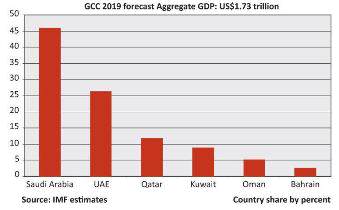

Strengthening economic activity in the GCC, the regional trade bloc is good news for global businesses and the wider MENA region in terms of increased financial support and as a source of much-needed FDI in non-oil producing Arab countries. Economist Moin Siddiqi reports:

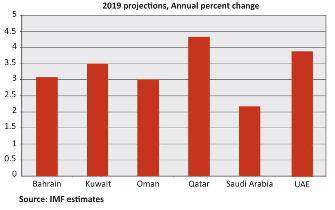

A combination of factors such as expansionary fiscal stance, higher oil revenue and publicly funded projects in priority sectors are underpinning growth revival across the GCC-bloc projected at three per cent this year after contracting in 2017, according to the International Monetary Fund (IMF).

Domestic demand should strengthen with [the] easing of fiscal consolidation, noted Washington-based Institute of International Finance (IIF). The sources of growth will be roughly balanced, with the contribution of private consumption to gross domestic product (GDP) growth doubling from 2016 to 2019 and that from fixed investment nearing a percentage point higher by 2020 (World Bank data). The IIF expects non-hydrocarbon growth to accelerate to 3.2 per cent by 2020. Overall, rebalancing the composition of public expenditures toward capital spend should help improve infrastructure, support non-oil growth, and spur productivity gains in GCC economies.

Moody's Investors Service echoed government spending on infrastructure and strategic projects, which contribute to economic diversification, will support non-oil businesses. It said, "The GCC corporate sector is dominated by state-owned enterprises, many of which benefit from strong business positions, good access to funding and supportive shareholders, and this has helped offset recent economic volatility. We have a stable outlook for credit conditions for GCC corporates."

But monetary tightening in context of the pegged exchange rates in GCC (except Kuwait), may offset anticipated gains from expansionary budgets. GCC central banks followed recent US central bank's move by also hiking key policy interest rates. The real estate and construction sectors are most exposed to higher borrowing costs. However, GCC's banking systems, which comply with international codes of the Basle Committee, are sound as capital adequacy ratios exceed 16 per cent. The share of non-performing loans (NPLs) to total loans stands at only two per cent in Saudi Arabia, Qatar, Kuwait and Oman, and between four and seven per cent in Bahrain and the UAE (IIF data).

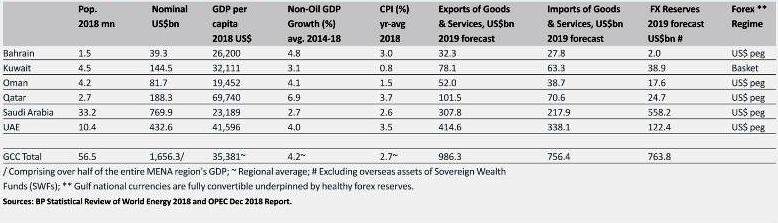

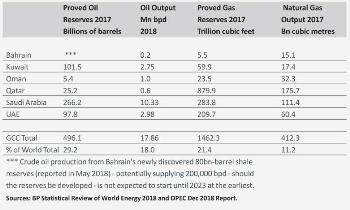

A one-third surge in average oil price in 2018 led to a marked turnabout in external and fiscal balances for oil-exporters that should continue this year. The combined current account surplus of 10 MENA oil-exporters rose by about US$150bn to US$197bn in 2018; of this, US$169bn was accounted for by GCC countries (World Bank data). Steady oil prices will slow recent debt build-up, whilst increasing official foreign reserves in the GCC-bloc (Table1 below).

Despite economic diversification efforts, the correlation between oil prices, public accounts and commercial activity in GCC remain strong. Fitch Ratings noted, "These are concentrated, narrow economies where government spending plays a significant role in economic growth. The degree of oil exposure varies. The IMF calculated that 'break-even' oil price at which GCC states could balance their 2019 budgets fluctuate from an average of US$108 per barrel in Bahrain to US$44 and US$47 respectively, in Qatar and Kuwait. Also struggling with a high break-even is Saudi Arabia (US$73) and Oman (US$70). While the UAE (most diversified economy) needs US$67 to balance the federal budget.

Fast facts on GCC member states

Strategic development plans

The stimulus initiatives underpin GCC's broader diversification strategy.

Factors such as demographic demand drivers and public/private funding combined with firm oil prices are catalysts for spend on capital/ infrastructure projects. The Arab Petroleum Investment Corporation (APICORP) envisages oil trading at US$60-70/barrel range by mid-2019. The long-term vision agenda of each GCC country targets priority sectors such as logistics, tourism, energy, financial services, healthcare and manufacturing to deliver on economic diversification and job creation. About one million new jobs per year are needed in the GCC-bloc to absorb new entrants into the labour market over the next five years, according to the IMF.

The GCC still boasts some of the best project opportunities in the world. As home to the globe's wealthiest countries, the financial muscle is available to develop/upgrade infrastructure and growth uptick in 2019-20 is conducive for project spending. "There are huge opportunities in the region and it is a reassessment of how we plan for those [opportunities] and how we deliver them. We need to evaluate the return on investment for these assets," said Deloitte Middle East. Though challenges have beset the market in recent years, with regional slowdown and weak oil prices affecting non-oil sectors and expansion.

Cross-country examples

As Saudi Arabia moves ahead with Vision 2030 based on greater private sector investments in non-oil ventures, local and foreign contractors can look forward to participating in mega-projects identified during last October's Saudi Arabia Conference. Those will have huge multiplier-effects both in Saudi Arabia and neighbouring countries. The kingdom is actively seeking to upgrade its transport-related infrastructure, as well as increase residential supply, healthcare and leisure facilities driven by the development of major schemes, notably The Red Sea Project, Neom, The Qiddiya Entertainment City and Maritime City. The value and quantum of building work to be awarded over the medium to long-term makes the kingdom a prime Middle East market with capital projects worth over US$1.2 trillion in pre-execution stages, according to Deloitte.

The UAE (led by Dubai) is laying the foundation for deepening a knowledge-driven economy and is increasing competition, boosting energy efficiency and promoting technology entrepreneurship, aiming to attract diverse global investors and start-ups. Dubai has allocated US$7bn for new construction and upgrade related to hosting Expo 2020 Dubai, which will feature companies from 132 countries and is expected to boost private consumption and services. Abu Dhabi, the major oil-exporter, has unveiled a US$13.6bn stimulus package for infrastructure and is focusing on industrial and SME projects. Deloitte estimates the value of various UAE projects in pre-execution stages at US$713bn.

In Kuwait, plans to invest US$115bn in the oil sector over the next five years, aimed at boosting output capacity by one-third to four million bpd by 2020, will also spur non-oil growth (via multiplier-effects). Kuwait's flagship diversification venture, the Northern Gulf Gateway project with a new US$12bn airport, an industrial hub, tourism and education zones, plus a US$18bn railway system and building new residential cities (currently in pre-development stages) will increase both internal and intra-regional connectivity.

In Oman, the development of Special Economic Zones in Duqm and Sohar will drive project activity, together with planned investments in oil/gas sector while Bahrain is focusing on transport and housing areas. The Ministry of Transport owns two mega planned projects, the airport expansion and light rail system (estimated worth US$18bn) and are anticipated to be awarded in late 2019.

Major project owners

Saudi Arabia's Public Investment Fund (PIF) remains number one GCC project developer, with a portfolio estimated at US$534bn and its biggest under-development assets include the Neom City, Rou'a Al Madinah and Rou'a Al Haram. It is followed by King Abdullah City for Atomic and Renewable Energy's nuclear power reactor (KA-CARE), worth some US$60-70bn and Saudi Aramco valued at US$36bn. PIF, Aramco, Saudi Electricity Company, Makkah & Medina Development Corp, and Saudi Railways Organisation are top project owners in the kingdom, owning around 70 per cent of the total amount of planned projects. PIF has taken a key role in delivering Vision 2030.

Dubai Aviation Engineering Projects ranks the fourth largest in GCC top-10 developers' list, with its most prized development being phase 2 of the Al Maktoum International Airport Expansion scheme, worth US$31bn, spilt last year into various phases and packages. Kuwait Authority for Partnership Projects also makes the list of 10, with pre-execution projects worth US$31.5bn, followed by public authority for housing, with a total pre-execution pipeline worth US$29.3bn. The housing authority's assets include the US$13.9bn Al Khiran City, and the US$13.5bn South Al Mutlaa City.

GCC member states are keen to develop and strengthen public-private partnerships (PPP) frameworks as a model for private sector involvement in project delivery with sound commercial returns, whilst lessening the burden on public finances. The current US$2.5 trillion transportation, logistics, energy (including renewables) and industrial as well as new cities' projects planned across the GCC-bloc offers huge opportunities for construction businesses and global investors in the coming years.

On current growth trend, the GCC's aggregate GDP should exceed US$2 trillion mark by 2020. However, the likelihood of oil prices trading significantly below pre-2014 peaks of US$100 per barrel underscores the need for Gulf region to continue with structural reforms to diversify the economy, improve the business environment and boost productivity in non-oil sectors' vital to job creation and FDI.

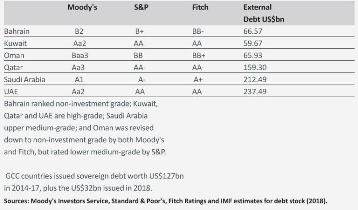

GCC sovereign credit ratings

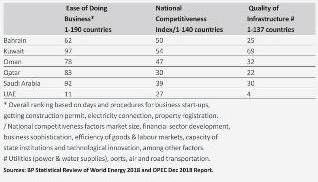

GCC countries rank highest on global indicators

Data on GCC hydrocarbon reserves and production

Who generates lion's share of regional output

Cross-country non-oil real GDP growth