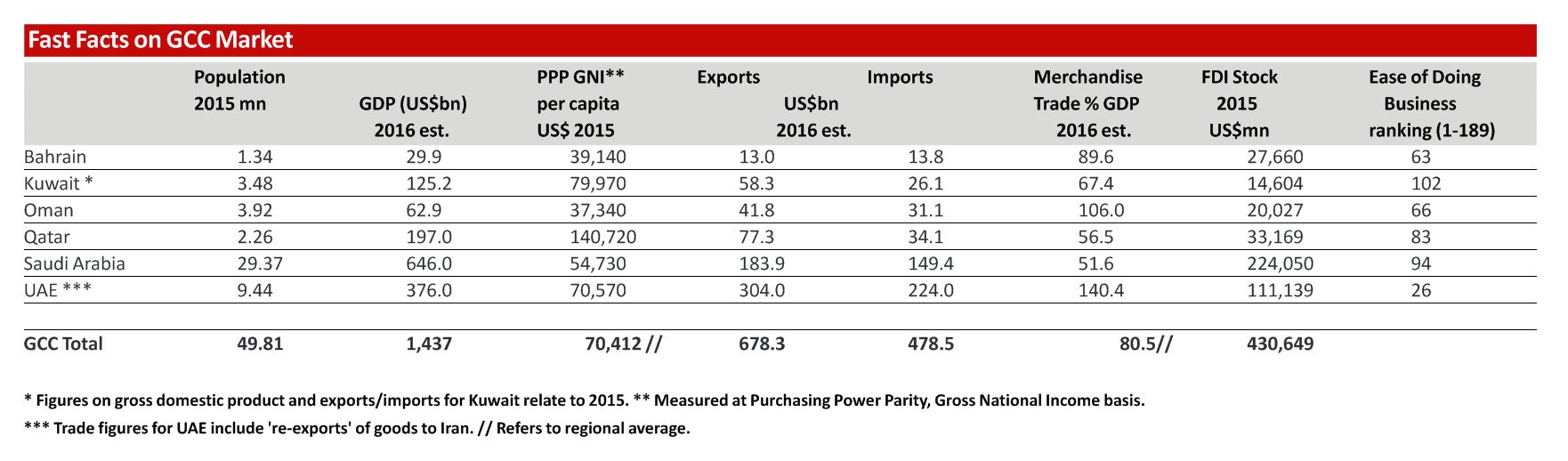

The six-member Gulf Cooperation Council (GCC) ? Saudi Arabia, the United Arab Emirates (UAE), Kuwait, Qatar, Bahrain and Oman ? represents one of the wealthiest country groupings in the world, equal roughly to total the GDP of Canada, but with a higher population

Diversifying income sources remain a pivotal challenge facing the region. The GCC has encouraged trade and foreign direct investment (FDI) to facilitate non-oil economic growth though regulatory reforms and fiscal incentives. FDI has helped member-countries gain access to sophisticated technology needed to expand production, marketing, transport, and communication networks.

In terms of investing, the World Bank Doing Business 2017 indicators rank GCC at the top of Middle Eastern economies, with the UAE in the higher tier (ranked 26) out of 190 economies ? above Netherlands (28), France (29), and Switzerland (31), respectively.

The low-tax environment and improved procedures such as access to construction permits and the registration of real estate and property make the GCC market attractive for foreign investors. These feature alongside favourable demographics and solid private consumption influenced considerably by Western lifestyles and tastes, as well as political stability and wealth. Countries are positioning themselves as vibrant hubs for transport and trade logistics, financial services, tourism and agro-processing. Saudi Arabia is investing in Red Sea ports and automotive manufacturing. Oman is developing its transhipment capacity.

1.The GCC?s five major bilateral trading partners are: China (US$137.16bn); India (US$104.88bn); Japan (US$91.85bn); USA (US$88bn); and South Korea (US$71.94bn) during the year 2015.

2. The EU-GCC total trade in goods in 2015 amounted to US$180.31bn, of which Germany, UK and France comprised US$37.55bn; US$31.54bn; and US$21.12bn, respectively.

3.EU exports to GCC are focused on industrial products such as power generation plants, railway locomotives and aircrafts as well as electrical machinery and mechanical appliances. EU imports from GCC countries are mainly mineral fuels and mining products and chemicals.

Tilting towards the East

The GCC is an important junction in the global economy, evident in growing external market integration and greater FDI flows (both inward and outward) over the years. According to the International Monetary Fund (IMF), the region?s merchandise trade accounted for an estimated four-fifths of GDP in 2016.

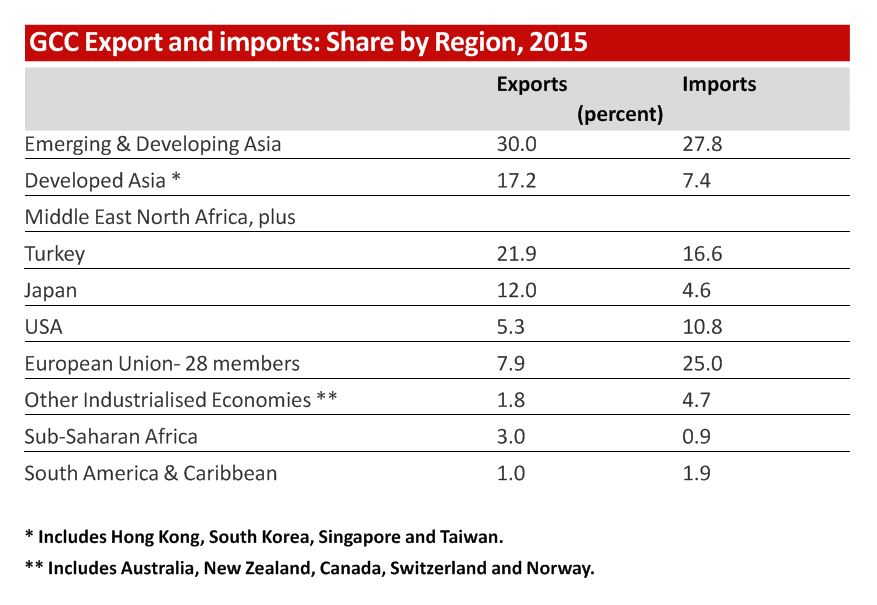

The Asian economies led by China, India and South Korea attracted nearly half of GCC?s total exports in 2015 ? dominated by shipments of liquefied natural gas (LNG), petroleum and oil derivatives ? reflecting Southeast Asia?s heavy energy demand fuelled by strong GDP growth and industrialisation.

GCC exports to India and China grew at a rate of 40 and 30 per cent, respectively, in the last decade, by far the highest rate with any major trading partners. Commercial ties have also spread to the Association of Southeast Asian Nations (ASEAN) group, with Thailand, Malaysia and Singapore standing out. Dubai and Bahrain look at Singapore as a model of thriving ?non-resource? based economy. The share of GCC imports from Asia-Pacific ? comprising machinery, manufactured goods and foodstuffs ? totalled over one-third of aggregate in 2015.

The Economist Intelligence Unit (EIU) notes, ?These developing trade ties allow the Gulf countries easier access to wider Asian markets in the energy, telecommunications and finance sectors, which is beneficial to their economic diversification strategies.?

North America, Europe and Japan, along with Australia and New Zealand, form a large trade/investment partner to GCC, accounting for 27 and 45 per cent, respectively, of exports and imports in 2015. The European Union (EU), led by Germany, Britain and France, remains the biggest western trading bloc in absolute terms, although its relative share of GCC trade has dropped in the past decade ? with other emerging-markets (notably Asia-Pacific) growing their share at the expense of the West. In 2015, total trade flows from Asia were US$454.8bn, compared to US$395.5bn from western economies.

1. The six Gulf Co-operation Council countries are all classified as high-income economies by the World Bank.

2. A high dependency on hydrocarbons as expressed in the share of oil and gas in total fiscal and export revenues (80 percent) and the share of the hydrocarbons sector in GDP (50 percent).

3. A young and rapidly growing national labour force; and a heavy reliance on expatriate labour in the private sector.

4. Central Bank international reserves in some GCC countries are equivalent to about 10 months of imports.

5. GCC-bloc has formed its own customs union and are working towards the goal of completing an internal market.

6. The GCC countries currently hold 30 percent of world's proven oil reserves; together they produced 1,019mn tonnes of crude oil in 2015, equivalent to 23.7 percent of total global production.

7. Sovereign Credit Ratings (Standard & Poor's): Bahrain [BB]; Kuwait [AA]; Oman [BBB-]; Qatar [AA]; The Kingdom of Saudi Arabia [A-]; United Arab Emirates [AA].

8. Sovereign Bond Issuances, 2015-16: Bahrain (US$2.5bn); Oman (US$3.5bn); Qatar (US$14.5bn); Saudi Arabia (US$10bn); and United Arab Emirates (US$5bn)

Emerging market investors

From a low base, GCC investment collaboration with Asia has grown rapidly in the last decade ? with Chinese, Indians and Koreans emerging as major investors in infrastructure, energy, telecoms, ICT and manufacturing.

According to US think-tank, The Heritage Foundation, Chinese construction firms were awarded contracts worth US$30bn between 2005 and 2014, representing one-tenth of China?s global contract wins, the largest of which was the US$3.7bn Waad Al-Shamal phosphate project in Saudi Arabia. Chinamex, real estate developer, helped to develop large malls in UAE (Dragon Mart Dubai) and Bahrain (Dragon City). The GCC is a prime market for China?s telecoms giant Huawei. Indian FDI in the GCC-bloc was reported at US$2.1bn in 2014. Indian entities have invested in some heavy industry; for instance Oman India Fertiliser Co. in Sur (opened in 2006) is a US$1bn joint venture between Oman Oil Co. and two Indian farmers? co-operatives. Jindal Steel of India owns Shadeed Iron & Steel in Oman, which it acquired in 2010 for US$464mn. Data from Alpen Capital, an Indian Dubai-based investment boutique, indicates that India is UAE?s third largest foreign investor. Largest investments included have US$300mn for Ultratech Cement in 2010 and the building of a cement factory in Fujairah free zone (worth US$150mn).

Korean engineering, procurement and construction (EPC) firms in Qatar are involved in infrastructure projects reportedly worth US$29bn, focusing on the construction of stadiums, railroads, highways and bridges ? in preparation for the 2022 FIFA World Cup. In March 2015, South Korea and Qatar signed MoU to enhance their bilateral co-operation. The tankers transporting Qatar LNG around the globe are manufactured in South Korean shipyards. In 2014, Koreans were part of three consortia awarded sections of a mega US$12bn Clean Fuels refinery project in Kuwait.

The full report can be read in the latest issue of Technical Review Middle East here.