The fossil fueld sector is responsible for approximately one third of total global methane emissions. (Image source: Adobe Stock)

The fossil-fuel sector offers the largest and most cost-effective opportunity for rapid methane abatement, according to the newly released Global Methane Status Report, launched on the sidelines of COP30 in Belém

Produced by the UN Environment Programme (UNEP) and the Climate and Clean Air Coalition (CCAC), the Global Methane Status Report assesses progress and remaining gaps in efforts to cut methane - a potent greenhouse gas responsible for nearly a third of current warming.

The report shows that although methane emissions are still rising, projected 2030 emissions under current legislation are already lower than earlier forecasts due to a mix of national policies, sectoral regulations, and market shifts. However, the report warns that only full-scale implementation of proven and available control measures will close the gap to the Global Methane Pledge’s target of a 30% cut from 2020 levels by 2030.

Urging decisive methane action to deliver the Global Methane Pledge, ministers attending the Global Methane Pledge Ministerial stressed that the policies, technologies, and partnerships needed to meet the target are available, but require rapid scale-up across the energy, agriculture, and waste sectors. Ministers also called for increased transparency from countries on ambition and action to track progress.

Julie Dabrusin, Canada’s Minister of Environment and Climate Change and Co-Convener of the Global Methane Pledge, said, “This report is a crucial assessment of our progress and a key indicator of the work that’s required to meet the Global Methane Pledge goal. In just four years, we have made improvements, but we must continue to drive faster, deeper methane cuts. Every tonne reduced brings us closer to cleaner air, more resilient communities, and a thriving global economy. It is important for all countries that have agreed to the Global Methane Pledge to continue to work closely together to drive momentum on methane mitigation, turning ambition into tangible benefits for the planet.”

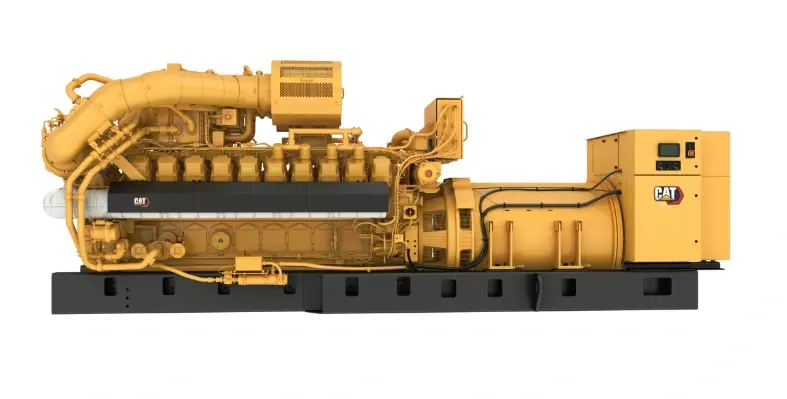

The fossil-fuel sector is the second largest source of anthropogenic methane emissions, responsible for approximately one third of the global total. Under current legislation, emissions from the sector are expected to rise by 8% in 2050 compared to 2020. This sector presents the single greatest potential for rapid, cost-effective methane abatement, according to the report. These reductions could be achieved through readily available technologies and practices, often at low cost.

Since the launch of the GMP, methane abatement policies in the oil and gas sector have become more innovative and widespread, while voluntary initiatives such as the Oil and Gas Methane Partnership (OGMP) 2.0 now cover up to 45% of global oil and gas production.

The rate of policy development and country participation, however, still fall short of what is needed to achieve the 2030 targets. Implementation and enforcement must also be strengthened.

The recent adoption of novel approaches, such as the European Union import standard, offers the potential to use the market to mitigate methane in oil and gas sector more rapidly at the global scale.

Bridging the methane policy gap in the fossil fuel sector calls for strong implementation of existing policies, continuous capacity building, increased ambition from additional producing countries, ramped up technical support and innovative financial mechanisms to facilitate mitigation in developing countries.

Key measures recommended include:

• enhancing monitoring, reporting and verification (MRV) systems across all fossil fuel operations

• expanding the use of direct measurement protocols and corroborated satellite data which could improve the accuracy and transparency of inventories

• expanding leak detection and repair (LDAR) programmes in oil and gas, which not only help reduce leaks but also enhance data quality for inventories and enhance workplace safety and asset integrity;

• ensuring proper sealing techniques during well closure, given methane emissions from abandoned wells can continue for decades after activities cease;

• strengthening enforcement mechanisms with the establishment of clear accountability structures, penalties for non-compliance and independent oversight;

• facilitating access to finance and capacity building;

• harnessing import standards as market leverage, creating a clear incentive for producing countries to adopt stronger mitigation practices; and

• leveraging international and bilateral frameworks for capacity and alignment.