Metso has expanded its screening solutions portfolio with the introduction of the new Grande Series

The series represents a significant enhancement for mining and aggregates operators, delivering high-performance screening technology designed to optimize capacity, uptime, and operational efficiency across the most demanding continuous-use applications.

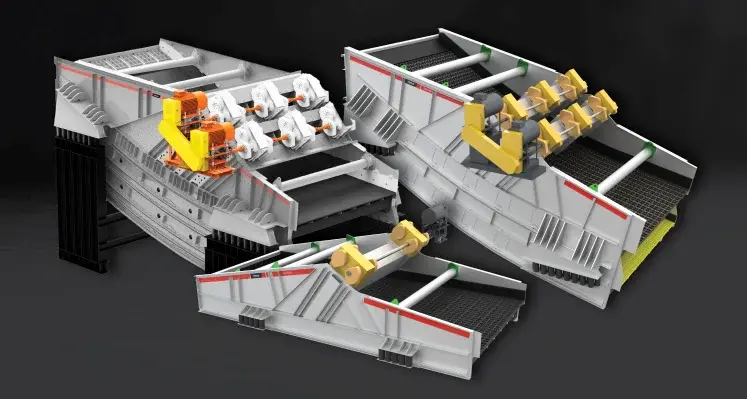

The Grande Series introduces three new stationary screen types, GLH, GMF and GFF, each engineered to support high-capacity production environments and deliver improved flexibility. With larger screen sizes than previously available in Metso’s lineup, the range enables customers to achieve greater throughput, minimise maintenance interruptions, and tailor their operations more effectively to meet business objectives.

“It’s all about helping our customers succeed with the right tools for their unique needs. With the newly launched Grande Series, customers gain more flexibility, easier screen replacements, and access to solutions for even the most demanding screening tasks,” commented Jouni Mähönen, vice-president, screening business line, Metso.

Screening options designed for varied operational applications

The GLH horizontal screens are optimised for heavy-duty use, including demanding slurry and water-handling duties in mining operations. Meanwhile, the GMF multi-slope banana screens are built to accommodate high-capacity screening for fine and near-size particle processing.

These additions introduce engineered-to-order configurations and ultra-large screen formats that were previously unavailable in Metso’s stationary screen offerings.

The GFF flip-flow screen type adds further capability by enabling efficient separation of difficult materials and fine fractions, reinforcing Metso’s position as a full-scope screening partner.

Compatibility with Trellex screening media ensures the new series integrates seamlessly with Metso’s broader screening technologies, enabling complete end-to-end solutions for users.

Easier replacement of non-Metso screens and flexible reconfiguration options further support customers looking to enhance or modify existing operations without disruption.

“The Grande Series is a result of our continuous screening portfolio development. We are strengthening Metso’s position as a screening solutions partner – expanding our offering with larger screens, lighter duty screens, and new flip-flow technology. With new technologies, larger sizes, and advanced capabilities, we’re expanding our portfolio to support the most demanding applications and strengthen our position in the growing screening market,” remarked Michael Gyberg, vice-president, capital equipment business, Screening, Metso.

Metso will roll out the Grande Series globally, with the GLH and GMF screens debuting publicly in early December 2025, followed by the GFF Series at the end of the first quarter of 2026.

Expanded screening portfolio and service ecosystem

The new Grande Series complements Metso’s broader offering, which includes UFS Series, EF Series, and BSE Series screens within the Metso Plus program, alongside a comprehensive range of multislope, inclined, horizontal, mobile, portable, and ultrafine screening solutions. Paired with Trellex rubber and polyurethane media systems, Metso provides full-spectrum screening solutions for diverse material-handling needs.