In The Spotlight

Jenan Real Estate acquires Dana Bay Waterfront Project

Jenan Real Estate Company has announced the full acquisition of the Dana Bay project, signalling a major milestone in its expansion strategy and marking the beginning of an ambitious new development phase under its sole ownership.

The move reinforces Jenan Real Estate’s growing presence in Saudi Arabia’s tourism and real estate sectors, aligning closely with the Kingdom’s long-term economic diversification goals.

The acquisition represents a strategic turning point for Dana Bay, one of the largest privately owned mixed-use waterfront tourism developments in the Kingdom. Located along a prime coastal stretch, the project spans more than 2.8 million square metres and is positioned to become a landmark destination on Saudi Arabia’s eastern seaboard. Once completed, the development is expected to reach a projected value of between SAR 6 billion and SAR 8 billion, underlining its scale and economic significance.

Jenan Real Estate continues to strengthen its role in shaping coastal tourism destinations by delivering fully integrated, high-quality developments that combine striking sea views with premium lifestyle amenities. These initiatives contribute to enhancing quality of life, attracting domestic and international investment, and generating both direct and indirect employment opportunities. The Dana Bay acquisition also supports Saudi Vision 2030 objectives by boosting domestic tourism and establishing leisure and hospitality as key drivers of sustainable national growth.

Through the comprehensive redevelopment of Dana Bay, Jenan Real Estate aims to stimulate domestic tourism by offering a destination tailored to families and visitors seeking a distinctive waterfront experience. The project boasts one of the longest private beaches in the Kingdom and will feature a diverse mix of residential, leisure and hospitality components. These include luxury beachfront villas with uninterrupted sea views, family-friendly chalets located close to the shore, and a wide range of supporting service facilities.

A standout feature of the development is “Loopagoon,” a women-only water park – the first of its kind in the Eastern Province – alongside a dedicated women’s spa and private beach, providing privacy-focused, high-end hospitality experiences. Dana Bay will also host world-class hotels and resorts catering to both local and international guests, as well as a fully serviced marina designed to attract yacht owners, sailing enthusiasts and luxury travellers.

Dana Walk will serve as a vibrant commercial and entertainment hub, offering restaurants, cafés, retail outlets and event venues with panoramic sea views. Premium catering services for events, celebrations and corporate gatherings will further enhance the destination’s appeal.

With plans to unveil a detailed development roadmap featuring major upgrades and new facilities, Jenan Real Estate aims to position Dana Bay as one of Saudi Arabia’s premier waterfront destinations and a key contributor to domestic tourism growth.

Oman explores future-ready electricity solutions

AtkinsRéalis, a leading global engineering and nuclear services company, in collaboration with Oman’s Ministry of Energy and Minerals, hosted the “Powering the Future: Oman Electricity Innovation Showcase” on December 10, 2025

The event convened senior leaders from government, utilities, regulators, and the private sector to explore strategies for meeting Oman’s rapidly growing electricity demand driven by AI-enabled economic development. Discussions focused on a balanced energy mix incorporating nuclear power, renewables, AI-ready grids, and storage solutions, all aligned with the nation’s goal of achieving net zero emissions by 2050.

H.E. Mohsin Hamed Saif Al Hadhrami, Undersecretary at the Ministry of Energy and Minerals, commented, “A secure and sustainable power system is central to our industrial strategy and economic ambitions, which includes recently announced initiatives like the Oman Digital Triangle, a gigawatt scale group of three AI superclusters under the National Digital Infrastructure Roadmap. This collaboration highlights technologies and delivery models that can help Oman diversify its energy mix, enhance grid resilience, and accelerate progress toward our national targets.”

The showcase featured sessions on decarbonisation pathways, grid resilience for AI-intensive economies, economic growth opportunities, and the complementary role of reliable nuclear energy alongside intermittent renewables. Lightning talks highlighted the importance of regional grid interconnections, hydrogen, financing, and policy frameworks. Participants engaged in interactive simulations to explore managing a diverse electricity supply mix and examined global case studies on nuclear project delivery and refurbishment.

Todd Smith, vice-president of marketing and business development at CANDU Energy Inc., added, “Reliable, clean, baseload power is the anchor for a modern grid, serving both people and a data-driven economy. Nuclear provides the dispatchable, low-carbon capacity that helps Oman scale renewables without sacrificing stability or affordability. The question is how to design the right mix, attract and sequence investments, drive new industry capacity and growth, and build the institutional capability to deliver at pace.”

The event was timely as Oman’s electricity demand grows at 6.1% annually, with MENA-wide consumption projected to increase by 50% by 2035. Data centre expansion, with installed capacity potentially tripling to 3.3 GW in the next five years and market growth expected to reach US$9.5bn by 2030, underscores the need for scalable, practical solutions to ensure energy security, economic competitiveness, and climate resilience.

Matthew Tribe, global market lead, buildings & places at AtkinsRéalis, said, “Our ambition with this showcase was to rise above the noise and illuminate innovative pathways grounded in evidence, strategic choices, and informed trade-offs. Today, cities, industries, and digital ecosystems converge on a singular imperative: abundant, resilient, and clean energy. In partnership with the Ministry, we have articulated a forward-looking roadmap that harmonises renewables, advanced storage, and grid-forming technologies with proven nuclear solutions, empowering Oman to accelerate near-term growth while steadfastly advancing toward a net-zero future.”

AtkinsRéalis combines extensive global nuclear and grid design expertise with a strong regional presence, drawing on decades of experience delivering CANDU reactors and managing a 7,000-person nuclear workforce. CANDU technology provides Oman and the broader region with a proven pathway to secure, low-carbon baseload power, supporting both grid stability and large-scale renewable integration. AtkinsRéalis remains committed to partnering with governments and industry stakeholders across the Middle East to identify opportunities and co-develop solutions that promote sustainable growth and deliver resilient, future-ready energy and infrastructure systems.

DEWA and Dell Technologies advance smart, sustainable utilities

Dubai Electricity and Water Authority (DEWA) has taken another decisive step towards shaping the future of smart and sustainable utilities by exploring strategic collaboration opportunities with Dell Technologies.

HE Saeed Mohammed Al Tayer, MD & CEO of DEWA, welcomed a senior Dell Technologies delegation led by Adrian McDonald, President for Europe, Middle East & Africa; Walid Yehia, Managing Director – Gulf; and Mohammad Amin, Senior Vice President – CEEMETA. The meeting was also attended by Marwan Bin Haidar, Executive Vice President of Innovation and the Future at DEWA, and Mohammed Bin Sulaiman, CEO of Moro Hub, part of Digital DEWA.

The discussions centred on strengthening cooperation to deploy advanced digital solutions that support Dubai’s smart infrastructure ambitions, accelerate green initiatives and transform utility services through innovation. Both parties examined how emerging technologies can play a pivotal role in redefining operational excellence across the energy and water sectors.

Al Tayer affirmed that, in line with the vision and directives of Dubai’s wise leadership to make AI the cornerstone of future initiatives and services in the emirate, DEWA is harnessing the latest Fourth Industrial Revolution technologies, particularly AI, to enhance performance and productivity. He emphasised the critical role of robust IT infrastructure, AI and Big Data analytics in building more resilient, efficient and customer-centric utility services.

The meeting highlighted opportunities for Dell Technologies to contribute its global expertise in digital transformation to support DEWA’s ambitious road maps for sustainable energy, integrated water management and smart city development. Discussions explored modernising critical infrastructure through next-generation IoT, edge computing and advanced data centre solutions to enhance grid reliability, seamlessly integrate renewable energy and optimise water distribution networks.

Both sides also examined how AI, advanced analytics and machine learning can unlock new operational efficiencies through predictive maintenance, intelligent demand forecasting and personalised customer engagement. Sustainability emerged as a core focus, with an emphasis on green data centres, energy-efficient system designs and innovative cooling technologies aligned with Dubai’s environmental goals.

The dialogue concluded with a shared commitment to strengthening cybersecurity frameworks, ensuring the long-term security, resilience and reliability of Dubai’s critical utility infrastructure in an increasingly digital future.

Wind energy is becoming a strategic pillar of renewable energy development in several Middle Eastern nations. (Image source: Adobe Stock)

Building a skilled workforce for Middle East wind projects

The wind energy sector in the Middle East is expanding rapidly as countries such as the UAE, Saudi Arabia and Oman push forward with ambitious renewable energy goals

As wind projects grow across the region, the need for a highly skilled and safety-focused workforce becomes increasingly important. Wind turbine technicians play a central role in this transition because they keep turbines operating efficiently and safely. One of the most widely recognised qualifications for these technicians is GWO certificates, which provide an international benchmark for technical ability and safety awareness in the wind industry. This article explores why these certificates are essential in preparing a qualified workforce for the Middle East’s evolving wind energy landscape.

The growing need for skilled technicians in Middle East wind energy

Wind energy development in the region brings unique challenges due to harsh climates, expanding infrastructure and the technical demands of modern turbines. Technicians must work at significant heights, handle mechanical and electrical systems and operate in extreme temperatures. They also need the skills to inspect equipment, troubleshoot issues and perform regular maintenance to avoid operational downtime.

GWO certificates offer standardised and comprehensive safety training that prepares technicians for these conditions. The training includes essential modules such as working at heights, manual handling, fire awareness and first aid. For companies building or maintaining wind farms in the Middle East, workers trained under GWO certificates provide a reliable and competent foundation for meeting regional project demands.

GWO certificates for wind technician safety and competence

Achieving GWO certificates has become an industry requirement for technicians working on wind turbines worldwide. This training ensures workers understand both routine safety practices and emergency response techniques that are crucial in a high-risk environment. Programme modules address working at height procedures, safe movement in turbine towers and how to react during unexpected situations.

For the Middle East, adopting GWO certificates is key to aligning wind energy operations with global safety and performance expectations. Many countries in the region are still expanding their wind energy infrastructure, making it essential to build a trained workforce from the outset. Certification gives employers confidence that technicians possess the correct skills to meet international standards and handle the environmental challenges specific to the region.

How GWO training supports wind energy growth in the Middle East

Wind energy is becoming a strategic pillar of renewable energy development in several Middle Eastern nations. As large-scale wind farms are introduced, project success increasingly depends on having well-trained personnel capable of maintaining turbine availability and performance. GWO-based training provides practical capabilities that technicians rely on daily, from climbing and rescue procedures to safe handling of equipment during routine inspections.

In addition, GWO certificates support broader industry goals by promoting a consistent safety culture across the region. As more companies adopt these certifications, teams gain shared knowledge and practices that reduce risk and improve reliability. This consistency is especially important for international firms entering the Middle East market since it ensures alignment with the safety expectations used worldwide.

Conclusion

The Middle East’s shift toward renewable energy places wind power at the center of long-term sustainability plans. The success of these projects will depend heavily on the capabilities of technicians responsible for turbine operation and maintenance. GWO certificates provide a structured and globally recognised path to building that skilled workforce and ensuring that safety and performance standards remain high.

Organisations that want to strengthen their workforce can explore training options through providers such as FMTC Safety. For more information about certification programmes suitable for the Middle East wind sector, visit fmtcsafety.com, where you can find course options designed to prepare technicians for the region’s challenging and fast-growing wind energy industry.

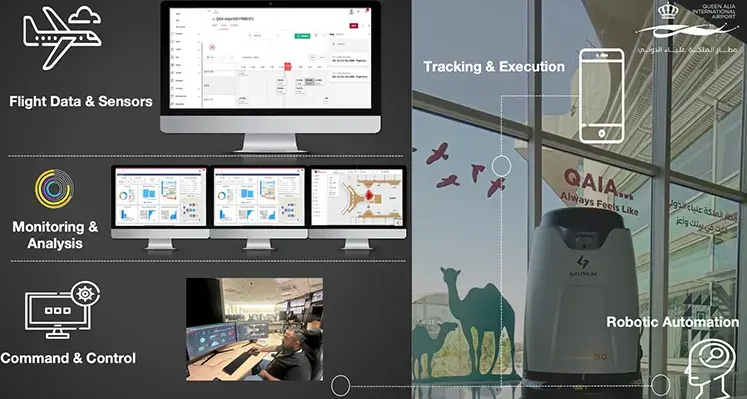

Smart cleaning innovation elevates QAIA passenger experience. (Image source: Queen Alia International Airport)

QAIA wins global award for smart airport operations

Queen Alia International Airport, operated by Airport International Group, has been honoured by Airports Council International with the Best Innovation in Airport Technology Award for its Smart Cleaning System

The award recognises a fully integrated, real time operational model developed under AIG’s leadership and implemented on site through its cleaning services partner, MENA Facilities Management, using the MIMS platform created by Arrow Labs.

The recognition highlights AIG’s long term strategy to modernise airport operations through digital innovation, data driven decision making and real time operational control. Within this framework, MENA Facilities Management is responsible for the daily execution of the Smart Cleaning System, applying the MIMS platform as part of the performance structure and operational standards defined by AIG.

The system brings together multiple data sources, including passenger movement patterns, flight schedules, IoT sensors, Building Management Systems and live feedback tools. This integration enables MENA FM to plan cleaning activities dynamically, respond quickly to changing operational demands and maintain consistent service levels throughout the terminal. Both AIG’s oversight teams and MENA FM’s operational staff benefit from improved visibility, coordination and responsiveness across airport facilities.

Since implementation, QAIA has recorded tangible operational gains, such as quicker response times, more efficient workforce deployment, improved transparency and higher levels of passenger satisfaction. The project demonstrates how AIG’s strategic direction, supported by specialised execution partners, can convert operational data into practical outcomes that enhance the overall airport experience.

“QAIA’s success reflects the strength of AIG’s visionary leadership, brought to life through close collaboration between a high-performing service provider and world-class technology,” said Rami Darwish, CEO, Arrow Labs.

He continued, “We are honored that our MIMS platform played a central role in this transformation. MENA Facilities Management’s commitment to service excellence and digital enablement was crucial in translating real-time operational intelligence into measurable performance outcomes. This award demonstrates what strategic leadership, strong partnerships, and continuous innovation can achieve.”

MENA Facilities Management plays a central role in turning digital insights into on ground execution, ensuring that the system delivers consistent performance across all airport areas.

“AIG’s dedication to digital innovation has been the true catalyst behind this milestone, and we are proud to have contributed as an integral operational partner. By adopting Arrow Labs’ MIMS platform, MENA FM has been able to enhance service delivery, optimise resources, and reinforce airport-wide coordination. This recognition is a clear testament to what aligned vision, advanced technology, and committed teams can deliver,” stated Aboud Abu Gharbieh, CEO, MENA FM.

As Jordan’s main international gateway, Queen Alia International Airport continues to strengthen operational excellence and digital transformation under AIG’s management. These efforts reinforce its standing among the region’s leading airports while supporting a smoother, more efficient travel experience for millions of passengers each year.

Palma awards US$207mn contract for West Residence in Jumeirah Islands

Dubai-based Palma Development has awarded a 760 million UAE dirhams (US$206.94mn) construction contract to Khansaheb Civil Engineering for West Residence, the first residential tower within the AED5 billion Serenia District, a flagship master-planned community in Jumeirah Islands.

The 46-storey West Residence tower will feature 411 one-, two-, and three-bedroom homes, alongside two exclusive penthouses, the developer confirmed in a statement. While no official completion date has been provided, the project is a significant addition to Palma Development’s expanding luxury portfolio in Dubai.

In July, Palma Development appointed APCC Piling & Marine Contracting to begin shoring and piling works for the tower, signalling the commencement of key foundational works.

The Serenia District is designed around six lifestyle zones: the Serenia Signature Clubhouse, Health and Social zone, Sports and Recreation spaces, Family Oasis, Nature Discovery zone, and a Wellness Retreat. This approach underlines Palma’s focus on creating a holistic and luxury residential experience in Dubai’s upscale communities.

Khansaheb Civil Engineering has a proven track record in the region, having successfully delivered Serenia Residences The Palm and currently executing Serenia Living on Palm Jumeirah. In April, Palma Executive Director Omar Derbas told Zawya Projects that the AED 3 billion Serenia Living on Palm Jumeirah’s West Crescent is on track for full completion by the fourth quarter of 2025.

With the West Residence project, Palma Development continues to strengthen its presence in Dubai’s luxury real estate market, offering modern, high-rise living in one of the city’s most sought-after master-planned communities.

How will Metso’s Grande series improve screening?

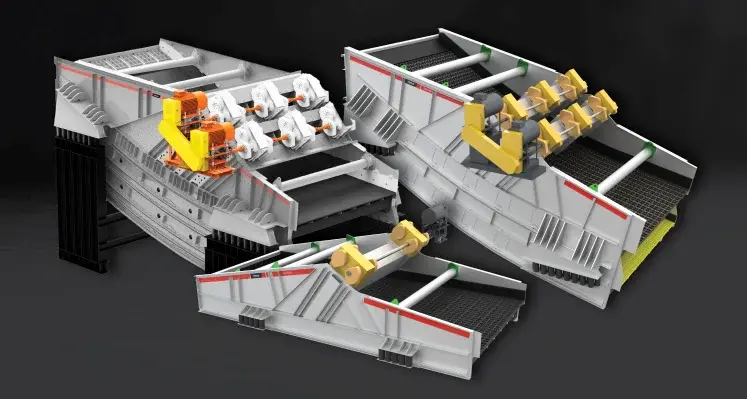

Metso has expanded its screening solutions portfolio with the introduction of the new Grande Series

The series represents a significant enhancement for mining and aggregates operators, delivering high-performance screening technology designed to optimize capacity, uptime, and operational efficiency across the most demanding continuous-use applications.

The Grande Series introduces three new stationary screen types, GLH, GMF and GFF, each engineered to support high-capacity production environments and deliver improved flexibility. With larger screen sizes than previously available in Metso’s lineup, the range enables customers to achieve greater throughput, minimise maintenance interruptions, and tailor their operations more effectively to meet business objectives.

“It’s all about helping our customers succeed with the right tools for their unique needs. With the newly launched Grande Series, customers gain more flexibility, easier screen replacements, and access to solutions for even the most demanding screening tasks,” commented Jouni Mähönen, vice-president, screening business line, Metso.

Screening options designed for varied operational applications

The GLH horizontal screens are optimised for heavy-duty use, including demanding slurry and water-handling duties in mining operations. Meanwhile, the GMF multi-slope banana screens are built to accommodate high-capacity screening for fine and near-size particle processing.

These additions introduce engineered-to-order configurations and ultra-large screen formats that were previously unavailable in Metso’s stationary screen offerings.

The GFF flip-flow screen type adds further capability by enabling efficient separation of difficult materials and fine fractions, reinforcing Metso’s position as a full-scope screening partner.

Compatibility with Trellex screening media ensures the new series integrates seamlessly with Metso’s broader screening technologies, enabling complete end-to-end solutions for users.

Easier replacement of non-Metso screens and flexible reconfiguration options further support customers looking to enhance or modify existing operations without disruption.

“The Grande Series is a result of our continuous screening portfolio development. We are strengthening Metso’s position as a screening solutions partner – expanding our offering with larger screens, lighter duty screens, and new flip-flow technology. With new technologies, larger sizes, and advanced capabilities, we’re expanding our portfolio to support the most demanding applications and strengthen our position in the growing screening market,” remarked Michael Gyberg, vice-president, capital equipment business, Screening, Metso.

Metso will roll out the Grande Series globally, with the GLH and GMF screens debuting publicly in early December 2025, followed by the GFF Series at the end of the first quarter of 2026.

Expanded screening portfolio and service ecosystem

The new Grande Series complements Metso’s broader offering, which includes UFS Series, EF Series, and BSE Series screens within the Metso Plus program, alongside a comprehensive range of multislope, inclined, horizontal, mobile, portable, and ultrafine screening solutions. Paired with Trellex rubber and polyurethane media systems, Metso provides full-spectrum screening solutions for diverse material-handling needs.

Distributed Power Europe (DPE)

Venue:

Rimini

Italy

Dates:

22-24 March 2023

Website:

22 Mar 23 - 24 Mar 23

Venue:

Rimini

Italy

Dates:

22-24 March 2023

Website: