Patrick Hutchins, CEO of Oldendorff Carriers, highlighted the strength of the long-standing relationship between the two organisations. “We are proud to continue our partnership with EMSTEEL. Over the years, our collaboration has been built on trust, transparency and shared objectives. We look forward to further strengthening this cooperation in the years ahead,” he said.

The renewed agreement underscores the shared commitment of both companies to long-term collaboration, operational reliability and mutual growth. By securing stable raw material transport capacity, EMSTEEL aims to maintain production continuity and support the ongoing development of the UAE’s industrial and construction sectors.

The UAE’s industrial and logistics sector maintained strong momentum in 2025, with rents rising across all major submarkets, as tight supply conditions continued to shape market performance, according to Knight Frank’s latest UAE Industrial and Logistics Report.

High occupancy levels and sustained rental growth were recorded nationwide, supported by solid economic fundamentals and expanding activity from both domestic and overseas occupiers, particularly logistics operators from mainland China. Investor appetite for industrial and logistics assets also remained firm, underpinning transaction volumes across the sector.

Faisal Durrani, Partner and Head of Research, MENA at Knight Frank, said: “Investor appetite remains firm and competition for institutional-grade stock continues to strengthen, placing further downward pressure on prime yields towards sub-8% territory. This should support capital values, even as rental growth moderates in parts of the market.”

He added that while new supply due in 2026 could begin widening the rental performance gap between older and higher-specification facilities, rental levels are expected to remain firm overall. “We expect the demand drivers that have underpinned rental growth over the past few years to be sustained this year,” Durrani said.

Dubai rents continue upward trend

Dubai’s industrial and logistics rents climbed further in 2025, driven by strong occupier demand and rising land and construction costs.

Al Quoz remained the city’s most expensive industrial submarket, with rents reaching AED 100 per sq ft, supported by its central location. Dubai Industrial City recorded the strongest annual rental growth at 32%, with rents rising to AED 58 per sq ft amid constrained high-quality supply and growing manufacturing demand. Dubai South followed, with rents increasing 25% year-on-year to AED 45–55 per sq ft.

Grade-A assets in Jebel Ali Free Zone (JAFZA) also posted annual increases of around 22%, reaching AED 40–45 per sq ft. Meanwhile, more established inland areas such as National Industries Park and Dubai Investment Park saw rental stabilisation, as relatively higher vacancy levels tempered upward pressure.

Maxim Talmatchi, Partner and Head of Industrial and Logistics, Middle East, said JAFZA presents further upside potential. “With its proximity to Jebel Ali Port and appeal to multinational occupiers, we anticipate scope for further rental growth,” he said.

Knight Frank is tracking 6.6 million sq ftof new supply scheduled for delivery in 2026, with additional completions expected in 2027 and 2028. However, Talmatchi noted that near-term supply will remain relatively constrained in prime locations.

“We expect Dubai’s industrial and logistics supply pipeline between 2026 and 2029 to be relatively stable in the near term, before rising sharply towards the end of our forecast period,” he said. “This new supply should offer some relief to occupiers in the form of stabilisation, or softening in rents in some locations, which could begin towards the end of 2026.”

Demand in 2025 was led by logistics and manufacturing occupiers, each accounting for 21% of total requirements, followed by retailers and traders at 14% and technology-focused occupiers at 12%. Mid-sized warehouses between 10,000 and 50,000 sq ft accounted for the majority of demand in the second half of the year.

Abu Dhabi market anchored by diversification strategy

Abu Dhabi continued to advance its industrial diversification strategy, with 33% of the UAE’s US$5bn in awarded industrial contracts last year located in the emirate.

Rental growth was more measured than in Dubai, with performance largely driven by asset quality and proximity to key transport corridors. The Abu Dhabi Airports Free Zone recorded the highest average rents at AED 625 per sq m, followed by KEZAD Mussafah (ICAD) and Al Falah at AED 550 per sqm, and Mussafah at AED 500 per sqm.

Talmatchi said: “Market conditions in Abu Dhabi are likely to remain broadly stable through 2026, with demand anchored around the ICAD and KEZAD clusters. A disciplined approach to land release and development remains a key stabilising influence, restricting excess supply and limiting volatility in rental performance.”

Looking ahead, project completions in Abu Dhabi are expected to exceed US$1bn in Q1 2026, with another major peak forecast in 2029.

The growth trajectory is underpinned by the Abu Dhabi Industrial Strategy, which aims to more than double the emirate’s manufacturing sector to AED 172bn by 2031, with a focus on foreign direct investment and priority industries including chemicals, machinery, electronics and pharmaceuticals.

Durrani said the UAE’s industrial and logistics sector is entering a more mature phase. “Performance will increasingly be determined at the asset level. Location, specification, tenant quality and active management will matter more than scale alone,” he said. “The medium- to long-term outlook remains positive, with occupiers expected to continue gravitating towards high-specification and quality assets.”

Most Read

-

-

-

-

-

-

-

-

-

- Details

-

-

-

-

Latest News

Most Read

Latest News

More Articles

Smart cleaning innovation elevates QAIA passenger experience. (Image source: Queen Alia International Airport)