In The Spotlight

More than 140,000 industry professionals from 128 countries attended CONEXPO-CON/AGG 2026 in Las Vegas, Nevada, as the global construction sector gathered to explore new technologies, equipment and business opportunities.

Held from 3–7 March, the event brought together contractors, manufacturers and technology providers to showcase innovations aimed at improving efficiency, safety and sustainability across construction operations.

Spanning more than three million square feet, the exhibition featured over 2,000 exhibitors presenting machinery, digital tools and services across the industry. Equipment ranging from heavy earthmoving machines and cranes to advanced paving systems was displayed alongside emerging technologies such as automation, connected jobsite solutions and low-emission machinery.

According to show organisers, the event provided contractors with an opportunity to evaluate equipment in person and connect directly with manufacturers when making purchasing decisions.

Dana Wuesthoff, show director for CONEXPO-CON/AGG, said the exhibition remains a key platform for unveiling technologies shaping the future of construction. She noted that the innovations presented at the event demonstrate the industry’s ability to adapt and improve jobsite productivity and safety.

Companies used the event to introduce a range of new machines and digital solutions. Komatsu highlighted developments in intelligent machine control technology, including its PC220LCi-12 excavator, designed to help operators excavate with greater precision using integrated sensors and 3D design data. The company also introduced the HM460-6 articulated truck, the largest model in its range.

Meanwhile, LiuGong presented several machines focused on electrification and efficiency, including the 870 HE loader and the 924 FE electric excavator.

Technology providers also showcased digital solutions aimed at improving operational visibility and productivity. Topcon Positioning Systems demonstrated its 3D-MC Edge feature, designed to enhance machine control accuracy, while Samsara presented systems that enable contractors to monitor equipment utilisation and fleet performance.

In addition, Doka displayed advanced formwork and digital jobsite technologies aimed at improving efficiency on large infrastructure and building projects.

Innovation at the event was also recognised through the Next Level Awards programme. Attendees selected Husco’s GenSteer technology as the Contractors’ Choice winner for best equipment, while the Gravis Rack developed by Gravis Robotics was voted best technology.

Beyond the exhibition floor, the event hosted more than 150 education sessions, workshops and panel discussions covering topics such as artificial intelligence, workforce development, infrastructure investment and sustainability.

Special programmes also focused on industry challenges including workforce recruitment and professional development. Workshops for women in construction, small business operators and maintenance professionals were introduced to encourage peer learning and collaboration.

Organisers confirmed that the next edition of CONEXPO-CON/AGG will take place from 13–17 March 2029.

Aviation will not decarbonise at the pace required unless Sustainable Aviation Fuel (SAF) projects can reach final investment decision (FID) far more rapidly, industry leaders warned during a recent Sustainable Aviation Futures webinar, hosted in partnership with technology company Johnson Matthey.

The session brought together voices from across the value chain: technology provider Johnson Matthey, airline group IAG, energy major Repsol, lender Santander, and insurer AXA.

The webinar host noted that while around 50 SAF plants are operational globally and roughly 40 more have secured financing, over 150 projects remain stuck in planning, with at least 50 abandoned or paused in recent years. “SAF is essential to decarbonise aviation, but getting projects from paper to FID is by no means guaranteed,” she said.

Defining FID readiness

For Paul Ticehurst of Johnson Matthey, being “FID ready” means a project is “fully defined” with clear capital and operating costs, timelines, production volumes, revenues and, crucially, a deep understanding of its risk portfolio. That includes off‑taker risk, feedstock risk, policy risk, construction risk, operational risk and technology risk. Early engagement with all stakeholders – investors, EPC contractors, insurers and off‑takers – is, he argued, essential to build confidence.

Sponsor strength, technology choice and regulation

From a developer’s perspective, Alfonso García of Repsol stressed that overall project risk hinges on three pillars: the sponsor’s financial strength and operating track record, the maturity and flexibility of the chosen technology, and the regulatory environment. In Europe, he described the policy framework as both “more material” and “more complex”, driven by multiple overlapping mandates. He underlined the importance of policy‑agnostic designs and product flexibility, allowing plants to switch output – for example, between SAF and renewable diesel – when market conditions shift.

Finance and insurance: putting risks on the right balance sheet

Urbano Pérez of Santander highlighted that most SAF plants to date have *not* been project‑financed, and that moving to true non‑recourse finance dramatically raises the bar for risk assessment. Lenders, he said, are “buying into the predictability of cash flows”, which in turn depends on robust off‑take agreements, secure and affordable feedstock, proven technology performance and disciplined construction.

Katie Lennon of AXA described SAF as a “relatively immature” industry that is unusually open about risk. She urged developers to bring insurers in “at the pre‑conception stage” so that technical risk consultants can help engineer out problems before construction. Insurance, she added, can absorb technology performance, credit, political and even weather risks – so long as the “right risk sits on the right balance sheet”.

Airlines’ long‑term role

Representing demand, Jonathan Counsell of IAG said SAF is “absolutely critical” to the group’s net‑zero plans, with up to 70% of its fuel potentially coming from SAF by 2050. IAG has already signed 10‑ to 14‑year off‑take agreements with power‑to‑liquid producers, but only after extensive due diligence on technology, pricing and policy exposure. Counsell backed SAF mandates in the EU and UK, but warned that sub‑targets – particularly for emerging e‑fuel technologies – must be realistic to avoid large‑scale buy‑outs that would signal “policy failure”.

Across the panel, one message was consistent: only early, coordinated engagement between developers, airlines, financiers, insurers, technology providers and policymakers will unlock the scale of investment needed to take SAF from niche to norm.

Aluminium producers in the Gulf are facing mounting supply challenges after shipping disruptions in the Strait of Hormuz and a production shutdown at a major regional smelter.

Aluminium Bahrain (Alba) has declared force majeure on some contracts after maritime activity in the Strait of Hormuz slowed significantly, according to Reuters.

The disruption follows escalating tensions in the Middle East after Iranian strikes in response to attacks by the United States and Israel affected vessels operating near the key shipping corridor between Iran and Oman.

A spokesperson for Alba said the company’s smelter operations remain unaffected, but exports have been halted because shipments cannot currently pass through the Strait.

“We are producing, but the metal is here in Alba because we are not able to ship,” the spokesperson told Reuters, adding that the declaration of force majeure is not related to any operational issues at the facility.

“Our force majeure is not due to any disruption or damage to the smelter facility,” the spokesperson said, noting that the company is working to identify alternative shipping solutions to reduce the impact on deliveries.

The Strait of Hormuz is one of the world’s most critical maritime chokepoints, carrying around one-fifth of global oil consumption and serving as a key export route for Gulf aluminium producers.

Industry estimates suggest that more than five million tonnes of aluminium are shipped through the passage each year by smelters in Bahrain, Qatar, Saudi Arabia and the United Arab Emirates.

At the same time, production has been disrupted at Qatalum, a joint venture involving Norsk Hydro. The company has begun a controlled shutdown of its aluminium production after a shortage of natural gas in Qatar linked to the regional conflict.

The shutdown process started on 3 March and is expected to be completed by the end of the month. The decision followed a notification from QatarEnergy that gas supplies to the smelter would be suspended.

Qatalum said the controlled shutdown aims to reduce health, environmental and safety risks associated with halting production while preparing the plant for a possible restart.

However, a full restart could take between six and 12 months, and it remains unclear when the facility might resume operations if the shutdown continues.

Hydro said it is assessing options to mitigate the impact and exploring alternative ways to meet contractual obligations. The company has also issued a force majeure notice to Qatalum customers following the production halt.

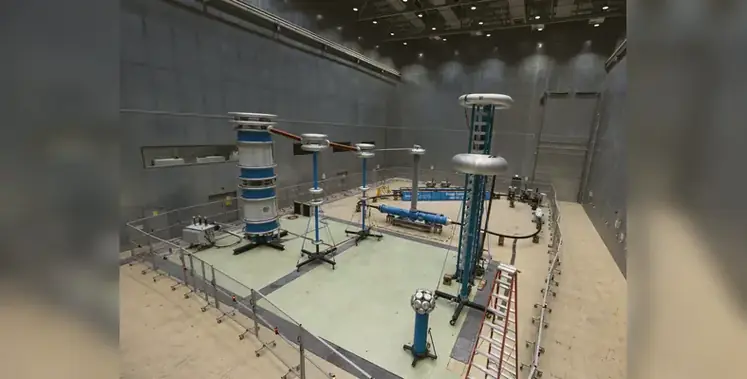

Siemens Smart Infrastructure has expanded its portfolio of industrial control and protection technologies with new developments aimed at improving electrical safety, operational reliability and sustainability in industrial environments.

The company has enhanced the capabilities of its semiconductor-based circuit protection technology while also introducing a refurbished soft starter developed under circular economy principles. The announcements reflect a broader push by Siemens to combine advanced electrical engineering with environmentally responsible manufacturing.

Central to the update is the continued development of the SENTRON Electronic Circuit Protection Device (ECPD), which was first launched in 2024. The device uses semiconductor technology to perform electronic switching far faster than traditional protection systems, helping to reduce short-circuit energy and safeguard connected equipment.

The ECPD can deliver switching speeds up to 1,000 times faster than conventional solutions. It also integrates more than ten configurable functions into a single unit, allowing operators to significantly reduce the space required within distribution boards while enabling software-based configuration.

Siemens plans to expand the product range with a single-phase version that will include integrated residual current monitoring. This function enables continuous supervision of electrical circuits to detect faults at an early stage without disrupting operations. Such monitoring is particularly relevant for facilities that require high levels of reliability, including data centres, exhibition venues and lighting installations, where uninterrupted power supply is essential.

A three-phase version of the ECPD is also under development to address higher-voltage systems operating at 400V and 32A. This model is expected to support a wider range of infrastructure and industrial applications, including conveyor systems, elevators, heat pumps, air conditioning installations and event power distribution networks.

According to Andreas Matthé, the company’s use of semiconductor technology is reshaping industry expectations for circuit protection by delivering faster response times, compact designs and improved system uptime.

Alongside the circuit protection developments, Siemens has also introduced its first refurbished soft starter designed according to circular economy principles. The SIRIUS 3RW5 -Z R11 refurbished soft starter is created through a controlled refurbishment process in which used devices are thoroughly tested, key components replaced and performance validated to meet the same standards as new equipment.

This remanufacturing process typically reduces carbon emissions by as much as 50% compared with producing a new device, primarily due to lower resource consumption. Environmental Product Declarations document the environmental benefits and ensure transparency.

The refurbished soft starter retains full compatibility with new units in terms of installation, parameterisation and functionality, enabling straightforward integration into existing systems. The product also incorporates traceability features such as a QR-based ID Link, allowing lifecycle monitoring across both its initial and refurbished service phases.

Siemens is showcasing the technology at the Light + Building 2026 in Frankfurt, where the company is highlighting how digitalisation and circular design can work together to support more sustainable industrial operations.

Airlines and aviation authorities across the Middle East are adjusting operations as regional tensions and airspace restrictions continue to disrupt travel, forcing carriers to reduce schedules while governments coordinate support for affected passengers.

Emirates confirmed it is operating a reduced flight schedule until further notice following the partial reopening of some regional airspace. The airline said it plans to run more than 100 flights to and from Dubai on 5 and 6 March in order to transport passengers and move essential cargo such as pharmaceuticals and perishables.

A spokesperson said the carrier will progressively rebuild its timetable as more airspace becomes available and operational requirements are met. Safety, the airline emphasised, remains its primary priority while it continues to monitor developments across the region.

Passengers have been advised to travel to the airport only if they hold confirmed bookings and to check the airline’s website and social media channels for the latest updates.

Meanwhile, Dubai-based carrier flydubai has resumed flights across parts of its network but is currently operating a scaled-back schedule. The airline said it is gradually adding services as restrictions on regional airspace begin to ease.

However, flight times may be longer than usual as aircraft are temporarily rerouted to avoid restricted zones. The airline also urged customers not to travel to the airport without confirmation of a booking or rebooked flight. Travellers connecting through Dubai will only be accepted if their onward flight is operating.

Despite wider disruptions, aviation activity in Jordan has remained comparatively stable. The Civil Aviation Regulatory Commission reported that airports across the Kingdom continued operating normally on Wednesday despite the closure of airspace in several neighbouring countries.

According to commission chairman Deifallah Farajat, Queen Alia International Airport recorded 67 inbound flights and 58 departures during the day, with national carrier Royal Jordanian accounting for the largest share of operations. Authorities said technical teams remain on standby to respond to any developments affecting airspace safety.

Elsewhere, the government of Oman has begun assisting foreign nationals stranded across the Gulf as the travel disruption intensifies. Foreign Minister Sayyid Badr bin Hamad Albusaidi said the country is working with governments and international airlines to organise flights for travellers seeking to leave the region.

Omani authorities are coordinating with diplomatic missions and carriers to ensure safe and orderly departures for affected passengers. The initiative reflects the Sultanate’s longstanding diplomatic approach of prioritising humanitarian assistance during regional crises.

The aviation disruption follows the escalation of the US-Israel-Iran conflict, which has prompted several countries to close or restrict their airspace. Airlines have been forced to cancel services or divert aircraft along longer routes to avoid conflict zones.

Industry observers warn that flight disruptions could persist in the coming weeks if hostilities continue, with travellers across the Middle East advised to monitor airline updates as schedules remain subject to rapid change.

Digital concrete technology company Giatec has announced a commercial partnership with specialty chemicals manufacturer Sika aimed at accelerating the adoption of data-driven solutions across the global concrete value chain.

The collaboration will combine Giatec’s digital monitoring and analytics platforms with Sika’s extensive global presence and expertise in construction materials. Through the partnership, the companies intend to expand the use of intelligent technologies in concrete production, transportation, placement and long-term performance monitoring.

Sika operates in more than 100 countries and offers a broad portfolio of construction solutions, including high-performance concrete admixtures and advanced building systems. By integrating Giatec’s digital tools into Sika’s global network, the two companies expect to broaden access to technologies that help construction firms optimise quality control, efficiency and sustainability.

Ivo Schädler, Head Construction at Sika, said the collaboration reflects a shared ambition to support the industry’s transition towards more digitally enabled operations.

“By combining Sika’s materials science and construction expertise with Giatec’s innovative digital concrete solutions, we aim to help the sector move away from reactive methods towards proactive, data-enabled decision-making,” he said. “This approach can improve project quality, boost productivity and support more sustainable construction outcomes.”

The announcement comes as the construction sector increasingly embraces digital tools and artificial intelligence. Industry forecasts indicate that the global market for AI-driven construction technologies could expand significantly over the next decade, driven by demand for improved productivity, cost control and environmental performance.

Giatec’s technology ecosystem includes wireless concrete sensors, artificial intelligence-based software platforms and in-transit monitoring tools designed to provide real-time data on concrete behaviour during transport and placement. According to the company, these systems help contractors and producers improve consistency, reduce material waste and make faster operational decisions.

Pouria Ghods, CEO and co-founder of Giatec, described the agreement as a key step in expanding the company’s global impact. He noted that combining Sika’s global reach with Giatec’s digital expertise will help address long-standing challenges related to efficiency, performance and sustainability within the construction sector.

“Together we can deliver measurable value for producers, contractors and project owners by providing greater transparency and insight into concrete performance,” Ghods said.

Both companies are showcasing their technologies and discussing the partnership with industry stakeholders at CONEXPO-CON/AGG 2026, where representatives are presenting solutions designed to support the digital transformation of construction practices.

Middle East Energy has been rescheduled from 7-9 April to 1-3 September 2026 at the Dubai World Trade Centre, organisers have confirmed via an official statement.

The new dates have also been updated on the Middle East Energy official website.

The 50th edition is now expected to welcome nearly 50,000 attendees from 178 countries, with the revised dates said to provide greater flexibility for travel, logistics and full-scale solution showcases across the power value chain.

While no reason has been formally stated for the change, the move comes amid ongoing regional tensions in the Middle East.

The statement added, "Hosting this landmark event in September 2026 will provide additional space at DWTC and an extended period for all participants to organise logistics and travel and prepare product, machinery and technology showcases, to maximise value for everyone."

Organisers said the team is committed to supporting participants and addressing any queries ahead of the September gathering.

Mark Ring, Group Director – Energy & Power, Informa, said, "This event has always been about bringing the global energy and power community together to share ideas, showcase innovation and drive progress. By hosting the 2026 edition in September, we are ensuring that exhibitors and attendees have the opportunity to make the most of this important event. We remain committed to delivering an exceptional experience for everyone and look forward to welcoming the energy sector to Dubai this September.”

Electric mobility firm Ampere has signed a joint development agreement with Spanish battery technology company Basquevolt to accelerate the development of lithium metal-based batteries for future electric vehicles.

The collaboration will focus on advancing and validating a new generation of battery technology designed to improve energy density, charging performance and overall efficiency in electric cars. The project will be carried out in Spain and forms part of wider efforts to support innovation within Europe’s rapidly evolving electric mobility sector.

Basquevolt’s lithium metal-based batteries are based on polymer electrolyte technology, which differs from the liquid electrolyte systems used in most current lithium-ion batteries. According to the company, this design could significantly increase the amount of energy stored in each battery while also enabling lighter and more compact battery packs.

Industry specialists say such improvements are essential for the next generation of electric vehicles, where manufacturers are seeking longer driving ranges, faster charging times and improved thermal safety.

By combining Basquevolt’s advanced battery research with Ampere’s engineering and vehicle integration expertise, the two companies aim to accelerate the path towards commercial deployment of the technology in passenger vehicles.

Pablo Fernández, Chief Executive Officer of Basquevolt, said the agreement represents an important step in bringing polymer electrolyte battery technology closer to large-scale production. He noted that working with Ampere will help validate the performance of the batteries under real-world automotive conditions.

Nicolas Racquet, Vice President for Vehicle and Powertrain Engineering at Ampere, added that the partnership highlights the growing role of collaboration in the development of next-generation energy storage systems.

“Together we aim to accelerate the development of advanced EV batteries capable of meeting the evolving expectations of customers,” Racquet said.

The two companies have already worked together for more than a year to refine the technology. Early tests indicate that the batteries could achieve high energy density while also reducing the cost of battery packs compared with traditional lithium-ion solutions.

Basquevolt says its polymer electrolyte approach simplifies the battery cell manufacturing process, potentially lowering production costs and energy consumption at gigafactories. The company estimates that facilities producing the cells could require around 30% less capital investment per gigawatt-hour of capacity, while energy use per kilowatt-hour of battery output could fall by a similar margin.

If successfully commercialised, the technology could help manufacturers produce more efficient and affordable electric vehicles, supporting the broader transition to low-emission transport across global markets.

The UAE Research Program for Rain Enhancement Science (UAEREP), overseen by the National Center of Meteorology (NCM), will unveil three new awardees for its Sixth Cycle grants at a press conference on 21 January at the NCM headquarters in Abu Dhabi.

The selected projects align with UAEREP’s key research priorities, which underpin the programme’s 10-year roadmap: Optimised Seeding Materials, Autonomous UAS, Limited-Area Climate Interventions, and Advanced Models, Software, and Data. Each awardee will present an overview of their winning proposal, highlighting their scientific methodology, expected outcomes, and potential contributions to global water security.

Research into optimised seeding materials aims to develop advanced cloud-seeding substances and innovative delivery techniques to enhance rainfall stimulation. Limited-area climate interventions explore localised methods such as solar radiation management and exploiting regional atmospheric conditions to improve cloud formation and precipitation.

Meanwhile, work on advanced models, software, and data focuses on creating sophisticated forecasting tools and decision-support systems that leverage data assimilation and machine learning to refine cloud dynamics modelling and operational efficiency.

Each grant recipient will receive up to US$1.5mn (AED5.511mn) over three years, with a maximum annual allocation of US$550,000. The funding is intended to accelerate next-generation rain enhancement technologies and address emerging challenges in water security worldwide, positioning the UAE at the forefront of climate innovation.

The announcement continues UAEREP’s commitment to fostering scientific research that supports sustainable water resources and strengthens the country’s expertise in cloud-seeding and rainfall enhancement technologies.

Prinoth has officially launched its new flagship Panther T23r, describing it as the largest and most advanced rotating crawler carrier in the industry. The debut took place during a press conference at Conexpo-Conagg 2026

The Panther T23r is the first machine to incorporate Prinoth’s newly developed PowerForce undercarriage, an innovation that forms the basis of more than 20 patent applications. The system is engineered to significantly enhance terrain capability, operational efficiency and overall machine performance.

With a payload capacity of 22.5 short tons, the T23r combines high carrying capacity with relatively compact dimensions. The unit measures 9.8 feet wide, 10.8 feet tall and has a total weight of 40 tons. Its 360 degree continuous rotating upper structure, paired with a rounded Hardox steel dump box and telescopic cylinder, allows for precise material placement in confined or restricted worksites where traditional haulers may struggle to operate.

At the core of the machine’s performance is the PowerForce undercarriage. Unlike conventional rigid walking beam systems that transmit terrain shocks directly to the operator and payload, the new design absorbs ground irregularities while optimising power transfer. This enables improved travel speeds, reduced fuel consumption and greater operator comfort.

The Adaptive Independent Suspension System positions eight wheels on individual arms, each offering seven inches of travel supported by hydro-pneumatic shock absorbers. These automatically adapt to load variations, maintaining consistent ride quality whether the carrier is operating empty at 41,200 pounds or fully loaded at 85,400 pounds. 60% of the load is strategically distributed to the centre wheels, enhancing zero-turn manoeuvrability and lowering ground pressure.

Engineers have also introduced an oblong, oval-shaped track configuration that reduces bend points by 50% and doubles the bend radius compared to traditional systems. This approach minimises energy loss during each track cycle, ensuring more engine output is translated into forward motion. The expanded ground contact area further improves flotation in soft terrain and traction on inclines.

Precision track alignment is another defining feature, with pitch accuracy said to be ten times greater than standard crawler carriers. The system incorporates precise link spacing and an auto-centering “fox head” profile, enabling planetary drives to engage 15 teeth simultaneously instead of relying on single-point contact. The combined roller and wheel arrangement is designed to virtually eliminate de-tracking during demanding manoeuvres, reducing downtime and extending track life.

The undercarriage also benefits from an automatic dual-action tensioning system that continuously adjusts track tension according to operating conditions. When lightly loaded, tension is reduced to limit wear. Under heavier loads or when greater traction is required, tension increases automatically. This real-time adjustment is intended to maximise performance while prolonging service life.

The Panther T23r’s dump box has been redesigned with a rounded, deep-section Hardox steel profile to support smoother material discharge and minimise carryback, particularly when handling sticky soils or aggregates. The box has been repositioned closer to the undercarriage centreline, improving centre of gravity and balancing loads across the suspension and central bearing. This refinement helps lower structural stress and overall frame complexity.

The machine is equipped with a newly designed cab featuring a near centre-mounted operator seat for improved visibility, especially to the right side where ground crews typically operate. Standard features include an air-ride seat, 7 inch touchscreen display, ergonomic joystick controls for dumping and rotation, intuitive steering wheel and foot throttle system, sun visor and cruise control to reduce fatigue over long shifts. An optional buddy seat is available.

“Customers are pushing farther into remote, sensitive and high-consequence environments,” said Frank M Gangi, product manager for the Prinoth Panther. “With the Panther T23r, we set out to give them a machine that feels completely in control on those sites, with a payload and undercarriage that lets them haul more in fewer passes while protecting the jobsite and the machine.”

A public unveiling ceremony will take place on Tuesday, March 3 at 4:30 PM PST at the Prinoth booth #W43845 in the West Hall of the Las Vegas Convention Center. The Panther T23r will remain on display at the booth from March 3 to 7.

Critical Metals Corp., a critical minerals company headquartered in New York, has signed a non-binding term sheet to form a 50/50 joint venture with Tariq Abdel Hadi Abdullah Al-Qahtani & Brothers Company (TQB), a 75-year-old industrial conglomerate based in Saudi Arabia.

The partnership aims to establish a state-of-the-art rare earth processing facility in the Kingdom, creating a fully integrated mine-to-processing supply chain and securing long-term offtake rights for 25% of the Tanbreez Project’s rare earth concentrate production.

The facility will produce separated rare earth oxides, metals, and downstream products, including magnet-grade materials for aerospace, defense, and advanced industrial applications. All finished materials are planned for shipment to the United States to support the country’s defense industrial complex, strengthening supply chain security for Western-aligned markets.

Tony Sage, Chairman of Critical Metals Corp., said, “This agreement represents a transformational milestone for Critical Metals Corp. By partnering with a leading Saudi Arabian industrial group and securing long-term offtake that brings Tanbreez to 100% committed production, we have effectively de-risked the project’s commercial pathway from mine to market. The establishment of an integrated processing platform in Saudi Arabia not only diversifies global rare earth processing capacity beyond China but also strengthens supply chain security for allied nations across Europe, the Middle East, and beyond. This transaction positions CRML as a cornerstone supplier of critical minerals essential to advanced manufacturing, energy transition technologies, and national security applications for decades to come.”

Under the JV framework, CRML will retain its 50% ownership interest on a carried-interest basis, without issuing equity or incurring debt for the construction of the processing facility. The partnership ensures 100% of Tanbreez production is now under long-term offtake agreements, providing full revenue visibility and supporting allied markets. A jointly governed development committee will oversee engineering, construction, commissioning, and market entry for the processed products.

Abdulmalik Tariq Al-Qahtani, CEO of TQB, commented, “Following the successful official visit of His Royal Highness Prince Mohammed bin Salman to the United States, we are pleased to announce the signing of a Memorandum of Understanding focused on cooperation in the development of critical materials. Critical materials—sourced from strategically important regions including Greenland and other resource-rich jurisdictions—form the foundation of modern technologies across energy, advanced manufacturing, artificial intelligence, defense, and data infrastructure. Securing diversified and resilient supply chains for these materials is essential to long-term technological progress.”

CRML and TQB will now work together to finalise the technical, commercial, and regulatory foundations of the JV, including plant design, development timelines, product specifications, and commercialisation strategy. The initiative is a major step toward diversifying rare earth processing capacity, reducing reliance on China, and strengthening global supply chain resilience.

The exhibition will cover six core product groups spanning the full lifecycle of process industries. (Image source: ACHEMA)

Saudi Arabia’s expanding industrial and energy transition ambitions are set to gain a new international platform with the launch of ACHEMA Middle East, scheduled to take place from 26-28 October 2026 at the Riyadh International Convention & Exhibition Center.

The inaugural regional edition of the long-established ACHEMA exhibition comes as the Kingdom accelerates large-scale projects aimed at decarbonisation and advanced manufacturing. These include a major carbon capture hub in Jubail, designed to capture up to nine million tonnes of CO2 annually by 2028, and the US$8.4bn NEOM Green Hydrogen Project, which targets the production of 600 tonnes per day of clean hydrogen by 2027.

Held under the patronage of the Saudi Ministry of Industry and Mineral Resources and supported by ASAS, the event is organised by Messe Frankfurt and powered by DECHEMA. The exhibition extends ACHEMA’s century-long legacy in chemical engineering and process industries into the Middle East, Africa and South Asia (MEASA) region.

For more than 100 years, ACHEMA has served as a global meeting point for the chemical, pharmaceutical, biotechnology and laboratory sectors. Its debut in Riyadh is intended to connect international technology providers with regional manufacturers, policymakers and researchers at a time when Saudi Arabia is pursuing industrial diversification under Vision 2030.

Exhibition main themes

The exhibition will cover six core product groups spanning the full lifecycle of process industries, including industrial engineering, laboratory and analytical solutions, automation and digital systems, packaging and supply chain technologies, and research and development. Organisers say the integrated scope reflects the increasingly interconnected nature of modern industrial operations.

Conference programming will centre on six innovation themes: process, pharma, lab, digital, green and energy innovation. CPD-accredited sessions and expert-led discussions will address topics such as electrification, bioprocessing, artificial intelligence-enabled operations and circular economy models.

Dr Björn Mathes, chief executive of DECHEMA Exhibitions, described the Riyadh edition as a strategic evolution. “By bringing ACHEMA to Riyadh, we are creating a platform where science, engineering and industrial innovation align with the ambitions of one of the world’s most dynamic industrial economies,” he said.

Azzan Mohammed, managing director of Messe Frankfurt Saudi Arabia, said the event would foster knowledge exchange and support the development of sustainable and competitive industrial ecosystems.

Early confirmed exhibitors include Yokogawa, GMM Pfaudler, Hach, Beckhoff, Aptek, Pharmadule Morimatsu, Tofflon and Sealmatic, signalling strong international interest ahead of the show’s first edition.

The Etihad Rail has unveiled fresh details of its forthcoming passenger services. (Image source: Etihad Rail)

The Etihad Rail has unveiled fresh details of its forthcoming passenger services, offering insight into what travellers can expect when the UAE’s national rail network begins operations later this year.

The announcement follows confirmation of the country’s long-anticipated intercity passenger rail system, positioned as a modern alternative to driving between the Emirates.

The service has been designed to reflect changing lifestyles across the UAE, with a focus on reliability, comfort and sustainability.

Azza AlSuwaidi, deputy chief executive of Etihad Rail Mobility, said the next phase marks a shift from delivering infrastructure to shaping the overall travel experience.

She noted that the ambition is to create a service people actively choose because it integrates seamlessly into their daily routines.

For commuters, predictability is central to the offering. A consistent timetable and guaranteed seating are intended to provide peace of mind, enabling passengers to plan their schedules with greater certainty.

Quiet, calm onboard environments are also expected to allow travellers to use their journey time productively or as an opportunity to rest.

Key features

AlSuwaidi said reliability remains the defining factor for daily passengers, adding that the rail network is designed to give people “useful and usable time back” rather than adding to the pressures of the working day.

Business travellers are another key demographic. Trains will feature onboard Wi-Fi, power outlets at every seat and spacious interiors, creating what the operator describes as a professional and connected setting.

The aim is to allow passengers to work, prepare for meetings or unwind while travelling between the UAE’s major commercial hubs.

Families and leisure travellers are also being targeted as core users of the service. Dedicated family seating areas and generous luggage storage are intended to make weekend breaks, holidays and visits to relatives easier and less stressful.

By removing the demands of driving, such as navigating traffic and long hours at the wheel, the operator believes rail travel can help families spend more meaningful time together.

AlSuwaidi highlighted that 2026 has been designated the UAE Year of the Family, noting that rail journeys can offer uninterrupted shared time that is increasingly rare in modern life.

The passenger experience has also been developed to reflect a distinct Emirati identity. From station architecture to onboard design, the network aims to embody national values centred on safety, quality and hospitality.

Officials say international best practice and rigorous operational standards will underpin the system, reinforcing confidence among citizens and residents alike.

OQ Alternative Energy has reported major progress across three renewable energy projects that are expected to deliver a combined 330 MW of wind and solar power in Oman by the end of 2026.

The developments – the Riyah 1 and Riyah 2 wind farms and the North Oman Solar plant – are being implemented in partnership with TotalEnergies with a total investment exceeding US$230mn. Once operational, the facilities will supply renewable electricity to the grid operated by Petroleum Development Oman (PDO).

The projects include Oman’s largest wind farm and have already set several logistical and construction milestones, including the transport of the country’s longest inland convoy to move turbine components to site.

The Riyah wind projects are located at PDO’s Amin and West Nimr fields in southern Oman, while the North Oman Solar facility is being developed at Saih Nahaydah in the north of the country.

According to OQAE, the solar project has reached around 95% completion of tracker and photovoltaic module installation. The remaining panels are expected to be installed by mid-March 2026 as the project moves towards mechanical completion.

Meanwhile, construction of the wind farms has also progressed significantly. Seven wind turbines, each reaching a tip height of around 200 metres, have been installed so far, with work continuing to erect the remaining units.

All 36 wind turbine generators required for the projects have already arrived in Oman, with 19 transported from the port to the project sites. In addition, turbine foundations have been fully completed, enabling construction teams to accelerate installation activities in preparation for commissioning.

The developments have also exceeded their in-country value targets, with approximately 30% of total project expenditure retained within Oman’s economy. A number of local companies have been involved in supplying equipment and services, including Voltamp, Oman Cables, Al Kiyumi Switchgear and Al Hassan Switchgear.

Engineering work for substations was carried out by Worley Oman, while specialised logistics for transporting turbine components were managed by Khimji Ramdas.

Workforce localisation has also exceeded expectations, with Omani nationals accounting for around 40% of the workforce during development and construction. The projects have created roughly 150 direct and indirect jobs and include structured training programmes designed to develop local expertise in renewable energy.

Kumail Said, acting chief executive of OQ Alternative Energy, said the developments were designed not only to expand clean energy generation but also to strengthen the country’s industrial capabilities.

He noted that the projects are intended to support long-term economic diversification and build a domestic renewable energy ecosystem aligned with Oman’s national energy transition goals.

Once completed, the wind and solar facilities will contribute significantly to the country’s clean power capacity while helping reduce reliance on natural gas for electricity generation.

Dubai Municipality has awarded five major contracts under the second phase of its Tasreef Programme, committing AED2.5bn to expand and reinforce the emirate’s stormwater drainage network.

The move follows directives from Mohammed bin Rashid Al Maktoum to strengthen critical infrastructure and ensure drainage systems are fit to serve Dubai for the next century. The newly announced package will cover 30 key districts across approximately 430mn sq m, supporting a projected population of three million residents by 2040.

Contracts have been signed with international contractors including DeTech Contracting and China State Construction Engineering Corporation, alongside specialist consultants. The scope comprises three construction agreements and two design and study contracts focused on selected locations across the city.

The latest awards build on Phase One allocations announced in April 2025 and form part of a phased delivery strategy aimed at improving flood resilience amid rapid urbanisation and intensifying climate pressures. Dubai Municipality said the projects are aligned with the objectives of the Dubai 2040 Urban Master Plan and broader national climate neutrality ambitions.

Marwan Ahmed bin Ghalita, Director General of Dubai Municipality, described Tasreef as one of the emirate’s flagship infrastructure initiatives, designed to embed long-term sustainability into urban planning. He said the programme seeks to establish an integrated stormwater management system that enhances preparedness, safeguards resources and improves quality of life.

Adel Al Marzouqi, CEO of the Waste and Sewerage Agency, added that Phase Two will raise network capacity in priority areas, improve service continuity and elevate safety standards.

Among the headline schemes is the construction of a main tunnel up to four metres in diameter, linking communities along Sheikh Mohammed bin Zayed Road and Al Yalayis Road to the primary drainage backbone. A separate 27 km integrated network will extend between Sheikh Zayed Road and Al Jamayel Road, incorporating advanced tunnels to protect a strategic industrial and logistics corridor.

Additional works include a new drainage tunnel and pumping station along Dubai–Al Ain Road and Sheikh Zayed bin Hamdan Al Nahyan Street, as well as a stormwater collection lake. Design contracts have also been issued for an integrated stormwater and groundwater system in Al Marmoom and Saih Al Salam, connected to the main line along Al Qudra Road.

More than 140,000 industry professionals from 128 countries attended CONEXPO-CON/AGG 2026 in Las Vegas, Nevada, as the global construction sector gathered to explore new technologies, equipment and business opportunities.

Held from 3–7 March, the event brought together contractors, manufacturers and technology providers to showcase innovations aimed at improving efficiency, safety and sustainability across construction operations.

Spanning more than three million square feet, the exhibition featured over 2,000 exhibitors presenting machinery, digital tools and services across the industry. Equipment ranging from heavy earthmoving machines and cranes to advanced paving systems was displayed alongside emerging technologies such as automation, connected jobsite solutions and low-emission machinery.

According to show organisers, the event provided contractors with an opportunity to evaluate equipment in person and connect directly with manufacturers when making purchasing decisions.

Dana Wuesthoff, show director for CONEXPO-CON/AGG, said the exhibition remains a key platform for unveiling technologies shaping the future of construction. She noted that the innovations presented at the event demonstrate the industry’s ability to adapt and improve jobsite productivity and safety.

Companies used the event to introduce a range of new machines and digital solutions. Komatsu highlighted developments in intelligent machine control technology, including its PC220LCi-12 excavator, designed to help operators excavate with greater precision using integrated sensors and 3D design data. The company also introduced the HM460-6 articulated truck, the largest model in its range.

Meanwhile, LiuGong presented several machines focused on electrification and efficiency, including the 870 HE loader and the 924 FE electric excavator.

Technology providers also showcased digital solutions aimed at improving operational visibility and productivity. Topcon Positioning Systems demonstrated its 3D-MC Edge feature, designed to enhance machine control accuracy, while Samsara presented systems that enable contractors to monitor equipment utilisation and fleet performance.

In addition, Doka displayed advanced formwork and digital jobsite technologies aimed at improving efficiency on large infrastructure and building projects.

Innovation at the event was also recognised through the Next Level Awards programme. Attendees selected Husco’s GenSteer technology as the Contractors’ Choice winner for best equipment, while the Gravis Rack developed by Gravis Robotics was voted best technology.

Beyond the exhibition floor, the event hosted more than 150 education sessions, workshops and panel discussions covering topics such as artificial intelligence, workforce development, infrastructure investment and sustainability.

Special programmes also focused on industry challenges including workforce recruitment and professional development. Workshops for women in construction, small business operators and maintenance professionals were introduced to encourage peer learning and collaboration.

Organisers confirmed that the next edition of CONEXPO-CON/AGG will take place from 13–17 March 2029.

A key focus at the show will be dust and spillage control at conveyor transfer points. (Image source: Martin Engineering)

Global bulk material handling specialist Martin Engineering has announced it will unveil a series of new conveyor accessories and flow technologies at CONEXPO-CON/AGG 2026, taking place from 3–7 March at the Las Vegas Convention Center.

Exhibiting at booth C30148 in the Central Hall, the company will present heavy-duty systems developed at its Center for Innovation, targeting safer and more efficient bulk handling operations across the aggregates and mining sectors.

Chris Schmelzer, Director of National Sales for the US and Canada, said the new portfolio has been tested in demanding real-world environments. He added that visitors will be able to explore solutions designed to support cleaner, safer and more productive material handling processes, from extraction through to final product.

Products on show

A key focus at the show will be dust and spillage control at conveyor transfer points, where emissions remain a persistent industry challenge.

Among the products on display is the Martin Skirtboard Liner, engineered to protect sealing systems by absorbing impact and abrasion inside transfer point skirtboards. The liner features a steel-reinforced urethane construction and a T-slot mounting interface that allows adjustment from outside the chute wall, reducing the need for confined space entry.

The company will also preview the Martin ApronSeal Urethane Skirting system, a dual-seal assembly combining a primary urethane seal with a self-adjusting secondary flap to contain fine material. Designed for belt speeds of up to 4.5 m/s, the system requires minimal maintenance and limited free belt space.

In addition, Martin’s modular A.I.R. Control Dust Curtains are designed to create controlled air recirculation zones within transfer enclosures, helping to reduce dust emissions compared with conventional rubber curtain systems. The curtains can be adjusted or replaced externally, cutting service times.

Flow improvement technologies will also feature prominently. The N2 Air Cannon Intelligence System monitors connected air cannons multiple times daily, detecting misfires, measuring blast efficiency and tracking pressure and temperature. A cloud-based dashboard enables predictive maintenance and reduces manual inspections.

An expanded line of electric vibrators will be introduced, aimed at improving material separation and preventing build-up in hoppers, silos and chutes. The new models offer increased power and efficiency while maintaining durability, backed by a three-year warranty.

The company will also present upgraded belt cleaning systems, including the Martin H1 Primary Belt Cleaner and P2 and R2 secondary cleaners, built with stainless steel components and tungsten carbide tips for use on abrasive materials and high-speed or reversing belts.

Aluminium producers in the Gulf are facing mounting supply challenges after shipping disruptions in the Strait of Hormuz and a production shutdown at a major regional smelter.

Aluminium Bahrain (Alba) has declared force majeure on some contracts after maritime activity in the Strait of Hormuz slowed significantly, according to Reuters.

The disruption follows escalating tensions in the Middle East after Iranian strikes in response to attacks by the United States and Israel affected vessels operating near the key shipping corridor between Iran and Oman.

A spokesperson for Alba said the company’s smelter operations remain unaffected, but exports have been halted because shipments cannot currently pass through the Strait.

“We are producing, but the metal is here in Alba because we are not able to ship,” the spokesperson told Reuters, adding that the declaration of force majeure is not related to any operational issues at the facility.

“Our force majeure is not due to any disruption or damage to the smelter facility,” the spokesperson said, noting that the company is working to identify alternative shipping solutions to reduce the impact on deliveries.

The Strait of Hormuz is one of the world’s most critical maritime chokepoints, carrying around one-fifth of global oil consumption and serving as a key export route for Gulf aluminium producers.

Industry estimates suggest that more than five million tonnes of aluminium are shipped through the passage each year by smelters in Bahrain, Qatar, Saudi Arabia and the United Arab Emirates.

At the same time, production has been disrupted at Qatalum, a joint venture involving Norsk Hydro. The company has begun a controlled shutdown of its aluminium production after a shortage of natural gas in Qatar linked to the regional conflict.

The shutdown process started on 3 March and is expected to be completed by the end of the month. The decision followed a notification from QatarEnergy that gas supplies to the smelter would be suspended.

Qatalum said the controlled shutdown aims to reduce health, environmental and safety risks associated with halting production while preparing the plant for a possible restart.

However, a full restart could take between six and 12 months, and it remains unclear when the facility might resume operations if the shutdown continues.

Hydro said it is assessing options to mitigate the impact and exploring alternative ways to meet contractual obligations. The company has also issued a force majeure notice to Qatalum customers following the production halt.

Airlines and aviation authorities across the Middle East are adjusting operations as regional tensions and airspace restrictions continue to disrupt travel, forcing carriers to reduce schedules while governments coordinate support for affected passengers.

Emirates confirmed it is operating a reduced flight schedule until further notice following the partial reopening of some regional airspace. The airline said it plans to run more than 100 flights to and from Dubai on 5 and 6 March in order to transport passengers and move essential cargo such as pharmaceuticals and perishables.

A spokesperson said the carrier will progressively rebuild its timetable as more airspace becomes available and operational requirements are met. Safety, the airline emphasised, remains its primary priority while it continues to monitor developments across the region.

Passengers have been advised to travel to the airport only if they hold confirmed bookings and to check the airline’s website and social media channels for the latest updates.

Meanwhile, Dubai-based carrier flydubai has resumed flights across parts of its network but is currently operating a scaled-back schedule. The airline said it is gradually adding services as restrictions on regional airspace begin to ease.

However, flight times may be longer than usual as aircraft are temporarily rerouted to avoid restricted zones. The airline also urged customers not to travel to the airport without confirmation of a booking or rebooked flight. Travellers connecting through Dubai will only be accepted if their onward flight is operating.

Despite wider disruptions, aviation activity in Jordan has remained comparatively stable. The Civil Aviation Regulatory Commission reported that airports across the Kingdom continued operating normally on Wednesday despite the closure of airspace in several neighbouring countries.

According to commission chairman Deifallah Farajat, Queen Alia International Airport recorded 67 inbound flights and 58 departures during the day, with national carrier Royal Jordanian accounting for the largest share of operations. Authorities said technical teams remain on standby to respond to any developments affecting airspace safety.

Elsewhere, the government of Oman has begun assisting foreign nationals stranded across the Gulf as the travel disruption intensifies. Foreign Minister Sayyid Badr bin Hamad Albusaidi said the country is working with governments and international airlines to organise flights for travellers seeking to leave the region.

Omani authorities are coordinating with diplomatic missions and carriers to ensure safe and orderly departures for affected passengers. The initiative reflects the Sultanate’s longstanding diplomatic approach of prioritising humanitarian assistance during regional crises.

The aviation disruption follows the escalation of the US-Israel-Iran conflict, which has prompted several countries to close or restrict their airspace. Airlines have been forced to cancel services or divert aircraft along longer routes to avoid conflict zones.

Industry observers warn that flight disruptions could persist in the coming weeks if hostilities continue, with travellers across the Middle East advised to monitor airline updates as schedules remain subject to rapid change.

Most Read

Latest News

Most Read

Latest News

More Articles

Smart cleaning innovation elevates QAIA passenger experience. (Image source: Queen Alia International Airport)